Executive summary:

- We believe successful long-term investing relies on process and discipline rather than predicting the future.

- Our core portfolios aim to return more than inflation over the long term at the least possible risk.

- Despite the volatility over the past two years, we still believe our long-term aims are realistic.

- For the best chance of achieving those returns, we use long-term investment assumptions to provide us with “guesstimates” as to what each asset class might return over the next 10 years if past behaviour was repeated.

- Both our strategic and tactical asset allocation have changed a lot in the last two years. For example, the bond market has changed dramatically, where expected yields on 10-year gilts and bonds rose from 0.75% and 1.9% to 4.5% and 6.25%, respectively. As a result, our core portfolios now have much more fixed interest than before.

- We also think that there are strong reasons to be positive about future returns, and we continue to negotiate the on costs of the underlying funds to make sure clients keep more of those returns.

A sound framework

It may sound dull, but successful long-term investing is all about process and discipline.

It has very little to do with clever individuals (or clever machines, for that matter!) who are somehow able to tell what will happen in the future better than everybody else.

Or, as Warren Buffett puts it:

“To invest successfully over a lifetime does not require a stratospheric IQ, unusual business insights, or inside information. What’s needed is a sound intellectual framework for making decisions and the ability to keep emotions from corroding that framework.”

Each year we publish our long-term investment assumptions study.

Some would say this is quite a technical, even boring (!) document. I couldn’t possibly comment… but there’s a very good reason why we do this; it provides the sound framework around which we make our investment decisions.

Our core portfolios aim to return more than inflation over the long term (at least 10 years). Ideally, we’d like Cautious to return about 4% p.a. more than inflation on average, Balanced about 5% and Adventurous about 5.5% real return.

Generally, we aim to achieve these returns with the lowest possible risk. Each portfolio has different risk characteristics; for instance, there are ranges defining the minimum and maximum equity each portfolio can hold, which we have to stay within at all times.

These are, of course, targets, not guarantees. In the last couple of years, returns have been below target as inflation reached over 10% and markets fell sharply. Unfortunately, there is simply nothing we could have put the money in over the past two years which would have achieved the aims within the risk limits, even if we had perfect foresight!

However, we still believe these are realistic long-term aims for mixed asset portfolios such as ours.

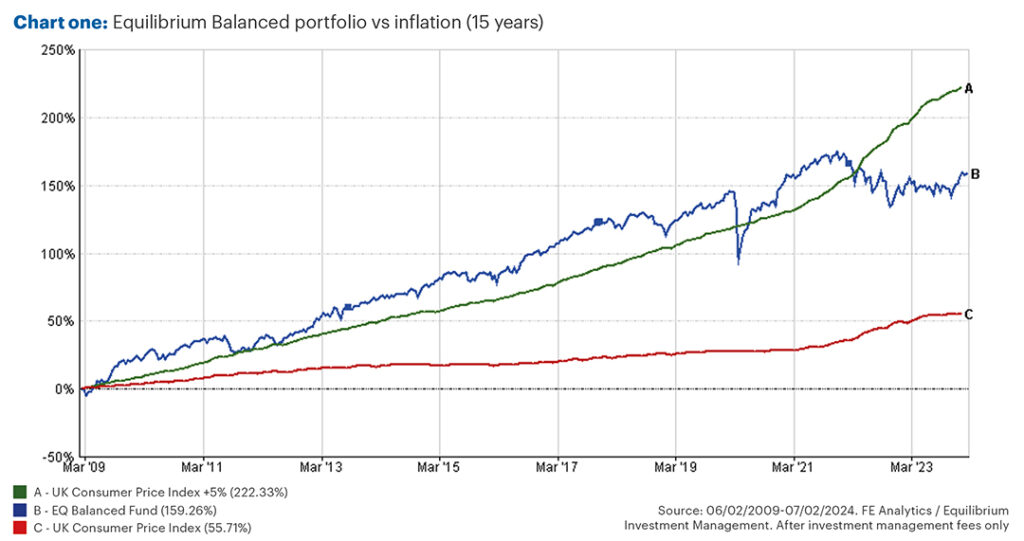

Chart one shows the return of the balanced portfolio over the last 15 years in blue. The red line is the total effect of inflation over that time period, whereas green is inflation plus 5% p.a.

For most of that period, the Balanced portfolio tracked roughly in line with inflation +5% target. Sometimes it was above and sometimes below.

Only recently, amid the extraordinary period we’ve been through since the pandemic, have returns dropped, and the green line steepened.

Future prospects

We believe that the target levels of returns remain realistic for the future.

In order to give ourselves the best chance of achieving those returns, we need some idea of what return is realistic from each asset class.

This is the purpose of the long-term investment assumptions study. It looks at each asset class and identifies the factors which have, in the past, given some guidance as to what returns might be.

For example, the yield on bonds has historically explained much of the return you end up with. If a bond has a yield of 5% p.a., this is likely to be a good indicator of the annual return upon maturity. Valuation metrics, such as the price/earnings ratio, have done a similar job for equities.

The study aims to provide “guesstimates” as to what each asset class might return over the next 10 years if past behaviour repeats.

From this information, we can determine the mix of assets that will give us the best chance of achieving the returns. We call this our strategic asset allocation.

Crucially, this assumes no active management. It assumes we simply buy an index tracker in each asset class and hold it for 10 years.

Of course, in reality, we don’t just do nothing! If we think an asset class will do better or worse in the short term, we will hold a bit more or a bit less than the strategic allocation would suggest. This is called our tactical allocation.

Our research makes us pretty confident of future returns since valuations are generally at levels which have led to good returns in the past.

This was not the case when we released our study in 2021, when many of the asset classes were looking expensive. At the time, we highlighted that to achieve the returns we might need to take more risk, and our active management would need to add more value.

We all know what happened in 2022, when many of the asset classes fell sharply at the same time.

When people ask us if there’s anything we’ve learned from the past couple of years, one response is perhaps we should have trusted our process more. For example, we could have significantly reduced risk in the short term, until such time as asset classes looked better value again (i.e. buy back in after they’d fallen).

Whilst we did do this to some extent in late 2021, we could have done so more aggressively. Of course, this is all obvious with hindsight! A big de-risking would also have led to some awkward conversations about why we were holding a lot of cash at a time when rates were very low, especially whilst markets were still rising sharply in late 2021.

Ch-ch-changes

Things have changed a lot since 2021. In particular, the change in the bond market has been dramatic. This means our strategic asset allocation has changed a lot in two years.

When we did our 2021 study, 10-year gilt yields were 0.75% and so the expected 10-year return on gilts was also an extremely low 0.75%. Corporate bond yields were 1.9%, so not much better.

However, by the time of our 2023 study, the yields had increased to 4.5% and 6.25% respectively (Source: LSEG Datastream /Equilibrium Investment Management 31/08/23).

This fundamentally changes things. It means you can now expect a half-decent return even from a “risk-free” asset like a gilt (provided you hold to maturity there is almost no chance of default). The yields on corporate bonds suggest they might return close to inflation + 4% on their own, which means it might be possible to achieve the Cautious portfolio target without the risk of stock market investing.

As a result, the allocation of all our core portfolios now has much more in fixed interest (bonds) than they did before.

Control the controllables

The strategic asset allocation assumes we are investing in index-tracking funds for each asset class.

However, we also use actively managed funds depending on the asset class, the timing, and the level of confidence we have in the fund manager.

Regardless of which we use, it is really important to keep costs down. We don’t know in advance what returns will be like or even how risky something will prove, but we can control what we pay for it.

We negotiate hard with fund managers to achieve discounts and access to the cheapest institutional share classes. Every active fund we select is compared to the passive equivalent and any additional costs must be justified in terms of expected added value.

Even with index funds, by being proactive we can keep a lid on costs. For example, we recently switched to a new US equity tracker as we can now access one which costs just 0.03% p.a.

Whilst that’s unusually cheap, overall, the cost of the underlying funds within our portfolios has come down. Our latest estimate for the balanced portfolio, for example, is that the weighted average underlying fund cost is just 0.42%. On Defensive – which has more fixed interest (and tends to be cheaper than equity funds) – the cost is 0.33% (Source: LSEG Datastream / Equilibrium Investment Management).

We believe there are strong reasons to be positive about future returns. Indeed, things have been going in the right direction (slowly) for a while now. For example, since markets bottomed out in October 2022, our Balanced portfolio has gained 11.7% (Source: FE Analytics 14/10/22 to 01/02/24).

By negotiating hard on costs on your behalf, it means we can make sure you keep more of those returns.

Past performance is for illustrative purposes only and cannot be guaranteed to apply in the future.

This newsletter is intended as an information piece and does not constitute a solicitation of investment advice.

If you have any further questions, please don’t hesitate to contact us. If you’re a client, you can reach us on 0161 486 2250 or by getting in touch with your usual Equilibrium contact. For all new enquiries please call 0161 383 3335.