Executive summary

- With a likely change in government in the upcoming UK election, in our opinion, there will be no significant impact on markets.

- Due to the forward-looking nature of markets, a Labour government has already been factored into prices, and we think portfolios will remain largely unaffected.

- Taxation is currently at 37% of GDP, the highest seen since 1948, leaving little room for Labour to significantly increase tax if they were to be elected.

- Furthermore, the Shadow Chancellor pledged not to increase the main taxes.

- The new British ISA may also not make the impact it hopes, with many questions yet to be answered.

- Across the Atlantic, politics are far more polarised, and perceptions of the economy are seemingly linked to how you vote.

- However, historical data shows that it makes little difference to the US stock market which party is in power, rather markets are more focused on what central banks have to say and interest rate expectations.

Politics and portfolios

2024 is set to be a record-breaking year for elections. According to the World Economic Forum, more than two billion voters in 50 different countries will take to the polls.

This, of course, includes the UK.

The latest polls put Labour well ahead, with the political news organisation Politico putting them on around 44% compared to the Conservatives who are well behind at 24% (based on a 6-month average of all major polls).

With a change of government looking likely, we’re increasingly hearing the question: “What will this do to my portfolio?”

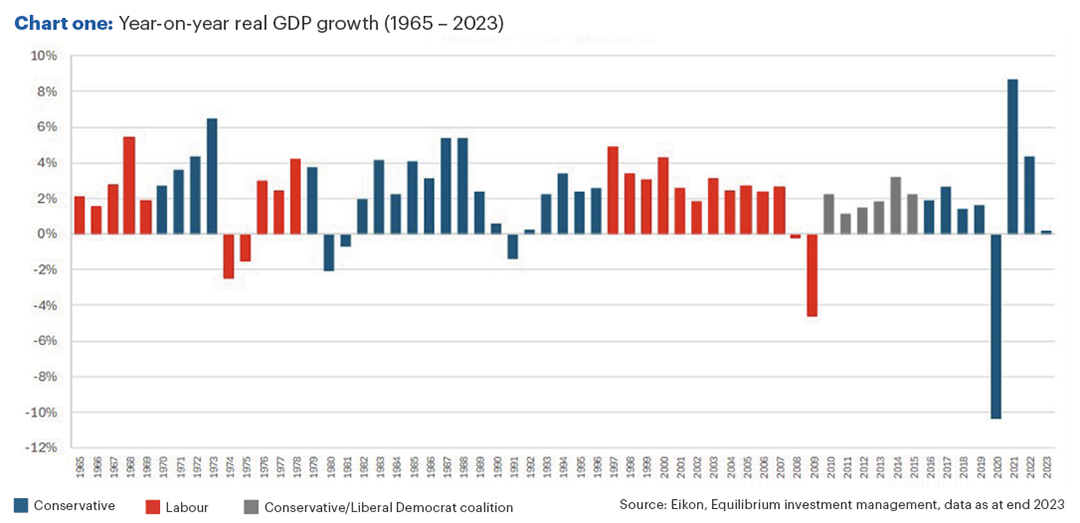

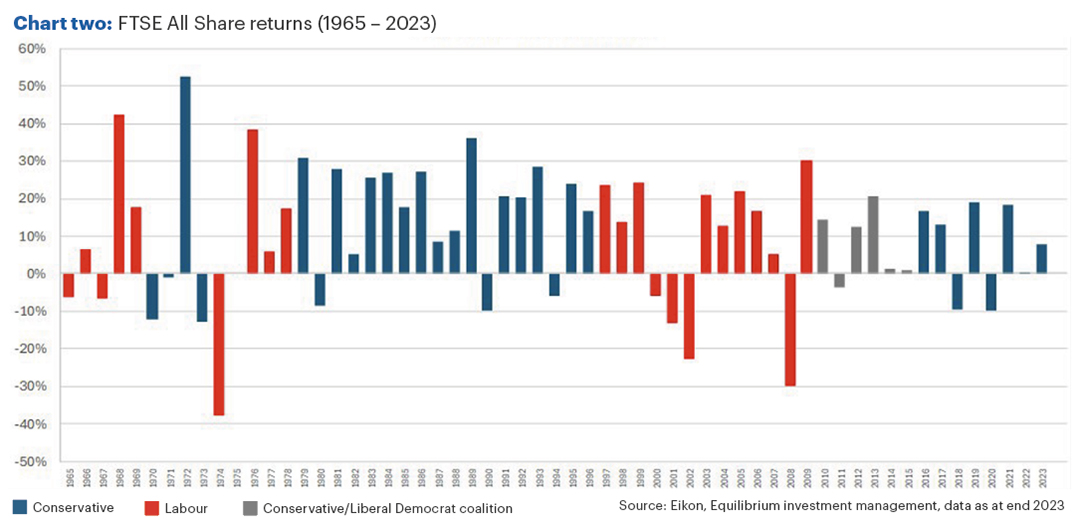

In our opinion, not a lot. Charts one and two show the performance of the UK economy and the UK stock market over time. The blue bars are when the Conservatives were in power, red is when Labour was in government (grey for a coalition). There is no discernible pattern about when the market or economy does better or worse.

Now, more than ever, we think the outcome will be largely irrelevant for markets. Firstly, the outcome is already looking pretty certain, and with markets being forward-looking, a Labour government is already largely factored into prices.

Secondly, traditionally the Conservatives have advocated less government control (less tax and less government spending) and Labour a greater amount of state control (more government spending, higher taxes).

But under the current government, overall taxation is already around 37% of GDP, the highest since 1948 (Source: Institute of Fiscal Studies). Of course, that’s partly because recent economic growth has been sluggish at best rather than purely because of tax hikes.

This leaves little room for Labour to significantly increase taxes, especially as the Shadow Chancellor has pledged not to increase capital gains tax, income tax, and national insurance, nor introduce a “mansion tax”.

Of course, that’s not to say that the election is insignificant for individuals and for certain industries. We’re sure our financial planners will have some work to do from a planning perspective, and we’re certainly not going to tell you how to vote!

That being said, as we saw with the Brexit vote, opinion polls can be wrong and even where they are correct, market reactions can be unpredictable. However, we think the outcome this time is unlikely to significantly affect portfolios.

BR-ISA?

Something else we don’t think will make much difference is the recently announced British ISA.

This is still to be consulted on, and we wouldn’t expect it to be introduced before the next election. However, in short, it seems everyone will be able to fund an extra £5,000 into an ISA each year (on top of the existing £20,000), provided they invest in something “British”.

What an eligible investment will be we’re not yet sure! Will it include bonds or just limited to stocks (equities)? If so, what exactly constitutes a British stock?

Does UK-listed Royal Dutch Shell, where revenues are 95% from overseas, count? What about a UK-listed investment trust which invests solely in emerging markets? Or will it be limited to small companies such as those outside of the top 100?

The idea is to boost investment in UK stocks, but the impact is likely to be very small.

According to FT Alphaville, it could amount to £10billion a year, but only if:

- Everyone who subscribed for £20,000 had another £5,000 ready to go.

- Everyone who subscribed for £17,500- £19,999 was trying to subscribe for £20,000 and had another £5,000 ready to go.

- The people who put £20,000 into cash ISAs are, despite all evidence, keen to invest in riskier assets.

- This £10bn won’t just be money that was destined for UK equities anyway.

Even assuming all these heroic assumptions are met, an additional £10bn a year is still a drop in the ocean. Relative to the market capitalisation of the FTSE 350 at £2.3 trillion (Source: FT Alphaville 7 March 2024), £10bn is a mere 0.04%.

Trump v Biden part 2

Across the Atlantic, political developments might be more significant.

Barring something unforeseen (prison?), Donald Trump will be the Republican nominee for the 2024 presidential election.

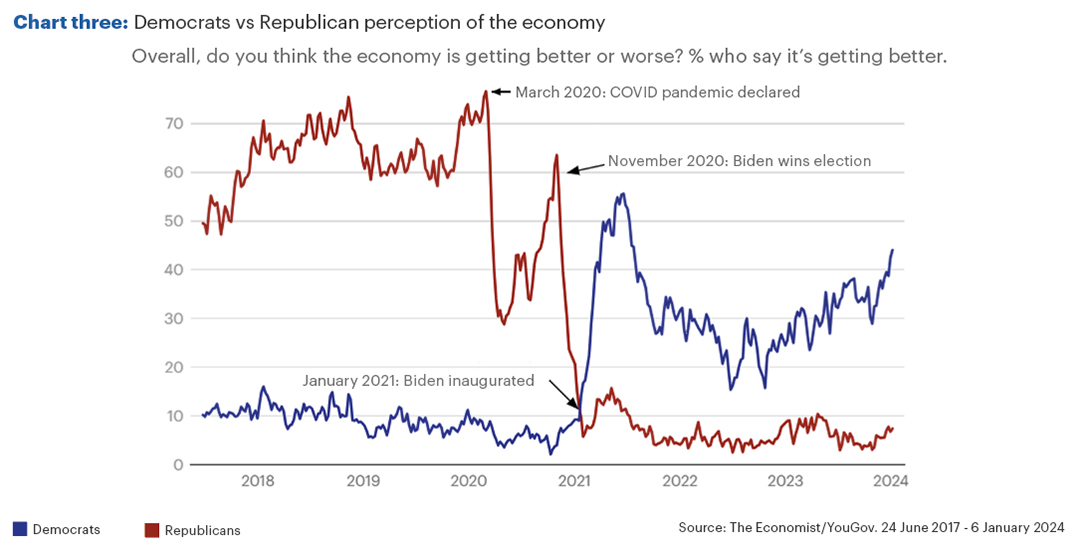

Politics is much more polarised in the US, even insofar as to how you vote seeming to affect your perception of the economy.

According to polling firm YouGov, 62% of Republicans think the economy is getting worse, compared to just 22% of Democrats. This sharply changed around the last election as we can see in Chart three.

Before the 2020 election, Democrats thought the economy was getting worse and Republicans thought it was getting better and now it’s the total opposite!

If Trump were to be elected again, there are a couple of things we think could affect markets.

Firstly, it is possible he will be much more “protectionist” than Biden, further straining relations with China, which might be negative for emerging market investments.

Secondly, one of his early acts last time around was to cut corporation taxes, boosting net profits of American companies, which in turn boosted the US stock market. Could he try and repeat the same trick?

As yet, the list of proposed policies is pretty thin, so this is something we will continue to monitor.

Also significant, will be what happens in Congress. Currently, the Democrats control the Senate and the Republicans the House of Representatives. How this changes will affect what policies can be enacted.

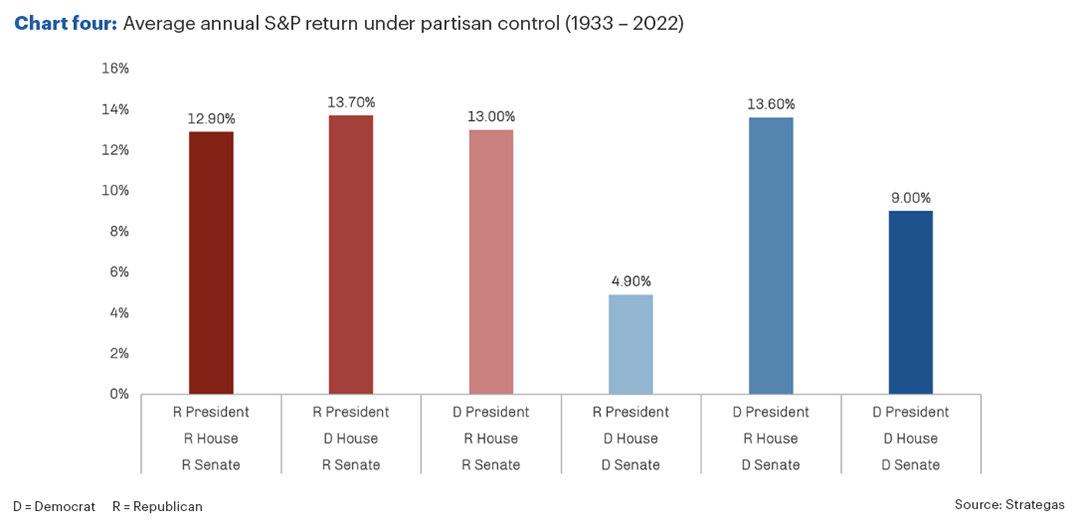

Again, history has generally shown it makes little difference to the US stock market and which party is in power, as can be seen in Chart four.

Politics will always make a difference, but for markets, the effects are unpredictable, even in the unlikely event that the opinion polls turn out to be 100% correct!

Markets are instead much more focused on central banks than they are on politicians, with the decision about when or if to cut interest rates deemed more important at present.

Past performance is for illustrative purposes only and cannot be guaranteed to apply in the future.

This newsletter is intended as an information piece and does not constitute a solicitation of investment advice.

If you have any further questions, please don’t hesitate to contact us. If you’re a client, you can reach us on 0161 486 2250 or by getting in touch with your usual Equilibrium contact. For all new enquiries please call 0161 383 3335.