Upon reflection…

Despite a backdrop of great uncertainty, 2019 was full of ups, with very few downs.

The beginning of the year is generally a time for reflection – what has happened over the past 12 months and why?

Allocation

In the latest newsletter, Mike gives an overview of asset allocation and how understanding the behaviour of different asset classes helps us deliver attractive relative returns in different market conditions.

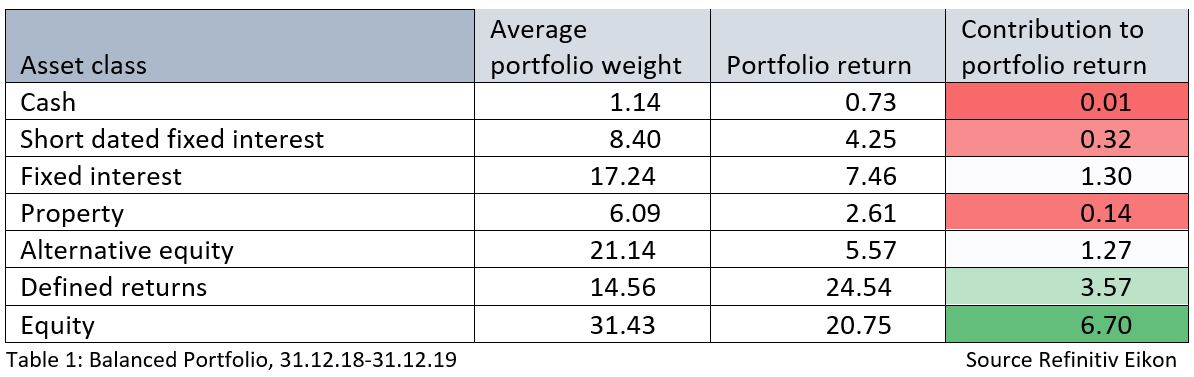

Table one relates to our Balanced Portfolio through 2019 and breaks down returns so we can see how each element of the portfolio performed and contributed to overall returns. It’s easy to see that returns have largely been driven by risk assets such as equity and defined returns.

Table one

Equity positioning

Focusing on equity, we can see from table two that returns have been positive across the board. The UK Dynamic Portfolio returned the most whilst Global Established contributed most due to it making up a larger proportion of the portfolio.

Table two

Split UK

UK assets in general have been depressed for some time as a directionless government gave way to high levels of uncertainty on the future of the UK and a lower sterling. International investors kept well away, unwilling to invest even as valuations relative to overseas markets often looked attractive. As the year progressed and factions in UK parliament persisted, an almost inevitable general election was called, the margin if not the result came as a far greater surprise.

In investment terms our UK equity portfolios also showed disparity in returns. The domestic focused UK Dynamic Portfolio, worst performing through 2018, was strongest in 2019 and outperformed the UK Conservative Equity Portfolio by nearly 10%. Inflection points in April then in December coincide with milestones in UK politics as Britain failed to leave the EU (and a no-deal Brexit was all but taken off the table) on 12 April and then again in December as a huge margin signalled a break to the political impasse.

Great Britain?

We have, for some time, favoured investing in smaller companies; we expect long-term returns to outperform those of larger companies and have tilted our portfolios to reflect this view. Through 2019 we added to our UK Dynamic Portfolio increasing it from about 21% to nearly 26% of our equity in our Balanced Portfolio.

Our expectations see UK companies able to look forward with a greater degree of certainty, investing more on staff and projects to boost profitability. Investors too can have greater confidence investing in a long under-owned region and could also look to shift portfolios.

The potential for increased earnings and rerating from investors willing to pay more for UK assets give us optimism that returns for UK equities with a domestic focus could continue to outperform.