Executive summary

- US inflation has fallen back to 4%. As a result, the Federal Reserve have paused further rate hikes for now.

- UK inflation remains stickier and the Bank of England is likely to keep hiking.

- This pushes up mortgage rates with the 2-year fixed now over 6% p.a. – the economy may slow later this year.

- Gilt yields have also gone up, but now look decent value compared to other government bonds.

- Other UK assets like equity also look good value compared to overseas stocks.

- US tech stocks have done very well recently, off the back of hype around artificial intelligence.

- We’ve recently banked gains in US tech and topped up bonds.

The special relationship?

When will the cost-of-living squeeze come to an end?

It’s possible America is close to that point. This month, we saw US consumer price inflation fall to 4% p.a., having been 9.1% last June, with forward–looking indicators pointing to further falls ahead. (Source: US Bureau of Labor Statistics: 12-month percentage change)

This gave the US central bank the confidence to “pause” and allow previous rate hikes time to do their job. That’s not to say they may not resume hiking if the economic data points to further inflation ahead, but they stressed they will remain “data dependent”.

Good news for Americans (and probably good news for global markets too), but as we highlighted in The Pulse last month, things seem a little different on this side of the Atlantic.

Here in the UK, we have seen various indicators tell us that inflation may prove “stickier” than expected. In particular, we continue to see a strong job market and wage growth has been accelerating (albeit wage growth is still below consumer price inflation).

At the time of writing (Monday 19 June) we’re expecting the Bank of England to put up interest rates again this week (Note: As at Thursday 22 June, the Bank of England has raised the official interest rate to 5% in a bid to tame current inflation which sits at 8.7% as measured by the latest data from the Consumer Prices Index).

This is already factored into the UK gilt market, where yields have risen recently (meaning prices have fallen) and indicates investors are already expecting rates to hit at least 5.5% p.a. by the end of the year (Source: Bloomberg 18 June 2023).

In turn, the increase in gilt yields has had an impact on the mortgage market. For example, the average two-year fixed rate mortgage is now 6.01% (Source: BBC / Moneyfacts 19 June 2023).

In our recent edition of Equinox, we highlighted how around two million mortgages are up for renewal in 2023, with a similar number to be renewed next year. The majority of these were fixed at rates of 2% p.a. or less. To move from 2% to 6% p.a. would represent a serious hit to some people’s finances.

This is why we always say that monetary policy works with a lag. Rate hikes are designed to slow the economy by slowing spending, but it takes time for this to work.

We have heard calls in some of the newspapers for the government to help with the looming “mortgage crisis” (Daily Telegraph) but we would be surprised if they intervened. Helping people with their mortgage payments not only comes at a cost, but would also force the Bank of England to put up rates even more! Essentially, government action would negate the inflation-fighting impact of previous rate hikes.

Given the government has promised to halve inflation this year, it seems unlikely they will do anything to jeopardise this.

Ironically, all these worries are essentially because the UK economy has done better than expected, with low unemployment and consumer spending holding up well.

Higher rates may well cause a slowdown later this year, but if the Bank puts up interest rates too far, this could turn into more of a major downturn. It is a fine balancing act.

More transatlantic differences

With rates in the UK now expected to move above those in the US and stay higher for longer, UK gilts now yield more than their US counterparts.

If you lend your money to the US government for 10 years, you can expect around 3.7% p.a. return. By contrast, lend your money to the UK government for the same length of time, you can now get close to 4.5% p.a. (Source: Refinitiv)

This is leading some fund managers to turn bullish on the asset class. According to Bloomberg, leading asset managers such as Blackrock, Invesco and Royal London Asset Management are now becoming big buyers of gilts. This is because not only is the yield higher than many other countries, but also there is a chance of a capital gain.

“The market’s pricing of five more hikes from the Bank of England is very unlikely,” said Alexandra Ivanova from Invesco (Source: Bloomberg).

If the anticipated rate hikes don’t happen, then yields ought to fall leading to a capital gain.

The government bond market is not the only area where UK assets look significantly better value than their overseas counterparts.

We highlighted last month how the UK stock market looks cheaper than most other developed markets, and how in many cases this seems unjustified.

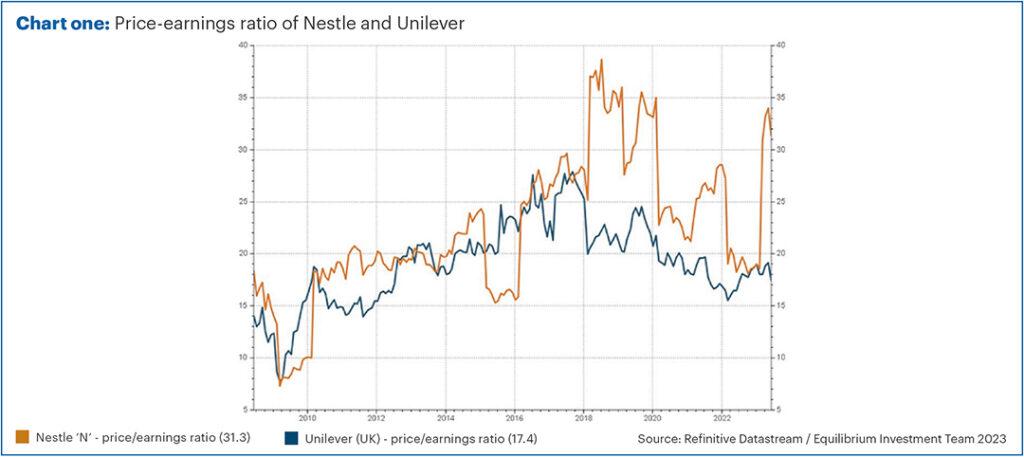

Here we give two examples. Chart one shows the price-earnings ratio (a measure of value) of Nestle (listed in Switzerland) compared to Unilever, listed in the UK. Both make a variety of consumer goods, from drinks to chocolate and ice cream.

For much of the last 15 years, Nestle in orange traded at a similar valuation to Unilever in blue. Over the last five years or so a gap has opened up, with Nestle now trading on 31 x earnings, whereas Unilever only trades on 17.4 x earnings, not much more than half.

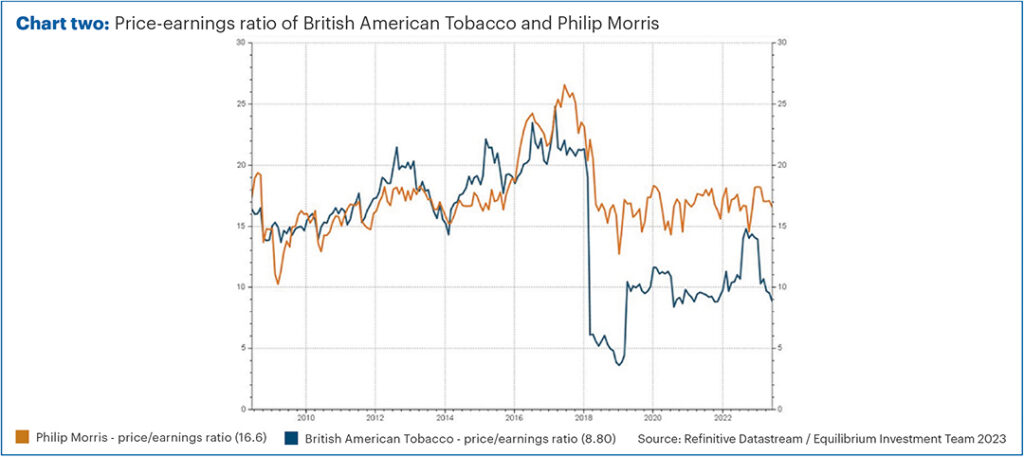

Now, of course, Unilever has had some well documented problems of late so it’s not fair to pick out just one example. But we can find others. Chart two shows a similar comparison, this time between tobacco product companies British American Tobacco (BAT) in blue and the American company Philip Morris (maker of Marlboro) in orange.

Again, these two companies traded at almost identical price-earnings ratios up until around five years ago. Now the US firm trades at 16.5 x earnings whereas BAT trades at 8.8 x earnings, again around half the valuation.

In both cases we are talking about multinational firms who sell all over the world but happen to have their shares listed in different places.

In essence, international investors are willing to pay more to own a firm listed outside of the UK than to buy a British firm. This is frustrating as it means the UK market has underperformed many overseas markets of late.

On the other hand, it also represents an opportunity to buy similar companies at cheaper prices, which in the long run ought to lead to superior returns.

Artificial Intelligence

So far, in 2023, the US stock market has outperformed the rest of the world, after a relatively poor 2022.

What is surprising is that this return is being driven by a very small number of stocks, primarily those that are poised to benefit from developments in artificial intelligence (AI).

For more information on AI and the investment implications, please read this recent blog by my colleague Neal Foundly, Artificial Intelligence: Killer app?

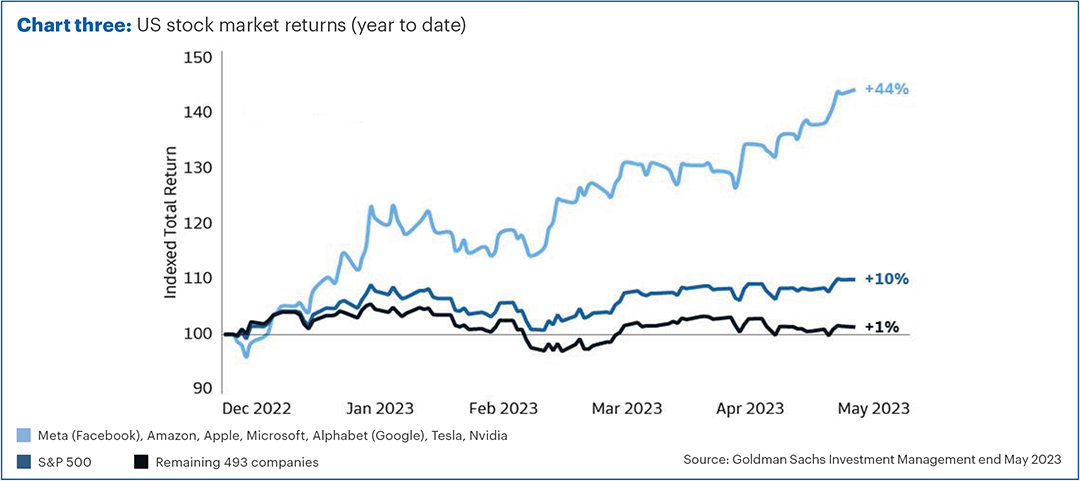

Chart three shows how the returns of the US stock market so far this year can be broken down.

The S&P 500 (the 500 largest companies in the US) has returned 10% up to the end of May.

However, had you just invested in the “super seven” of Meta (Facebook), Amazon, Apple, Microsoft, Alphabet (Google), Tesla, and Nvidia, you would have seen a 43% return so far this year.

Take those companies out of the S&P, however, and the remaining 493 companies are up a measly 1%.

We think AI will be a big driver of improvements in productivity over the long term. This may even help keep inflation under control and offset the impact of ageing populations and a shrinking workforce. It should be an overwhelmingly force for good.

However, we can’t escape the feeling that things have got a little ahead of themselves amidst the hype.

Take the company Nvidia, who make powerful processors which have historically been used for gaming in the main. Those processors also happen to be great at powering AI, and therefore Nvidia could be a big beneficiary of this boom.

But this is a big bet on future growth. In the most recent results, Nvidia’s revenue was actually down by 13%. However, their forward guidance was that they expect revenue to increase by 64% over the next quarter alone.

Investors responded enthusiastically and Nvidia is now up 192% so far this year (Source: Investing.com).

This leaves the stock on an eye-watering valuation of 222 x reported earnings!

This may well be justified, but they had better come through with the expected growth or shareholders might be in for a shock.

In many of our portfolios, we held a Nasdaq 100 Index tracker which is highly exposed to these big technology stocks. Having seen stellar returns from this fund so far this year we’ve decided to bank gains and have sold it in all our portfolios except for Global Equity (where we halved exposure).

We have also sold another tech-heavy US fund in Cautious and Balanced. We’ve partly switched to US smaller companies, which are lowly valued and have been lagging behind in a similar way to what we’ve seen in the UK, so as retain the exposure to the US.

In many of our portfolios, with the increase in yields on bonds, we have also taken the opportunity to increase our fixed interest weighting. With gilt yields above their US counterparts, we are particularly looking to increase exposure here.

Buying gilts at these levels should also provide a defence should the economy take a downturn. If things do take a turn for the worse, then we think central banks would be forced to cut interest rates again, which ought to lead to gains in bonds such as gilts.

This newsletter is intended as an information piece and does not constitute a solicitation of investment advice.

Past performance is for illustrative purposes only and cannot be guaranteed to apply in the future.

If you have any further questions, please don’t hesitate to contact us. If you’re a client you can reach us on 0161 486 2250 or by getting in touch with your usual Equilibrium contact. For all new enquiries please call 0161 383 3335.