ISFL portfolio funds & factsheets

Equilibrium has three funds, which many of our clients invest in. These are called portfolio funds because they are specific to Equilibrium.

They are composed of a variety of other managed funds, which we have researched and put together as the most appropriate investments available to service the needs of our clients. We regularly review the composition of the funds and change them when market conditions make alternative investments preferable.

We keep clients updated on any changes by sending out factsheets about each fund.

What investment funds does Equilibrium offer?

The three funds have different risk-reward profiles.

- Adventurous: The higher risk portfolio, with the highest target return.

- Balanced: Medium risk and target reward.

- Cautious: Lowest risk and lowest expected return.

All three of our portfolio funds are designed with post-retirement investors in mind and for this reason, all of them are relatively low risk.

Why is the choice of portfolio fund important to me?

The fund you choose will affect the profits you earn on your investment. Every investment involves a risk that you lose money instead of making a profit. In general, the higher the risk, the higher the potential reward. This means that the holy grail of the investment business is to find the highest rewards for the lowest risk.

How do we at Equilibrium weigh up the risk and reward of your investment portfolio? We assign our Equilibrium expected annual growth rate (AGR) assumption to each of the five asset classes in your portfolio. We include a long-term inflation assumption of 2%. From the annual growth rate assumption, we work out the overall expected AGR from your portfolio’s blend of assets.

How long should it take for my portfolio to earn the returns that you forecast?

Our portfolios are designed to be held for a minimum of five years, so we forecast expected returns over the same time period, and we also look at 5-year historical returns. It is only when you have five years of annual returns data that your performance can be compared with our expectations. Returns over shorter periods can be much more volatile.

Our funds have different risk profiles and also different target returns. We specify the expected return for each fund.

The table below shows, as an example, our expected returns for our ‘Balanced fund’ strategic asset allocation, which we designed to return 5% per annum above inflation.

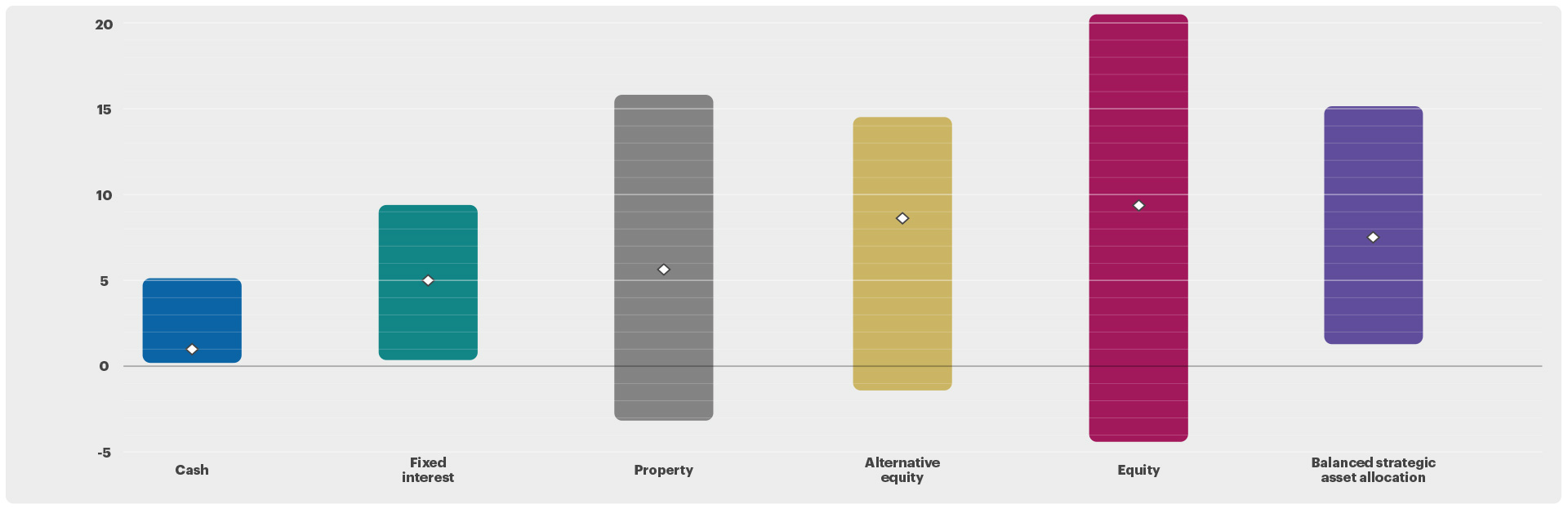

The chart below shows the expected performance ranges, based on historical data, to show how our funds’ performance compares with the markets as a whole. These ranges give an idea of the annualised variations in performance that could be expected over a typical five-year period.

Please note that no financial market always behaves “typically” which means that what happens in the future may be different from these historic performances.

(SOURCE: Financial Express)

Your actual returns could of course be higher or lower than our expected figures. They could even exceed the historical ranges if market conditions are more volatile in the future than we have seen in the past. In other words, returns are not guaranteed and your capital is at risk. You may not get back the amount you originally invested.

Client stories

Hear more from our clientsGet in touch

Get in touch with our advisers by completing this short form or by calling 0808 156 1176.