Executive summary

- Markets, by nature, are volatile and assets which have historically produced the highest long-term returns have tended to be the most volatile.

- For example, when looking at FTSE All-Share Index dating back to 1986, the index went up 2,544%, or around 9% p.a.

- However, in that time 12 years out of 38 were negative and even in the positive years, there were periods of losses.

- It is therefore perfectly normal to experience market “corrections” (drops of 10% or more) as they tend to happen in most years.

- We believe a short-term correction is likely given significant market gains in recent months, particularly in the US market.

- It’s impossible to know when markets will correct therefore, we would not advocate selling out of equities altogether as this could result in missed gains.

- In our core portfolios, we always have exposure to stocks, but we regularly rebalance our weighting to bank the gains on the way up and look for opportunities on the way down.

- Another benefit is that we don’t just invest in equities, we try and buy a diverse mix of assets.

- Most recently, we have shifted small amounts from stocks to fixed interest which currently have attractive yields in our view.

- In mixed asset portfolios such as ours, the falls in value tend to be smaller than those comprising of 100% equities.

- For example, our Balanced portfolio has on average experienced one negative year in every four compared to one in three for the FTSE All Share over the same period.

- The biggest difference compared to a pure equity portfolio is that a market “correction” presents us with opportunities to top up and volatility is simply the price we pay for high potential returns over the long term.

Corrections and opportunities

This month’s newsletter was written before the announcement that there will be a General Election on 4 July. We don’t think this has major portfolio implications – March’s edition of The Pulse explains why here.

There’s a reason that we always say that investing is for the long term!

That’s because markets can, of course, be very volatile. In general terms, those assets that have historically produced the highest long-term returns have tended to be the most volatile.

That is the case for equities.

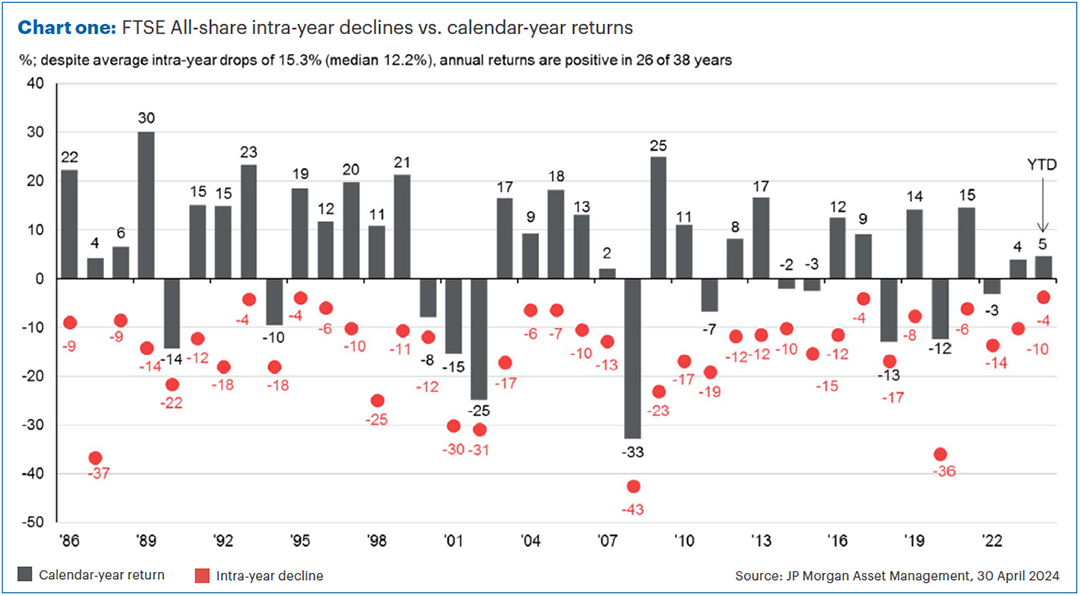

For example, Chart one shows the annual returns of the UK stock market as represented by the FTSE All-Share Index, going back to 1986.

The grey bars show the return in each calendar year. The market went up in 26 out of the last 38 years, frequently producing double-digit returns. In total, from 1 Jan 1986 to 30 April 2024, the index went up 2,544%, or around 9% p.a. (Source: FE Analytics).

However, 12 out of the 38 years were negative (a little less than one year in three). In addition, the index tends to have periods of losses even during those years when the market rises for the year as a whole.

This is illustrated by the red dots. These show the maximum amount you could have lost in each calendar year had you bought and sold at the worst possible times in that year.

The average intra-year drop is 15.3%. Most years see a drop of 10% or more, with the smallest loss during any year being 4%.

All of this is to hammer home the point that “corrections” in stock markets happen very frequently.

A correction is when the market drops by 10% or more. They are perfectly normal and happen in most years.

Given recent market moves, we think the risk of a short-term correction has risen. However, if and when it does happen, we also don’t think it’s anything to worry about.

Correct or incorrect?

So, why do we think a correction is likely?

Well apart from the fact that we’ve not had one for a while(!), the magnitude of recent market gains has been pretty steep. This is particularly the case in the US market.

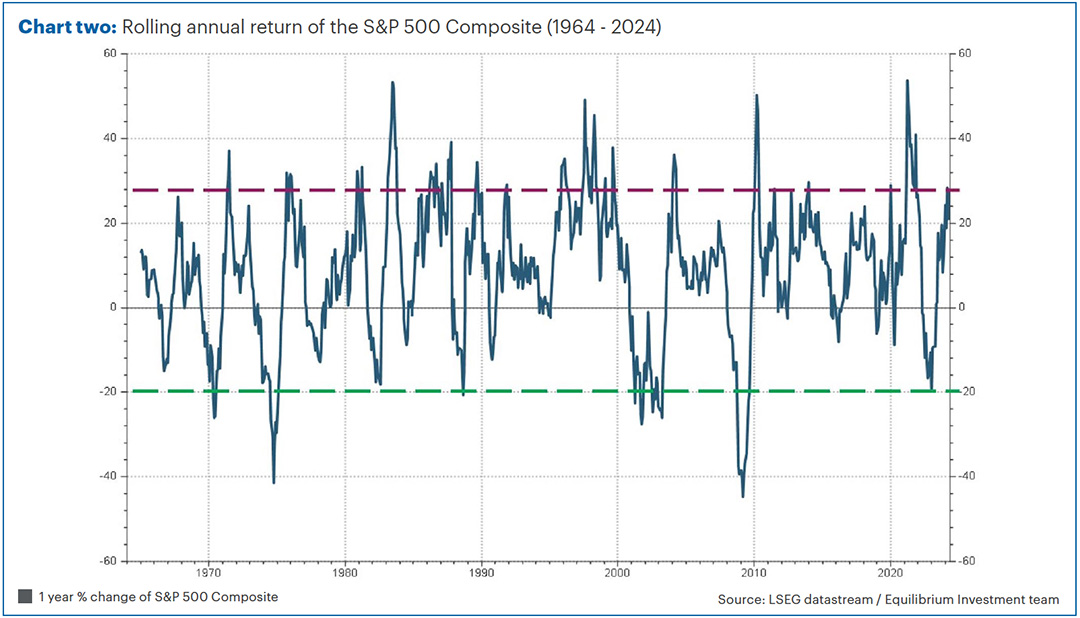

Chart two shows the rolling annual return of the S&P 500 (the main US stock market) going back to the 1960s. Over the last 12 months, the S&P is up 28% (Source: FE Analytics to 13 May 2024, in US dollars).

The dashed red line on the chart is also placed at 28%. Most of the time, when the blue line goes through the red line (so the annual return is at 28% or more), the market then turns down shortly after. You can see that often the blue line goes below zero after breaching the red line.

This doesn’t happen every time, or at least there can be some time between the red line being breached and the returns being negative. However, we can say generally that the longer the blue line stays high, the steeper the fall has been historically.

This works in the opposite direction too. When markets have fallen 20% or more (represented by the green line), the blue line invariably turns strongly upwards shortly afterwards.

So, what should we do?

None of this is to say we can predict the future. We can’t. We certainly wouldn’t recommend selling out of equities as a result.

Even if the market does correct, it might go up a lot more before it does, and we might therefore miss out on gains in the meantime.

In our core portfolios, we will typically always have exposure to stocks. We might increase exposure a bit when markets are low, and reduce a bit when markets are high like they are now.

However, making massive allocation shifts in either direction would be a huge risk. If we sold all our shares, even if we got that call right, when would we buy back in? On the other hand, if we think shares look great value, we still shouldn’t put 100% of the portfolio in them as we could be wrong!

Instead, we think the above chart is a great advert for the need to rebalance your portfolio regularly.

For example, let’s assume we decide the optimum balance of risk and return for a particular client or group of clients is 50% in equities, and 50% in cash.

If the stock market goes up by 20%, our 50% in equities will have increased to 60% (assuming no return on cash).

All of a sudden, our portfolio has got riskier. Then, if things reverse and stocks fall by 20%, a portfolio with 60% equities might drop by 12%, compared to a 10% fall in a portfolio with 50% in shares.

Rebalancing is simply banking some of the gains from the market increase and reducing equity exposure back from 60% down to 50% again.

This regular rebalancing is important to control risks, but also to take advantage of opportunities as it means we can potentially buy assets that have fallen.

Of course, we don’t just hold equities and cash. We try and buy a diverse mix of assets. Whilst equities have done very well recently, fixed interest (bonds) has done less well, meaning the bonds still have very attractive yields in our view.

Therefore, our recent rebalancing of portfolios has mainly been to shift small amounts from stocks into fixed interest.

For example, we have had a couple of defined returns products kick out recently. For those that aren’t familiar with these investments, broadly they are structured products which provide a fixed rate of return should markets be the same or higher than their starting levels at particular dates (usually the anniversaries of the product being created).

We considered reinvesting back into defined returns, however not only are markets now much higher than when previous products were struck, but the rates on offer are now much lower. Typically, we can get defined returns at higher rates when market volatility is high (right now, it is very low).

For example, on a defined return linked solely to the FTSE 100, we might get a rate of 10% p.a. at present, and in order to get the payout the market would need to be at 8,400 or more.

Or we can put the money in high-yield corporate bonds, where we are getting yields not too dissimilar but without the need to see market growth. That’s not to say they are risk-free, as this is lending to companies (which could therefore default), but they do tend to be less volatile than equities.

Drawdowns but not drawbacks

In mixed asset portfolios such as those we manage, the falls in value tend to be smaller than in those comprising of just equities.

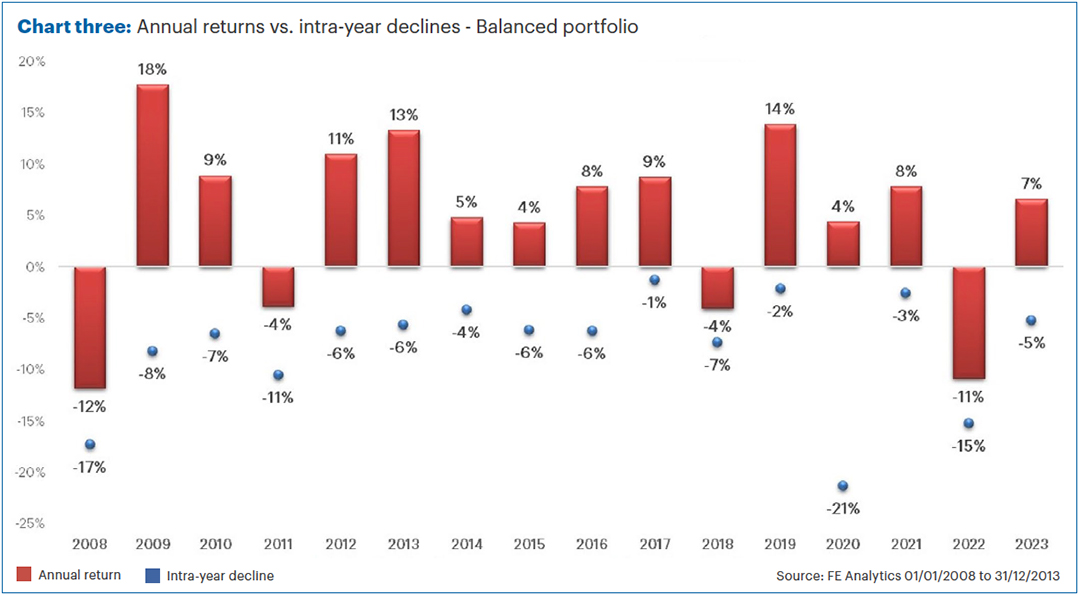

This can be seen in Chart three, which shows similar data to Chart one, but this time for the balanced portfolio.

Here, there have been just four negative years in the past sixteen, meaning only around one in four years is negative (it was around one in three for the FTSE All Share).

In addition, the average annual drawdown (maximum loss in each year) is around 8%, about half that of the FTSE All Share.

But the biggest difference compared to a pure equity portfolio is that if we did see a correction in markets, then this presents opportunities for a multi-asset portfolio.

A drop in stock markets would give us the chance to top up equities at a lower market level. For example, we might sell some of the bond holdings and buy back into stocks.

If we can take advantage of market falls consistently through regular rebalancing of portfolios, which also ensures we bank gains at relative highs, this should help long-term returns.

If we do get a correction in markets, then please do not worry. This volatility is simply the price we pay for the high potential returns available from equity investing. Long-term investors should view corrections as opportunities.

Past performance is for illustrative purposes only and cannot be guaranteed to apply in the future.

This newsletter is intended as an information piece and does not constitute a solicitation of investment advice.

If you have any further questions, please don’t hesitate to contact us. If you’re a client, you can reach us on 0161 486 2250 or by getting in touch with your usual Equilibrium contact. For all new enquiries please call 0161 383 3335.