Executive summary

- Financial predictions for 2024 were varied, but the S&P 500 significantly outperformed forecasts, closing at 6,074 on 5 December 2024 – a 27% increase.

- The forecast for the number of interest rate cuts this year was optimistic, with the Bank of England base rate at 4.75% (at the time of writing) after just two 0.25% cuts.

- Global economic growth for 2024 was slightly better than predicted, with the US and UK economies performing above expectations.

- UK inflation predictions were accurate, with CPI at 2.3% in October 2024 and expected to remain around this level into 2025.

- Stock markets are expected to be volatile in 2025, with historical data indicating regular fluctuations and potential for significant drawdowns.

- Bitcoin has shown extreme volatility, with significant gains and drawdowns, emphasising its high-risk nature for investors.

Making sense of market forecasts

“Prediction is very difficult, especially if it’s about the future!”

So said the Nobel Prize-winning physicist, Niels Bohr. But that doesn’t stop people from trying! At this time of year, financial newsletters are full of commentators confidently explaining what will happen in the next 12 months.

Instead of joining them, this edition of The Pulse looks at some of the predictions others are making. We’ll also look at what was being predicted this time last year and see how those forecasts compare to reality!

In addition, we’ll examine some historical data and see if those predictions stack up against the usual market behaviour.

Will stocks go up?

Last year, the predictions from the big Wall Street banks varied significantly.

We have the most data for the S&P 500, the main US stock market. The lowest prediction was from JP Morgan, who thought it would end 2024 at 4,200, about 12% DOWN from the 4,769 where it ended in 2023.

The highest forecast came from Yardeni Research, which predicted it would gain to 5,400. The average forecast was 4,861, a gain of just 2% (Source: Bloomberg / Creative Planning). They were all miles out!

At close on 5 December 2024, the S&P was at 6,074, over 27% up during 2024 (Source: Investing.com, excluding dividends). It was 12% higher than the more optimistic forecast and nearly 25% higher than the average.

Not everyone has published their forecast for 2025, but of those we’ve found the lowest calls for a 7% gain. After being burnt last year, we’ve not found one major house predicting a fall!

The average analyst is expecting a 10% gain, with Yardeni Research again amongst the most bullish, predicting over 15% returns (Source: Forbes Banks’ S&P 500 Price Targets Call For Another Year Of Strong Gains).

The banks are citing the potential for President-elect Trump to cut taxes, the strong US economy, and the potential for artificial intelligence to boost tech earnings as reasons for their bullish outlook. Later on, we’ll look at how this stacks up against market fundamentals.

Interest rates will be cut?

At the beginning of this year, the Bank of England base rate stood at 5.25%.

This time last year, markets had anticipated around six 0.25% rate cuts over the year, totalling a 1.5% reduction. They were a bit too optimistic!

At the time of writing, the base rate is 4.75%, with just TWO 0.25% cuts so far.

In the US, market participants had expected five 0.25% cuts during 2024. So far, we’ve seen one 0.5% and one 0.25% cut.

Markets expect a further 0.25% cut from the Federal Reserve before the end of December, while the Bank of England is likely to keep rates on hold. Additionally, markets are pricing in further cuts of 0.75% during 2025 from both central banks. (Source: LSEG Workspace / Equilibrium Investment Management).

The economy will grow?

As of January 2024, the International Monetary Fund (IMF) predicted global growth of 3.1% for 2024. While the actual figures will not be known until a few months into next year, their latest estimate suggests growth of 3.2% – a slight improvement on predictions.

The US performed particularly well, with an expected 2.8% growth in 2024, up from the 2.1% the IMF expected at the start of the year. The IMF predicts growth will slow to 2.2% in 2025.

UK growth has also been revised upward, with the IMF now expecting a 1.1% increase in 2024, well in excess of the 0.6% expected at the start of the year. The IMF forecasts further acceleration to 1.5% in 2025, while the OECD (Organisation for Economic Co-operation and Development) is more optimistic, expecting 1.7%.

Will inflation be lower?

At the end of November last year, economists surveyed by Reuters expected UK CPI (Consumer Prices Index) inflation to drop to 2.3% by the end of 2024 (Source: LSEG Workspace), down from the 4% recorded at the end of last year.

The latest reading (October) shows CPI inflation at 2.3%, so at the moment those predictions look pretty accurate! (Source: ONS).

Current predictions anticipate CPI will remain around those levels throughout most of 2025, perhaps dropping to 2.1% by the end of the year. This is still slightly ahead of the Bank of England’s target.

Data, not guesses

While we have no reason to disbelieve any of the economic predictions, it’s important to say that something unexpected will likely arise, which may affect those predictions for better or worse!

We will not make any predictions about where markets will end up. Instead, we will look at historical data on stock market returns to see if there is anything we can predict about market behaviour instead.

Stock markets will be volatile

One thing we can confidently predict is that stock markets will remain volatile, at least in bursts.

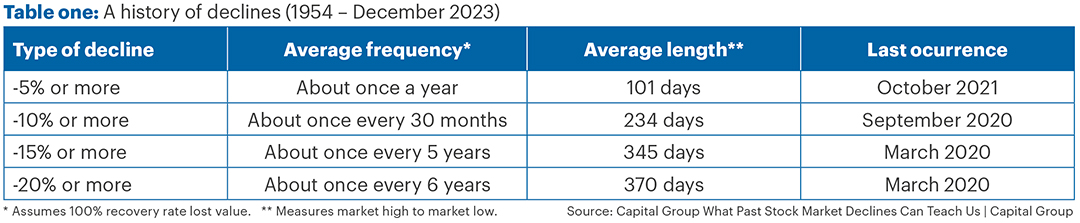

Table one shows a history of peak-to-trough declines in the US stock market up to the end of 2023. It shows that falls of 5% or more tend to happen about once a year, while 10%+ falls – which we call a “correction” – happen roughly every two years on average.

Bear markets – defined as a fall of 20% or more – occur on average about once every six years.

Of course, these time periods are just averages. Sometimes, drawdowns can be close together, while at other times, there is a big gap between them!

Whilst we can confidently predict that a large market drop will happen at some point in the future, we can’t pinpoint when it will happen.

However, we do have a strong suspicion (not a prediction!) that 2025 will be more volatile than 2024. The reason we say this is because this year has been unusually quiet!

In 2024, there was a very brief 8.5% drawdown from mid-July to early August, but markets regained their losses by mid-September. Apart from that, the upward momentum has been remarkably strong.

The next 10 years will be different from the last 10 years

The past 10 years saw the US market do far better than pretty much any other asset class, with an astonishing 232% increase, or 12.9% p.a.

Meanwhile, it was a terrible time for many bond investors. For example, UK Gilts returned essentially zero over 10 years and are down 24% over the past three years (Source: FE Analytics, total return in local currency to 5 Dec 2024).

We can say with certainty that things will be different going forward. We strongly suspect (again, not a prediction) that stocks will perform less well, but bonds will do better than they did during the last decade.

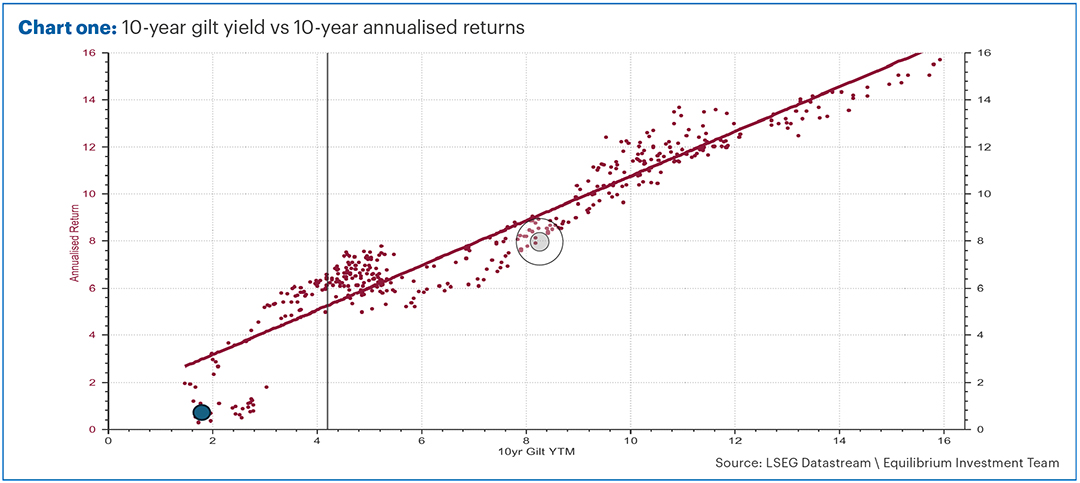

For gilts, the yield at the start of the 10-year period has tended to be a good guide to what returns you get from the gilt index over the next 10 years. Historically, there’s been about a 90% correlation between the yield and the 10-year return.

Chart one shows this correlation. Each dot represents a different 10-year period for gilts, with higher dots indicating higher returns. Across the horizontal axis is the yield, and the dots form a fairly straight line, showing that low yield tends to mean low returns, while high yield leads to high returns.

A decade ago, the yield on the gilt index was 1.92%, so we should have expected a low return.

The most recent 10-year period is shown by the blue dot. This was perhaps slightly on the lower end of the expected range of returns but well within what is expected.

The current 10-year gilt yield is 4.3%, marked on the chart by the vertical black line. In the past, we have typically seen returns of 4% to 6% when yields have been at these levels – much better than we saw over the last decade.

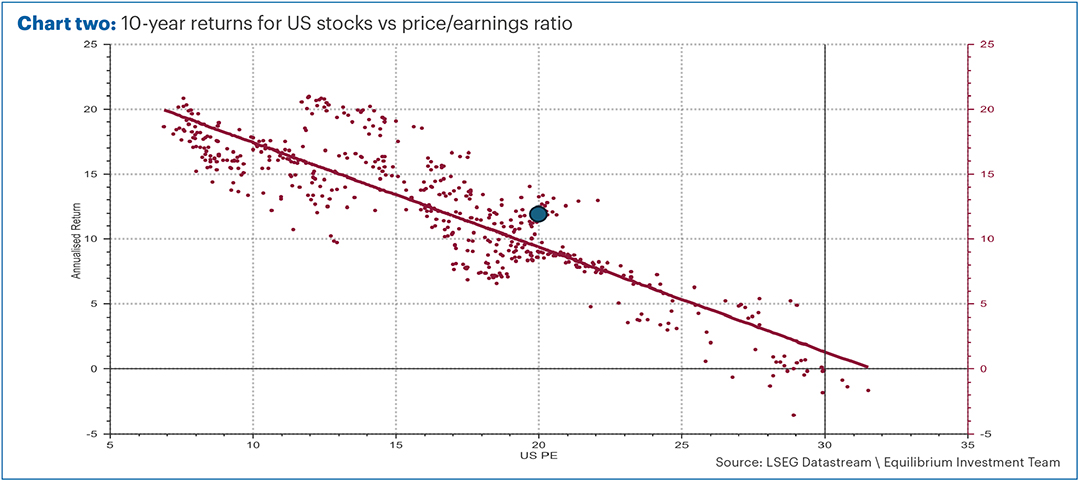

For the US stock market, the price/earnings (PE) ratio has historically been a good guide. Chart two works in the same way as chart one, but each dot now represents past 10-year periods for US stocks. Across the horizontal axis is the price/earnings ratio at the beginning of each 10-year period.

Again, there is a clear pattern, with a low PE ratio tending to result in high returns, and a high PE ratio often leading to low returns. The correlation is 78% – less strong than for gilts but still significant.

Ten years ago, the PE ratio was 20.2, marked with a blue dot. Returns during this 10-year period were perhaps on the higher end of expectations but still within the anticipated range.

The current PE ratio is 30 times, marked with the vertical black line. This means the market is 50% more expensive than it was 10 years ago.

In the past, the market has often been negative over 10 years when the ratio has been as high as this.

Again, that is not a prediction. The future could be quite different, and even if the PE ratio does remain a good guide to 10-year future returns, it offers no insight into the next 12 months and is no help with market timing.

However, from a portfolio perspective, we think it is sensible to have a bit more in bonds – including corporate bonds, which yield a lot more than gilts at 5.5% p.a. – and a bit less in US equities compared to the past.

Bitcoin will crash…at some point!

One final prediction: Bitcoin will be even more volatile than stock markets!

Bitcoin recently hit a rate of $100,000 per coin. At the beginning of December 2014, it was only $375 per Bitcoin – that’s a gain of 26,566%! Well done if you’ve held it throughout – I hope you’re enjoying reading this from your private island. (Source: Investing.com)

However, even committed “HODLers” would have needed to hold their nerve at times. During that period, Bitcoin fell more than 77% on three separate occasions, with the worst being an 83% drawdown. (Source: Investing.com)

Of course, most people did not hold it throughout. Typically, more people tend to pile into assets near the highs and bail out when they fall. Usually, doing the opposite is a better strategy. In the past, buying Bitcoin just AFTER a 77% fall has worked pretty well.

Will that hold true for the future? I have no idea, unfortunately. However, given recent gains and past behaviour, this asset class is best suited for those with a strong stomach and only using money they can afford to lose. The future is difficult to predict, so be cautious about paying too much for it!

Investing is inherently uncertain. However, we think it is possible to use market data and evidence of past behaviour to get some sense of the likely long-term outcomes. This can help us decide when to reduce risk and be more cautious, and when to take advantage of attractive valuations in a particular asset class.

If you have any further questions, please don’t hesitate to contact us. Clients can reach us on 0161 486 2250 or by getting in touch with your usual Equilibrium contact.

If you are new to Equilibrium and would like to speak with one of our experts, contact us here or call us on 0161 383 3335 for a free, no-obligation initial chat.

Past performance is for illustrative purposes only and cannot be guaranteed to apply in the future.

This newsletter is intended as an information piece and does not constitute a solicitation of investment advice.