Executive summary:

- UK Budget market reactions: The UK Budget led to a slight increase in gilt yields, indicating higher government borrowing costs. However, the market reaction was relatively calm compared to past events like the Liz Truss mini-Budget of 2022.

- Impact on AIM stocks: The Alternative Investment Market (AIM) saw a positive reaction as inheritance tax relief was reduced rather than completely removed, causing a significant rise in affected stocks.

- US election market reactions: The election of Donald Trump led to a rise in US stock prices, particularly among smaller companies, due to expectations of corporate tax cuts and reduced regulation.

- Long-term concerns: Despite short-term gains, there are concerns about Trump’s policies on tariffs and immigration, which could negatively impact economic growth and inflation in the long run.

- Investment strategy: We continue to emphasise the importance of maintaining a well-diversified portfolio to navigate the uncertainties and potential impacts of recent political events.

Political waves and market ripples

It’s been an interesting few weeks in the investment world, with the Labour government’s first Budget and the US presidential election both having the potential to affect investment returns.

In the end, both events had a largely positive effect on portfolios, even if the longer-term picture remains somewhat cloudy (more of which below).

There were also plenty of tax changes in the Budget of course, which may affect a number of our clients. There will be further communications on this in due course from our financial planning team, but this newsletter will concentrate on investments.

UK Budget – market reaction

There are a couple of main points to note in terms of market reaction to the UK Budget.

Firstly, gilt yields increased, which means the amount the government pays to borrow money has gone up. Before the Budget, the 10-year yield had been around 4.3% p.a., with it now being around 4.5% p.a. (Source: LSEG Datastream), so an extra 0.2% p.a. – a relatively small difference.

It is difficult to work out how much of this is due to the expected additional borrowing from the government and how much is due to changing international conditions. US and European bond yields went up over the same time, with investors believing that fewer interest rate cuts are in the offing.

This is also a world removed from the Liz Truss mini-Budget of 2022 when the 10-year gilt yield increased by well over 1% p.a. over the course of a few days. In essence, despite the government being likely to borrow more money than previously expected, the market seems fairly relaxed about this prospect.

The other significant Budget reaction was in the Alternative Investment Market (AIM). Here, stocks that previously qualified for inheritance tax relief at 40%, had that relief cut to 20%.

However, the reaction on the market was positive, as investors had feared the relief being removed in its entirety. As a result, the affected stocks jumped, with our AIM Portfolio going up by 7.1% in the afternoon after the Budget (Source: LSEG Eikon / Equilibrium Investment Management).

What was largely missing from the Budget were any major new announcements to boost investment in the UK, something we were expecting to see given the government’s pledge to have the “strongest sustained growth in the G7” (Source: 5 Missions for a Better Britain Report, Labour Party, 2024).

We hope to see further measures aimed at boosting growth in the near future.

US Presidential Election – market reaction

We saw more market reaction following the election of Donald Trump as the next president of the USA.

The biggest reaction was again in the stock market, where the potential for Trump to cut corporate taxes (which therefore increases net profits) saw share prices increase.

The main S&P 500 Index went up 2.5% on 6 November, the day after the election, but the big move was in smaller US companies with the Russell 2000 Index jumping by just shy of 6% on the day (Source: Investing.com).

This is partly because smaller companies tend to pay higher US corporate taxes than multinational firms that make more profits overseas. It is also because the small-cap index contains more banks, which are seen as a potential winner of Trump’s desire to reduce regulation. We have been positive about smaller US companies for some time, and so this helped to boost portfolios.

The other impact was in the government bond market, with a small increase in US government bond yields. Trump’s agenda is likely to keep inflation higher, which might mean interest rates need to stay higher for longer.

In the run-up to the election, we took some profits on our US government bonds (which did very well in the summer) and kept back more cash than usual, which we held in US dollars. As we had suspected, the dollar jumped in the wake of the election, and bonds fell slightly, so this strategy also worked well.

But, while the short-term reaction was positive, we do have some concerns about the longer-term outlook.

In particular, Trump’s promise/threat to put tariffs on all imports could have a significant impact. He has speculated that this tax would be between 10% to 20% and perhaps 60% on Chinese goods. If so, this would likely make goods more expensive (and is therefore inflationary) and potentially reduce economic growth.

He has also promised to dramatically cut immigration and potentially deport a large number of undocumented migrants. Again, that would probably not be good for growth.

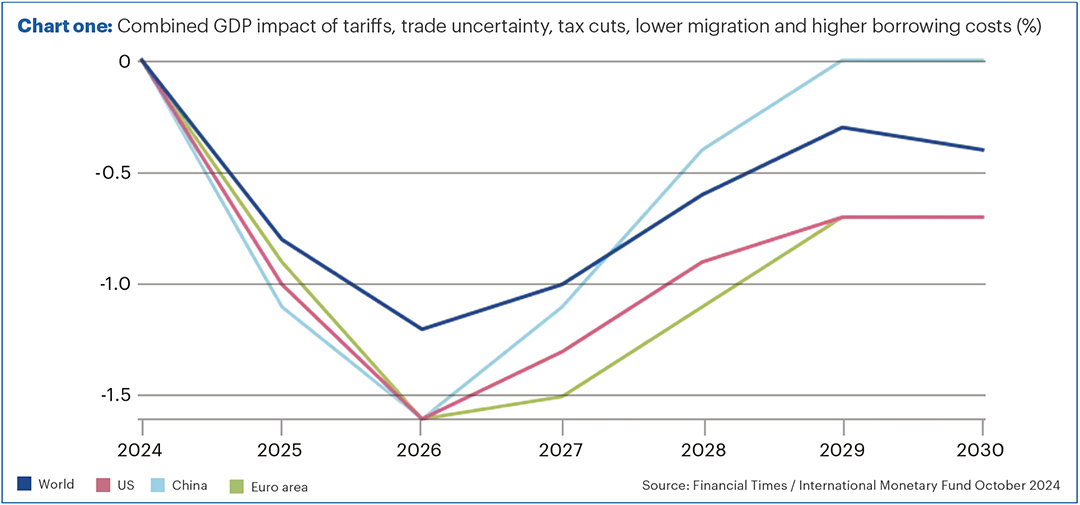

Chart one is from the Financial Times but is based on calculations by the International Monetary Fund (IMF). This shows the likely impact on growth should these policies be enacted in full. The IMF expects US growth to be about 1% lower next year and 1.5% lower in 2026, with significant hits to European and Chinese growth (who are big exporters).

With Trump, we, of course, need to take his promises with a pinch of salt! He often doesn’t follow through on what he says, claiming that some of it is a deliberate negotiating tactic to secure better trade terms.

As we’ve discussed in previous publications, we do worry that the US stock market looks a little expensive, and anything that reduces growth, even a small amount, could have an impact on share prices.

However, we do think some US companies outside of the big technology stocks look better value, so we hold a US equity fund which allocates the same amount to each of the stocks in the S&P 500 Index. This means there is a bit more in the slightly smaller companies and a bit less in the big technology stocks, which make up more than a third of the main market index.

We are also allocating more to the US via defined returns, as outlined in September’s edition of The Pulse. These can potentially provide a double-digit return even if the market goes sideways over the next few years.

With significant events, such as what we’ve recently seen, it doesn’t always pay to take big positions. Instead, we think it is better to have a well-diversified portfolio of assets that might do well in different scenarios, and that is how we continue to run the portfolios.

Past performance is for illustrative purposes only and cannot be guaranteed to apply in the future.

This newsletter is intended as an information piece and does not constitute a solicitation of investment advice.

If you have any further questions, please don’t hesitate to contact us. If you’re a client, you can reach us on 0161 486 2250 or by getting in touch with your usual Equilibrium contact. If you are new to Equilibrium and would like to speak with one of our experts, contact us here or call us on 0161 383 3335 for a free, no-obligation initial chat.

Mike Deverell

Mike Deverell