2024 is the year of the election.

Amazingly, 64 countries are set to head to the polls, with some already voting. This means more than 4 billion votes will be cast, representing nearly 50% of the world population.

The UK will vote on 4 July, whilst the US will cast their ballots on 5 November. Given those dates, you will no doubt be drowning in puns relating to fireworks, but historically has this had an explosive (sorry) impact on worldwide stock markets?

When it comes to the UK general elections, it is always a hot topic in client meetings, so with that in mind, we thought this would be a good time to reflect on what we’ve experienced with our funds.

Equilibrium became discretionary managers on 1 January 2009, allowing us to make portfolio changes without needing prior consent from our clients. This was a significant landmark, as gone were the days of clients queuing out of the front door to authorise changes as they did at the height of the Credit Crunch. Instead, Investment Manager, Mike Deverell and the team were able to make switches en masse and instantly react to the ever-changing investment landscape.

Since this momentous day, the UK has had six Prime Ministers, starting with Labour, before the Tories took the reins in 2010 and held four general elections. Unlike the UK, Equilibrium has been guided throughout by Mike. Given his consistent approach, what outcomes have we experienced around election time?

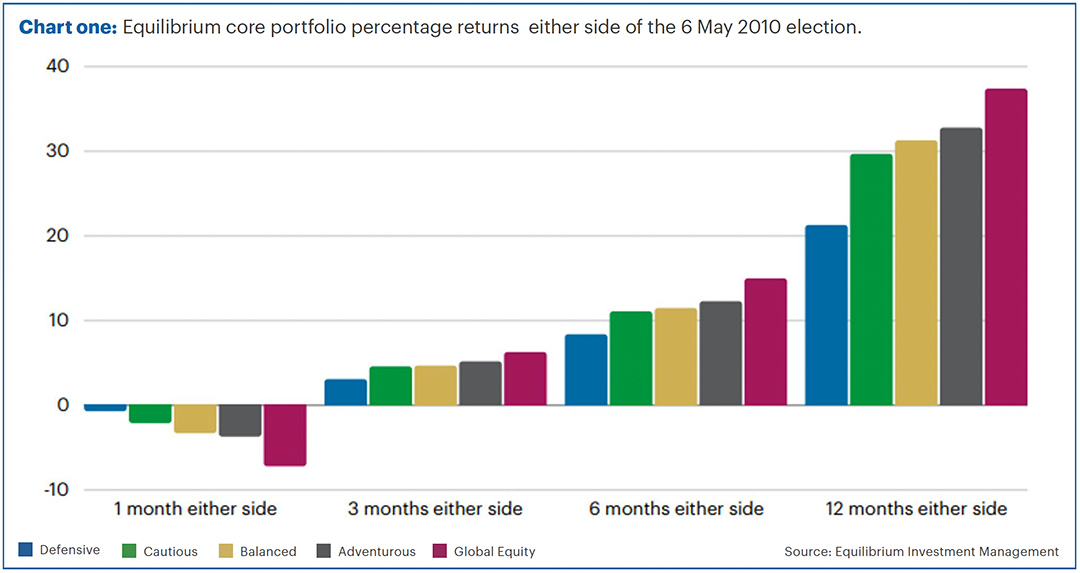

6 May 2010

Just as the ash from the volcanic eruption in Iceland was settling, and Gordon Brown was caught out on the election trail for calling a pensioner a “bigot”, the UK was gripped by election fever.

In a changing of the guard, Labour was defeated as voters awoke to a new Conservative-led coalition.

With such uncertainty both before and after the election and everyone frantically googling what a coalition actually means, let’s take a look at the impact on our funds.

The chart below gives a measure of how much each fund has returned over a specific period, with the election date being the midpoint. In this instance, the election date is 6 May 2010 so the column on the right labelled “12 months either side” covers the period of 6 May 2009 to 6 May 2011.

In the shortest timeframe, initial uncertainty potentially linked to a change of government leads to a drop in all funds with Global Equity hit hardest falling -7.2%.

As confidence and stability was restored, the funds proceeded to build on the gains prior to the election giving a positive two-year return, with the highest-risk fund achieving 37.4%.

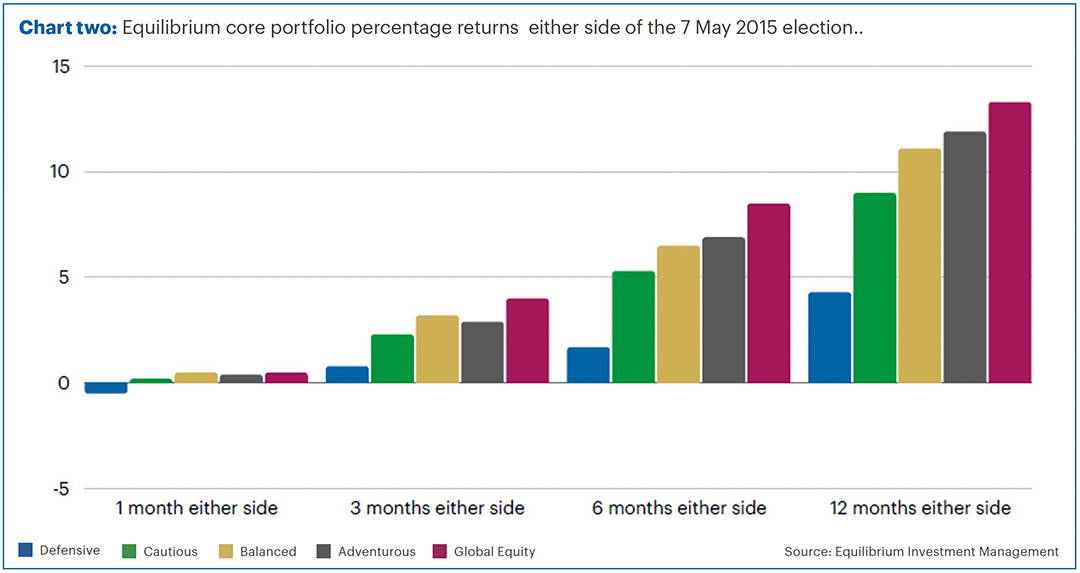

7 May 2015

As Facebook passed a billion users, and Jeremy Clarkson punched a producer, the Tories defied the polls and won the general election with a slender majority.

With a change of leadership in the other major parties, and Mr Cameron sticking by his manifesto pledge to hold an in-out referendum on EU membership, this again led to uncertainty with a microscope firmly focused on the impact this would have on domestic and wider global markets.

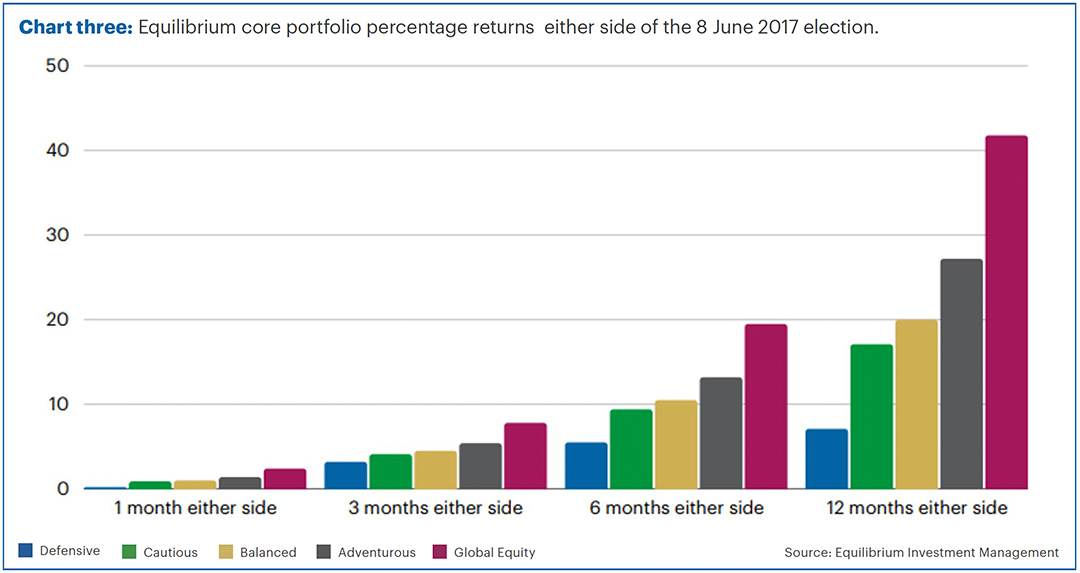

8 June 2017

It was the UK’s greenest-ever year as we had our first full day without using any coal power since the Industrial Revolution, over 200 years ago. Following on from the fallout of the UK’s decision to leave the EU, the Tories lost their majority and once again they formed a coalition this time with the Democratic Unionist Party of Northern Ireland.

On the back of the snap election, amidst a lack of clarity as to what Brexit might actually look like, would we now be entering a period of spiralling returns in our funds?

Once again, the so-called experts’ scaremongering didn’t bear fruit, and amazingly there was not a single negative period in the Equilibrium suite of funds during the times sandwiched between the election.

The 2017 election provided the greatest dispersion over the two-year period, amid a 34.7% differential between the highest and lowest risk fund, as an amazing $9 trillion was added to global stock markets in 2017 alone.

Whilst the FTSE 100 did well and achieved a record level, the FTSE 250 which is considered a better reflection of the state of the UK economy, outperformed the “Footsie” offering promise to domestic businesses.

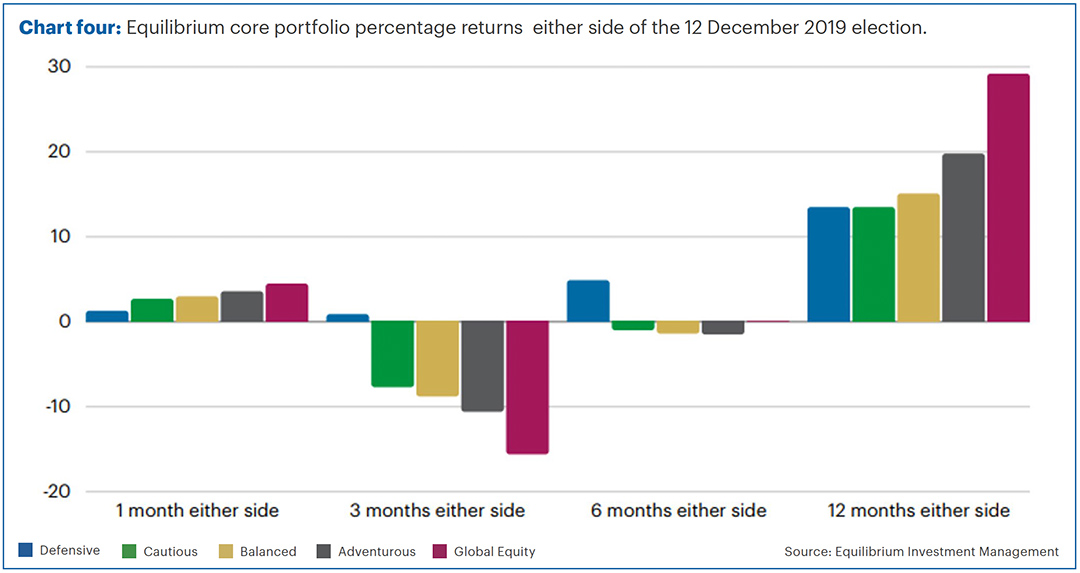

12 December 2019

As Thomas Cook collapsed and Notre-Dame was saved from total destruction after a blaze ripped through the cathedral, Britain took to the polls. It turned out to be a very merry Christmas for Boris as the Conservatives recorded a landslide victory.

With Covid just around the corner, such a once-in-a-lifetime event must surely have a devastating impact on markets with nobody knowing for sure what the effect would be and how long it would last.

The impact of Covid instantaneously hit the world, and stock markets tumbled with the FTSE250 losing 41% between 20 February 2020 and 19 March 2020.

Unexpectedly amid the chaos, the recovery was strong and from the low point in March 2020 to the end of the calendar year, the Equilibrium Global Equity fund was actually up by 11%!

“This time is different.”

Sir John Templeton, the successful inventor and fund pioneer deemed these the four most dangerous words in investing.

Whilst past performance should never be used to accurately predict the future and living in the moment feels unique, the returns do indicate that although unsettling in the immediate short term, over a two-year period (one year either side of the election date), you are rewarded for taking on risk. The reality is that each fund historically has been perfectly placed from a returns-adjusted perspective, relative to the risk you are prepared to take.

So, whilst in the short term the forecast might be foggy in the aftermath of Independence Day and Bonfire Night, once the air clears, hopefully, history will repeat itself!

We are here to help

If you have any further questions, please don’t hesitate to contact us.

If you’re a client, you can reach us on 0161 486 2250 or by getting in touch with your usual Equilibrium contact. If you are new to Equilibrium and would like to speak with one of our experts, contact us here or call us on 0161 383 3335.

This article is intended as an informative piece and should not be construed as advice.

Past performance is for illustrative purposes only and cannot be guaranteed to apply in the future.