Executive summary

- Inflation continues to fall, and as a result, many investors now expect interest rates to be cut in early 2024.

- This change in expectations has helped equity and bond markets to rally sharply after falls in the early Autumn.

- In particular, this has helped stocks which were hard hit by rising rates, including UK stocks and smaller companies.

- Inflation in the UK has been higher than in many other regions but is now coming back in line.

- In addition, economic growth was not as weak as expected, and our recovery from the pandemic is now thought to be better than that of Germany or France.

- We have recently seen a number of bids for small UK stocks from large US investors, especially private equity.

- We think this shows that there is good value in UK stocks and that this bodes well for future returns.

- We are always mindful of the risks, especially as rates might not be cut as much as expected by markets.

- We expect UK inflation to go back up again in the New Year due to the revised energy price cap but think this will be a temporary change of direction.

A return to normality?

In last month’s The Pulse, we discussed how inflation was coming back down to more normal levels, and how, as a result, many think that interest rates have now peaked.

In fact, markets are now anticipating rate cuts early next year.

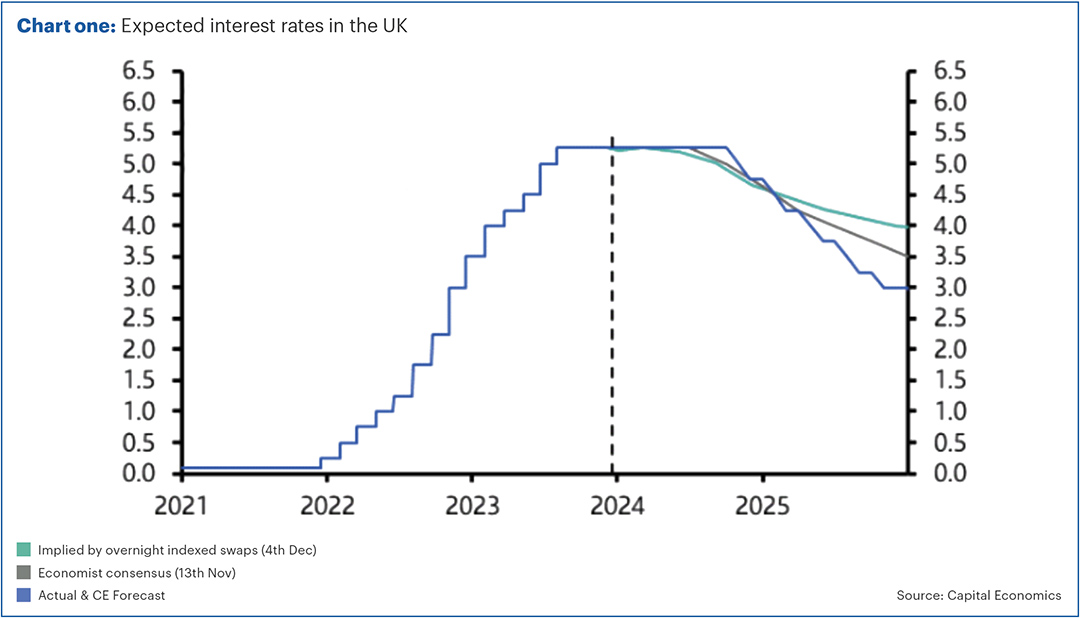

Chart one shows how steeply UK interest rates have gone up over the past few years, along with various forecasts for how they may change in the future. Depending on which forecast you look at, rates are expected to be cut midway through next year from the current 5.25%, to somewhere between 3% and 4% by mid-2025.

Chart one – expected interest rates in the UK

It’s a similar picture across the Atlantic. A couple of months ago, we wrote that the US 10-year government bond yield had risen to 5% p.a., which broadly meant that investors expected interest rates in the US to average 5% per year over the next decade.

Since then, the yield has dropped to 4.2% (Source: LSEG Datastream 13/12/23). Bearing in mind that current interest rates are 5.25% in the US, this shows that over the long term, rates are now expected to be substantially lower.

UK gilts have seen a similar move. The 10-year gilt yielded 4.7% in late October but has now dropped back to 3.95% (Source: LSEG Datastream 13/12/23).

This means that bond investors have seen a strong rally. For example, the FTSE All Stocks Gilt Index rallied by 5.26% between 19 October to 11 December 2023 (Source: Financial Express). Stock markets have also rallied over the period, and this has helped portfolios to make some strong gains.

As we outlined last month, we think the return of rates and inflation to more normal levels after such steep increases, may lead to some more “normal” investment conditions.

For example, in this period when bond yields have fallen, we’ve seen some of the things which have struggled in the face of rising rates outperform over the short term. This includes UK stocks, especially smaller companies, as well as assets like property shares.

Can Britain be Great again?

Earlier this year we asked whether there was something wrong with the UK which has caused UK assets to underperform (The Pulse – May 2023).

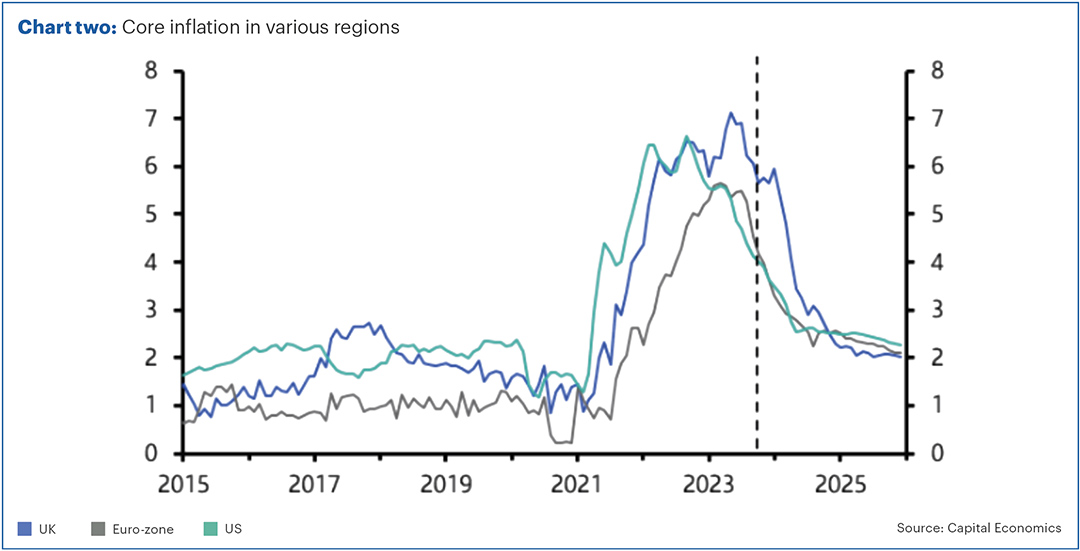

Certainly, there appeared to be evidence that inflation had gone up more than in many other regions, as you can see in Chart two. This looks at core inflation rather than just the headline, which strips out some of the more volatile components like energy.

However, as can also be seen on the chart, UK inflation is now falling rapidly, and core inflation is forecasted to come back in line or even below other regions during the next 12 months or so.

Chart two – core inflation in various regions

In addition, official statistics previously showed that the UK’s economic recovery from the pandemic seemed weaker than any other G7 country.

However, after some revisions to the official figures, UK growth was revised up to 1.8% from the end of 2019 to the end of July 2023, which now puts it ahead of both Germany (0.2%) and France (1.7%) over the same period (Source: Office for National Statistics).

Meanwhile, despite gloomy predictions, the UK has defied expectations for a recession. Growth has essentially been flat, but we think this is pretty good going given the increases in the cost of living and borrowing costs.

Whilst we agree with those who say we need to increase productivity and efficiency; recent data suggests that perhaps the UK isn’t such an outlier after all.

We’ve discussed previously how we think selected UK assets look cheap compared with some other regions. Recent activity seems to indicate that some large international investors agree with us.

For example, in November the giant US conglomerate Mars made a bid for Hotel Chocolat at a 170% premium to the previous day’s share price.

We’ve also seen US private equity firms make big bids for other UK stocks, such as Ten Entertainment (ten-pin bowling) at a 32% premium to the share price, and Smart Metering Systems at a 40% premium. (Source: Financial Express).

These bids have helped returns in both the core portfolios and in our AIM portfolio.

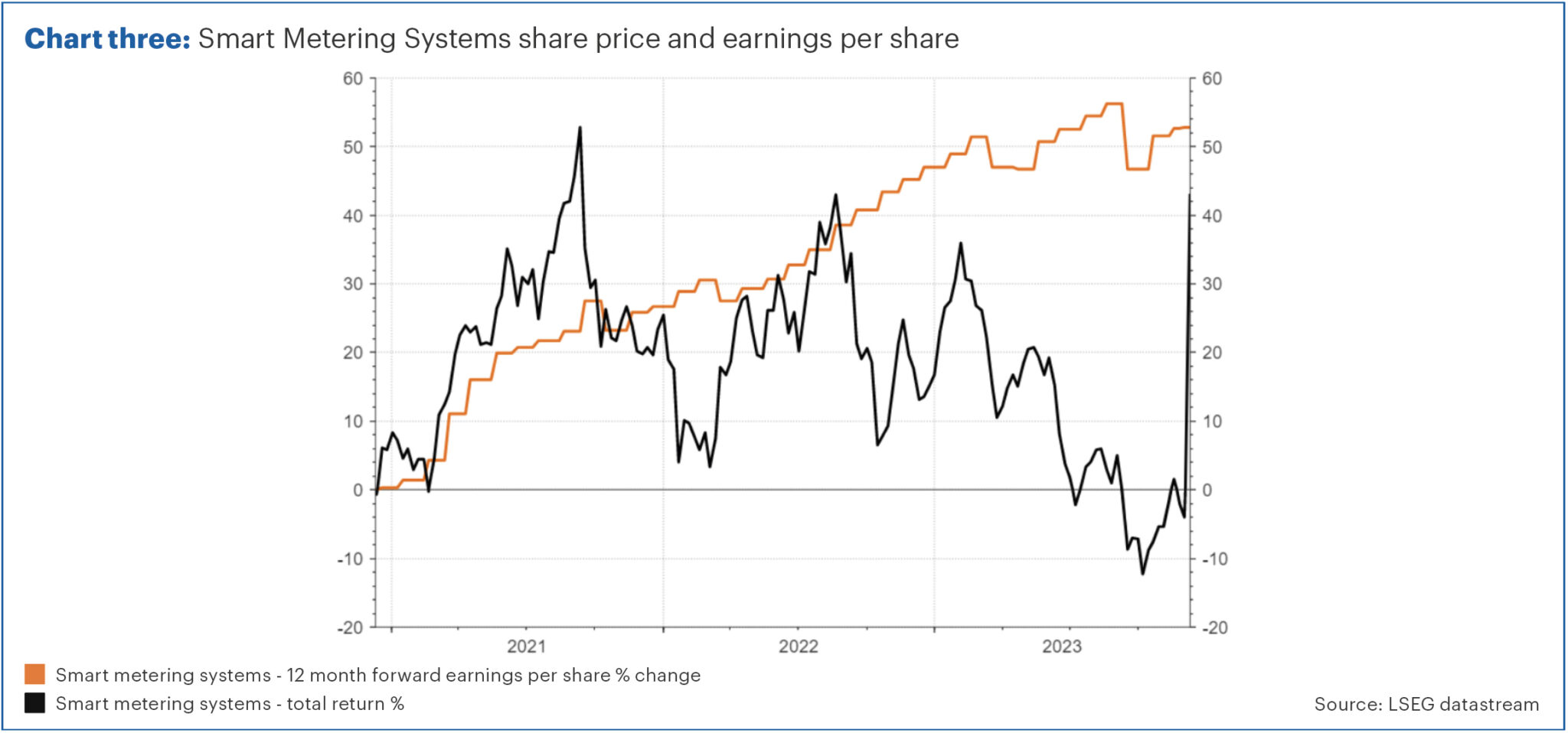

Chart three shows why private equity firms might be interested in such stocks.

The black line shows the share price of Smart Metering Systems over the past three years. Until the recent bid, the share price was lower than it was in late 2020.

The orange line shows the earnings per share (profits) being made by the company. You would expect that over time, the share price would reflect the growth in profits.

Apart from a few minor blips, profits have carried on growing and are up by more than 50% over the same period. The jump in the share price after the bid is merely catching up with how much profits have gone up.

Chart three – Smart Metering Systems share price and earnings per share

We have numerous other examples of other companies with similar dynamics, and therefore we don’t expect these to be the last bids we see.

Whilst these are individual company examples at the moment, if current trends continue then we think UK stocks could benefit more generally.

A note of caution…

We are very optimistic about future returns with numerous assets looking good value in our opinion.

However, we would not be Equilibrium if we weren’t also looking at the risks and trying to work out what could go wrong!

With markets beginning to price in rate cuts next year, this of course leaves room for disappointment should the cuts not occur. For example, if economic growth proved stronger or inflation remained higher than expected, then central banks would likely keep rates on hold.

In fact, we also want to point out that inflation may well go back up in January. This is because January 2023 saw some deflation in that month, which will drop out of the annual figure in January 2024.

In addition, January 2024 is when we’ll see the next revisions to the energy price cap which will go up by about 5%, pushing up inflation in that month (Source: Ofgem.gov.uk). Whilst we expect this to be a blip rather than the beginning of a renewed increase, we wouldn’t be surprised to see some market volatility in the new year.

However, taking a longer-term view, with bond yields now higher than a year ago, and many stock markets even cheaper, we think there are real reasons the current positive trends can continue.

We wish all our clients a very happy and healthy Christmas and New Year!

Past performance is for illustrative purposes only and cannot be guaranteed to apply in the future.

This newsletter is intended as an information piece and does not constitute a solicitation of investment advice.

If you have any further questions, please don’t hesitate to contact us. If you’re a client, you can reach us on 0161 486 2250 or by getting in touch with your usual Equilibrium contact. For all new enquiries please call 0161 383 3335.