Executive summary

- At 5%, Bank of England base rate is at its highest since 2008.

- On the face of it, this makes savings rates quite attractive (before tax).

- However, savings rates are still well below inflation. To beat inflation over the long term you need to invest.

- Despite challenging investment conditions, portfolios have still beaten cash over 5 years, and significantly outperformed inflation over 10 years.

- Higher rates also means higher implied returns for many asset classes, notably bonds where yields are higher than interest rates.

Real return

Last month, the Bank of England increased its base rate to 5% p.a., its highest level since 2008.

This has some interesting implications for many asset classes. As we’ll see below, higher rates should be viewed as a positive for the outlook of many types of investment.

Of course, a higher base rate ought to mean higher rates on cash. But as usual, things are more complicated than they first appear.

Firstly, it’s very hard to get anything like base rate without tying up your money for a long time. The best instant access savings rate I can find is from Chip (who? 1) at 4.21%, a lot lower than the headline 5%.

Net of basic rate tax that’s 3.36% and it’s only 2.5% after higher rate tax.

It’s also well below inflation which is currently 7.9% (Source: ONS – UK consumer prices index (CPI) – June 2023). Whilst we believe inflation should soon fall, simplistically we can say this account currently offers a real rate of return of -5.4% p.a. for a higher-rate taxpayer.

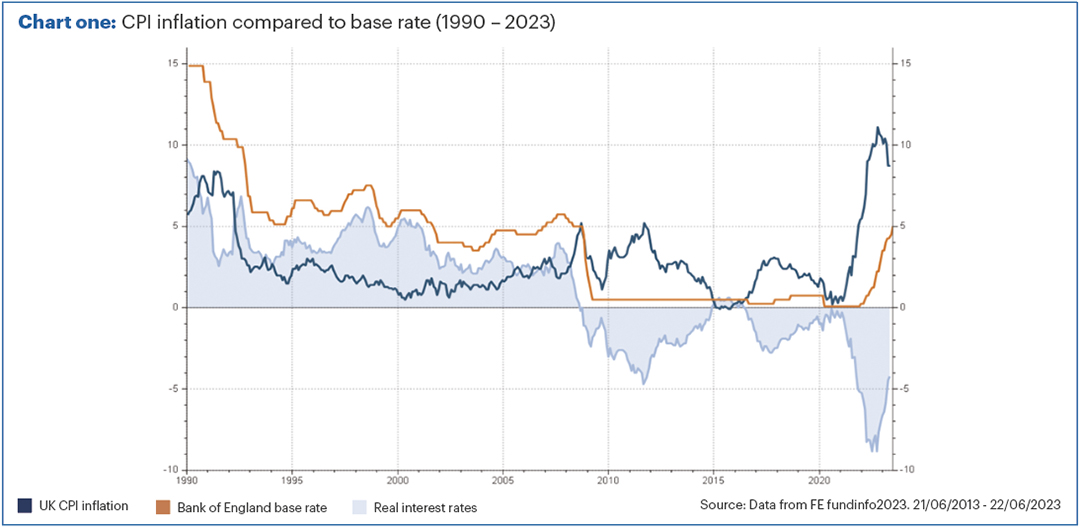

In fact, if we use base rate as a proxy for cash rates, or compared to inflation, we’re at one of the worst points in history for cash returns.

Chart one shows CPI inflation since 1990 (blue line) compared to base rate (orange line). The shaded area shows the “real return” on cash (base rate minus inflation) – it has rarely been lower. Since 2008, base rate has almost never been above inflation, except for a short period when inflation fell to near zero.

To beat inflation over time – which means growing your money rather than seeing it shrink in real terms – you need to invest (and do so tax efficiently).

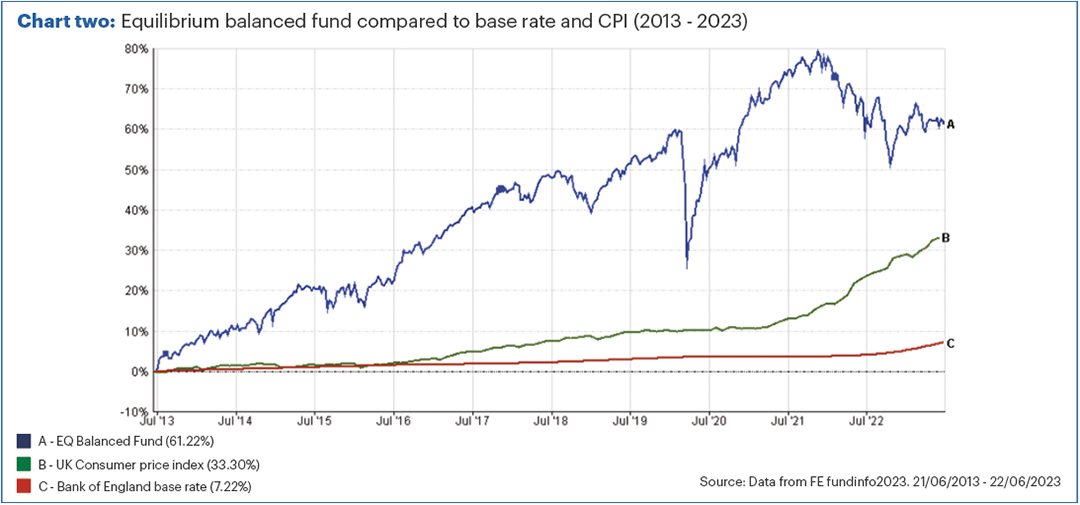

Chart two shows our balanced portfolio over the last ten years (blue line). Investors have found things very difficult recently, with two bear markets in just over three years.

However, even after taking this into account, had you been invested in our balanced portfolio for the last 10 years, your return would have been around double that of inflation.

If we look shorter term over 5 years, portfolio returns have been below inflation. However, at 9.34% total return, our balanced portfolio almost doubled the return on cash (base rate) which produced only 5.07% over the same period (Source: FE Analytics, 5 July 2018 – 5 July 2023). Note, this is stated after investment management fees and both portfolio and cash returns are stated gross of tax. We think this is the fairest comparison as it is “gross with gross.”

Looking backwards or looking forward?

For some, it might be natural to look at the low investment returns recently, compare this with current cash rates, and conclude that the certainty of cash might be preferable to the rollercoaster of investing.

However, that is looking backwards in respect of investment returns, but forward in terms of cash rates. It is always important to make fair comparisons over the same time periods. Remember, until very recently cash rates were essentially zero.

Whilst the base rate is currently at relative highs, our view is that it is unlikely to stay there for long. Rates have been put up with the intention of slowing the economy and bringing inflation down. However, as we have previously discussed, this takes time to come to fruition. This is mainly because companies and individuals often borrow at fixed rates, and it is only when that borrowing is renewed that the pain is felt.

It seems likely to us that if the economy does start to slow down (as seems inevitable) then rates will end up being cut again.

But don’t take our word for it. Even central bankers tell us this is likely to be the case. The US Federal Reserve publishes what each member of the rate-setting committee thinks rates will be, at the end of the next three years and in the longer run.

Taking the median prediction, the Fed tells us their rates are likely to be lower at the end of 2024 than at the end of 2023, lower still in 2025, and returning to around 2.5% in the “longer run” (which is not well defined) (Source: Federal Reserve “dot plot” June 2023).

The Bank of England does not publish such data, but we’d expect them to follow a similar pattern.

Be a lender, not a borrower

Higher interest rates don’t just make cash look more attractive.

It also makes many asset classes we invest in more attractive too. In fact, there is a positive relationship between high interest rates and higher stock market returns – you generally tend to get a higher return on equities during periods which start with higher rates! (Source: Refinitiv Datastream / Equilibrium Investment Management). Perhaps this is because higher rates imply a stronger economy, or partly it may be because interest rates are more likely to be cut when you begin at a high point.

But the relationship is much more obvious when looking at the bond market.

We had a meeting recently with the Chief Investment Officer of a well-known fund management group. I liked his description of the bond market when he said bonds are “self-evidently much better value than two years ago.” So, why might this be the case?

Higher interest rates, of course, mean it costs more to borrow money. For companies and individuals looking to borrow this is tough – I’m certainly not looking forward to renewing my mortgage next year!

However, for those who are lending money, there are opportunities to profit.

For the average “investment grade” company (those with “strong” credit ratings) to borrow money on the corporate bond market, it will cost them around 6.5% p.a. (Source: Refinitiv Datastream 3 July 2023).

When interest rates are high, it pays to be the lender rather than the borrower. If we buy corporate bonds, we are lending money to companies.

By acting as a lender, we can benefit from the higher return available for taking a small amount of risk (that the company might default on our loan) compared to that on cash.

Whilst we might get a 6.5% yield from lending to a fairly safe company, if we take a bit more risk and lend to a less established firm then we can “charge” them more – perhaps around 10% p.a. (Source: Equilibrium high-yield funds, based on data from the various fund managers as of end April 2023). The extra yield more than compensates us for this additional risk in our view.

As long as we hold the bonds to maturity and the company doesn’t default, we know exactly what return we will get over the period. However, if interest rates go up even more than expected then the price of the bonds could fall in the short term.

For example, if rates go up sharply, investors might now want 7.5% for lending to a company rather than 6.5%. If so, bonds issued at 6.5% would need to fall in price to make them as attractive to investors as new bonds offering higher rates. However, that would simply be a “mark-to-market” loss, and if we held to maturity, we would still get back our full loan.

The market has already priced the likelihood of interest rates going above 6% and so we feel this risk is now relatively low.

Of course, if we look backwards at corporate bond returns recently, they have been very poor indeed.

That’s because, in mid-2020, the “yield” on such bonds was only around 2% a year. Investors now want 6.5% and therefore the price of bonds issued at that very low level had to fall significantly.

But again, that is backwards looking. We can’t look at what has happened to bonds in the past when yields were at 2%, and project this into the future now yields are 6.5%. The yield gives us a good indication of future returns, whereas past returns don’t tell us anything about the future.

I was recently asked if I had ever been this excited about investing in bonds before? My answer was I had never been excited about bonds before in my (almost) quarter century in financial services but now I am!

However, we are aware that some clients find bonds confusing and so we will shortly be producing a series of communications specifically explaining how they work, and why we think they look such good value now.

Higher rates lead to some good opportunities for investors, but to beat inflation we have to be prepared to take some risk. The good news is that we now have to take less risk to achieve the same potential return as we would have done in the past.

(1) Chip is the online brand of ClearBank. We’re not particularly familiar with them, but from Companies House we note that there have been lots of ownership changes involving Czech and Barbados-based companies. They don’t have a credit rating from the likes of Moody’s or S&P, but the Refintiv “model implied” rating would be BB- which is very low for a bank. Oh, and their address is 13 Dirty Lane! Care is advised when choosing a savings account.

This newsletter is intended as an information piece and does not constitute a solicitation of investment advice.

Past performance is for illustrative purposes only and cannot be guaranteed to apply in the future.

If you have any further questions, please don’t hesitate to contact us. If you’re a client you can reach us on 0161 486 2250 or by getting in touch with your usual Equilibrium contact. For all new enquiries please call 0161 383 3335.