This article is taken from our autumn 2023 edition of Equinox. You can view the full version here.

There’s a phrase we often use in the office: “don’t poke the Chimp!” At Equilibrium, we are big fans of “The Chimp Paradox” by Professor Steve Peters. In his book, Peters explains that we cannot always control how we react to new information or events.

Whilst our “human brain” can analyse things in a rational, detached fashion, often our initial reactions to stimuli are more emotional and “animalistic.” Peters calls this our “Chimp.”

Our Chimp brain works quickly as it is based on instinct, which can sometimes be helpful (if you’re in the jungle and you see a tiger, for instance). However, these emotional reactions can lead us to make poor decisions in today’s modern world.

Peters says that to control our Chimp we need to understand it rather than ignore it. It can even be helpful to name it. For example, Equilibrium founder, Colin Lawson, calls his “Igor” (coincidentally I call mine “Colin”!).

If I want Colin (our founder) to agree to something within the business, it pays for me to appeal to his “human” brain and avoid poking Igor!

Portfolio reporting

So, what does this have to do with investing?

Numerous studies have shown that humans tend to have strong, emotional reactions to investment losses. These negative emotions are perhaps twice as strong as the positive feelings we have when we make gains. 1

However, if we want to achieve returns above cash, we need to take some risks. Investors will inevitably experience losses from time to time, but investing should be for the long term.

In fact, the more frequently you look at your portfolio, the more likely you are to experience losses.

Let’s look at the S&P 500 (the main US stock market) where we have the most data. Between 1951 and 2022, 53.6% of days were “up days” and 46.4% were “down days”.2

If you held an S&P tracker and looked at your valuation daily, you’d experience a loss almost half of the time!

The less frequently you check your portfolio, the less likely you are to experience a loss.

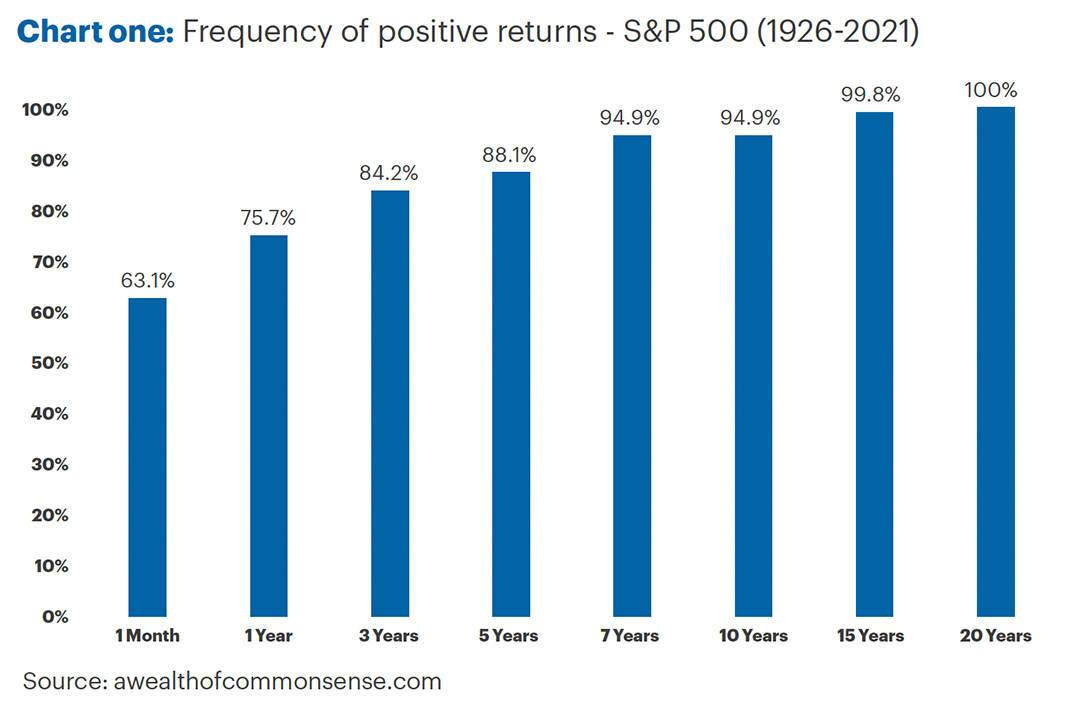

Chart one shows how frequently the S&P 500 was positive over various time frames from 1926 to 2021.

Those investors who checked their portfolios monthly would have experienced losses more than a third of the time.

However, leave 12 months between portfolio reviews and 75.7% of periods were positive. Leave it 20 years and 100% of periods saw gains!

Triggering your Chimp

Why do we send you a valuation each quarter? In doing so, we may have unnecessarily triggered your Chimp.

We originally reported in this way because we needed to review portfolios and make changes to align with target positions. However, this is now done daily for most clients who are in the IFSL Equilibrium funds.

We have also historically reported your percentage returns net of all financial planning and platform fees, and investment management charges. There are two problems this can cause:

- We are inadvertently asking you to judge our financial planners solely by investment returns. But these return figures don’t consider tax savings through tax planning, cash flow forecasting to provide confidence in the future and any intergenerational planning.

- It makes it difficult for you to assess our investment performance. If we report the performance net of financial planning and platform fees, then we ought to adjust any benchmark to consider such fees as well. To put it another way, if our financial planners had recommended a different investment manager or platform then the financial planning and platform fees would still be charged. Further to this, we reported on money-weighted performance which adjusts returns for the amounts you add and withdraw from your portfolio.This can be more accurate in many ways, but it can also be misleading when looking at relative performance and cannot be compared to a benchmark where returns are shown as simple time weighted. Your return is influenced by the exact timing of contribution and withdrawals, which can make a big difference especially if the amounts are large relative to the overall value of the portfolio.

Separate reporting

Given the above factors, we have decided to separate out the reporting of Equilibrium Financial Planning (EFP) and Equilibrium Investment Management (EIM).

We are looking to phase out quarterly valuations although you can still access your valuations via our portal. EFP will continue to provide an annual update as part of your financial plan review.

EIM will enhance their quarterly investment reporting to provide more information about performance in relative and absolute terms.

We already hold quarterly market updates and we will enhance this by providing more written and video content. It is then your choice whether you wish to look at this content.

Answering the key questions

Our reporting will always aim to answer three common concerns:

- Am I ok and will my finances survive the market’s ups and downs? EFP

- Are you doing ok compared with relative benchmarks and other

investment managers? EIM - What actions are you taking? EFP & EIM

There’s a big difference between market returns, investment performance and results. Markets are beyond our control – they happen to us. Performance is how we do relative to benchmarks or other investment managers. Results are what you end up with – after the inflows and outflows, timing of contributions and withdrawals, changes made, and any planning carried out together.

In future, EIM will report on markets and performance and EFP will report separately on your results. This shift will hopefully keep your Chimp under control and your human brain in check!

If you have any further questions, please don’t hesitate to contact us. If you’re a client you can reach us on 0161 486 2250 or by getting in touch with your usual Equilibrium contact. For all new enquiries please call 0161 383 3335.

Past performance is for illustrative purposes only and cannot be guaranteed to apply in the future. This article is intended as an information piece and does not constitute a solicitation of investment advice.

Sources

(1) Loss aversion (www.behavioraleconomics.com)

(2) Stock Market Yo-Yo (www.pcrestmontresearch.com)