It’s fair to say that in the last few years, it certainly hasn’t been a smooth ride for the investor. For some, it may have felt like an uncomfortable rollercoaster ride, others may have felt it was a never-ending loop-the- loop and what about the people who just wanted to get off altogether? The point is we all react to news and information in our own unique way.

Here at Equilibrium, we have always carried out a risk profile questionnaire (using a system called FinaMetrica) for all our clients at the outset before making any recommendations, but this is designed purely for the purpose of identifying risk tolerance. It does not consider psychological and behavioural traits – or put simply, one’s needs and desires. These are what we refer to as “the three pillars of risk”, something which we believe can be harnessed through the discovery of your financial DNA.

Financial DNA is a system designed to ascertain an individual’s distinct financial personality, behaviours and tendencies. Through a series of questions, like that of a personality test, the answers reveal how a person relates to money, reacts to unfavourable market conditions, makes financial decisions and manages their finances.

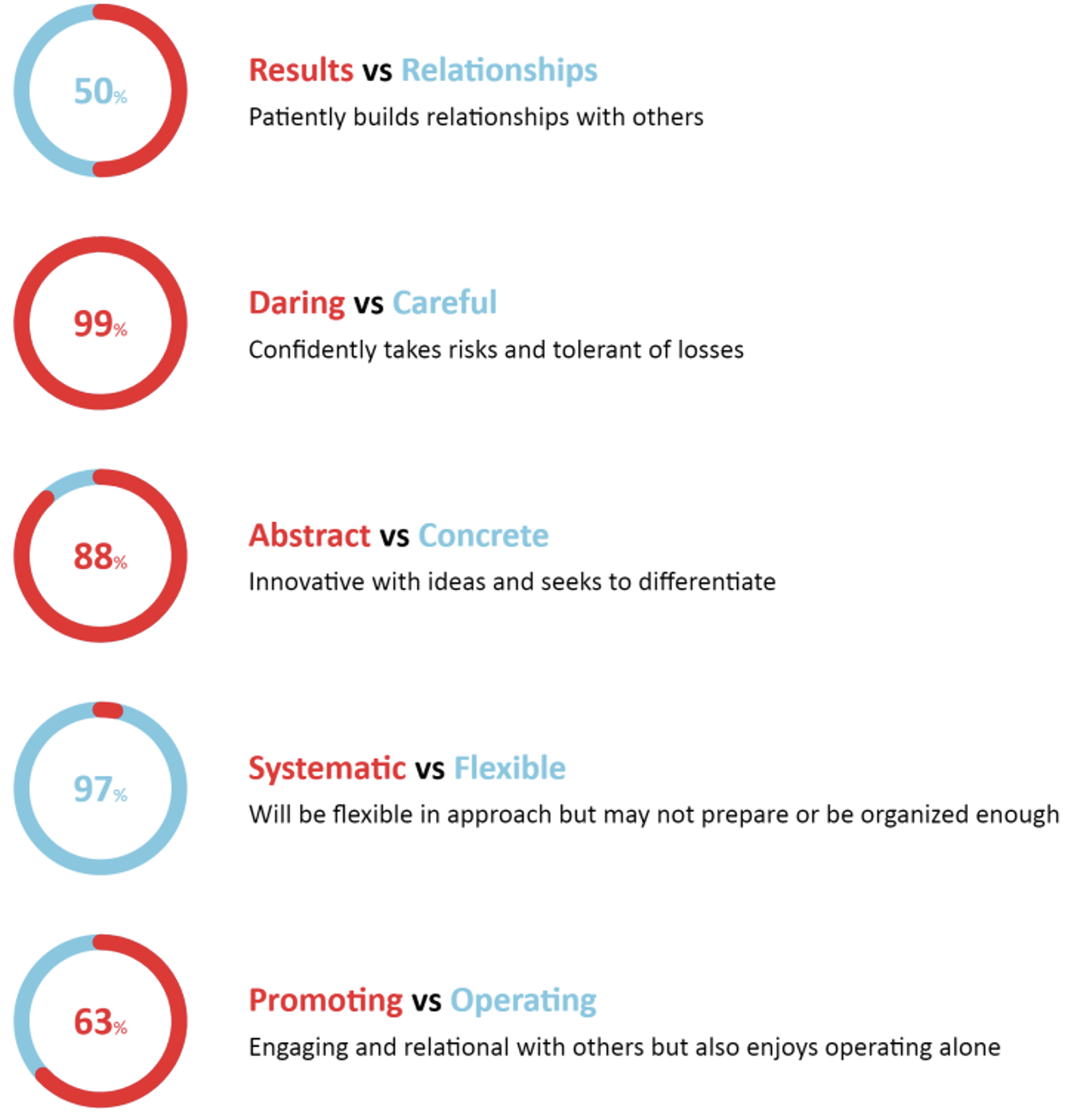

Take our Founder, Colin Lawson, for instance (see example below), he is extremely comfortable taking risks, tolerant of losses, and likely to recognise and balance emotional impulses with logic.

Colin’s results

Understanding your financial DNA can indeed be a valuable tool for self-reflection and making better financial decisions. Here are some ways in which understanding your financial DNA can help you:

1. Define

Financial DNA refers to the unique combination of factors that shape our financial behaviours and attitudes. It encompasses our upbringing, cultural influences, personal experiences and even our personality traits.

2. Align

Upbringing and environment: Our family’s financial habits and values play a significant role in shaping our financial DNA. If we grew up in a household where money was openly discussed and managed responsibly, we are more likely to adopt similar habits. On the other hand, if we witnessed financial struggles or unhealthy money behaviours, it may have impacted our financial mindset.

Cultural influences: Cultural norms and societal expectations can also play a part. Different cultures have varying attitudes towards money, such as saving, investing and debt. Understanding these cultural influences can help us recognise any biases or beliefs that may be limiting our financial growth.

Personal experiences: Our past financial experiences, both positive and negative, leave a lasting impact. For example, if we experience a financial setback, such as a divorce, illness or job loss, it may influence our risk aversion and approach to financial planning. Conversely, achieving financial milestones can boost our confidence and shape a more optimistic financial mindset.

Personality traits: Another contributing factor is our inherent personality traits, such as being risk- averse or risk-seeking (such as Colin). Some are naturally more inclined to take risks and seek investment opportunities, while others prefer a more conservative approach. Recognising our personality traits can help us align our financial decisions with our comfort levels.

3. Understand

It’s essential to reflect on our financial habits, beliefs and emotions surrounding money. Ask yourself questions like: How do I feel about saving? Am I comfortable with taking risks? Do I have a scarcity or abundance mindset? Identifying patterns and triggers can provide valuable insights and help us make conscious changes if needed.

4. Leverage

Once we understand our patterns of behaviour, we can leverage them to make better financial decisions. For example, if we have a natural inclination towards saving, we can set up automatic savings plans to capitalise on this strength. If we tend to be risk-averse, we can explore low-risk investment options that align with our comfort levels, this can create a more sustainable and fulfilling financial future.

5. Break free

Understanding our financial DNA can also help us identify and challenge any limiting beliefs or negative money scripts that may be holding us back. For instance, if we have a scarcity mindset, constantly worrying about not having enough, we can work on shifting our mindset towards abundance and gratitude. By reframing our beliefs, we can open ourselves up to new opportunities and possibilities.

Our financial DNA is a powerful force that shapes our behaviours, attitudes and beliefs. By understanding and embracing it, we can make more informed financial decisions, leverage our strengths and overcome any limiting beliefs.

Remember, just as we have the power to shape our physical health through lifestyle choices, we also have the power to shape our financial wellbeing. So, take the time to explore yours and unlock the potential for a brighter financial future.

If you’re new to Equilibrium and would like to complete the Financial DNA questionnaire and receive a full report and analysis, please call us on 0161 383 3335. If you’re already a client, please reach out to your usual Equilibrium contact who will be able to arrange this for you.

This article is intended as an informative piece and should not be construed as advice.