Investments may (will) fall as well as rise. It should not be relied upon in making investment decisions and is intended solely for the entertainment of the reader.

Fund launch bulletin 17th November 2017

We’re delighted to report that the launch of the new IFSL Equilibrium funds has been successfully completed.

Over the past two weeks, we have switched clients into the funds on the Nucleus and 7IM platforms. We did this in stages so as to reduce out of market exposure, with clients switching between 3 and 15 November. This staggered approach has proved marginally positive since markets have fallen since the first sales were made on the platforms. This means we’re typically buying back at a lower price within the funds than we sold on the platform.

The other reason for switching in tranches was to place certain sales and purchases at the same time. For example, our defined returns products normally have a 1% spread between the buying and selling prices. By doing the trades at the same time the investment banks waived this spread. We carried out the same process for certain other funds where a spread or dilution levy might have otherwise applied.

All the funds are now invested in essentially the same assets in the same proportions as our model portfolios were before launch. The only major difference at this stage is a slight increase in alternative equity by the inclusion of a new fund, Henderson UK Absolute Return. We are also slightly underweight in index-linked gilts and defined returns which we will top up shortly.

Cash levels are already below what they were prior to the move and over the coming few days we’ll reduce this further, topping up the above positions and using the rest to buy short-dated fixed interest funds. These are funds which are at the lower end of the risk spectrum and which we aim to beat cash by a reasonable margin over a 12 month period rather than shooting the lights out.

From December we’ll produce monthly factsheets showing all the holdings within each fund, the performance since launch as well as market commentary. We’ll make these available on our website and via the MyEQ portal (for those that have signed up for this service).

If you hold one of the funds on the Nucleus platform you will also be able to click on the name of the fund within your account and this will bring up an abridged factsheet. This is in a prescribed format as it is provided by a third-party data provider and so will only show the top 10 holdings. Again, this data will be updated early in December.

We will send out a further email once these factsheets are available. In the meantime, the tables below show how the new funds are invested and how this compares to the model portfolio held prior to launch.

I’d like to take the opportunity to thank you all for your positive comments, feedback and patience as we have carried out this project! We appreciate that there has been a lot of paperwork and a lot of information to take in during this period.

We’re confident that the launch of our funds will help us provide the risk adjusted returns you have come to expect. We’ll continue to report on progress via our usual monthly newsletters as well as the fund factsheets.

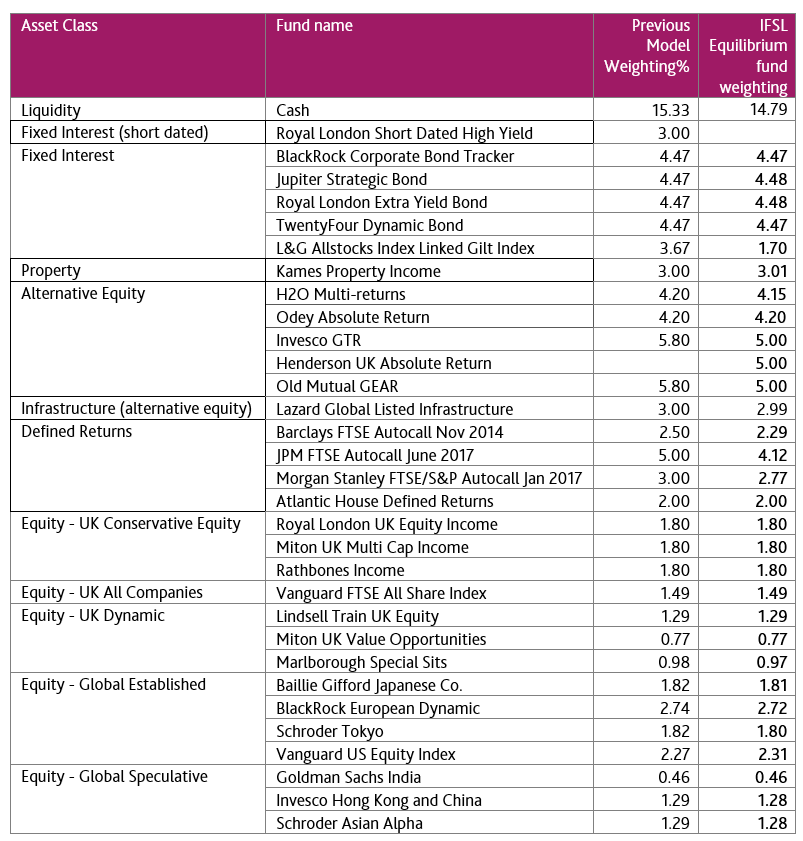

Cautious

Fund weightings as of 12 noon on 16 November 2017

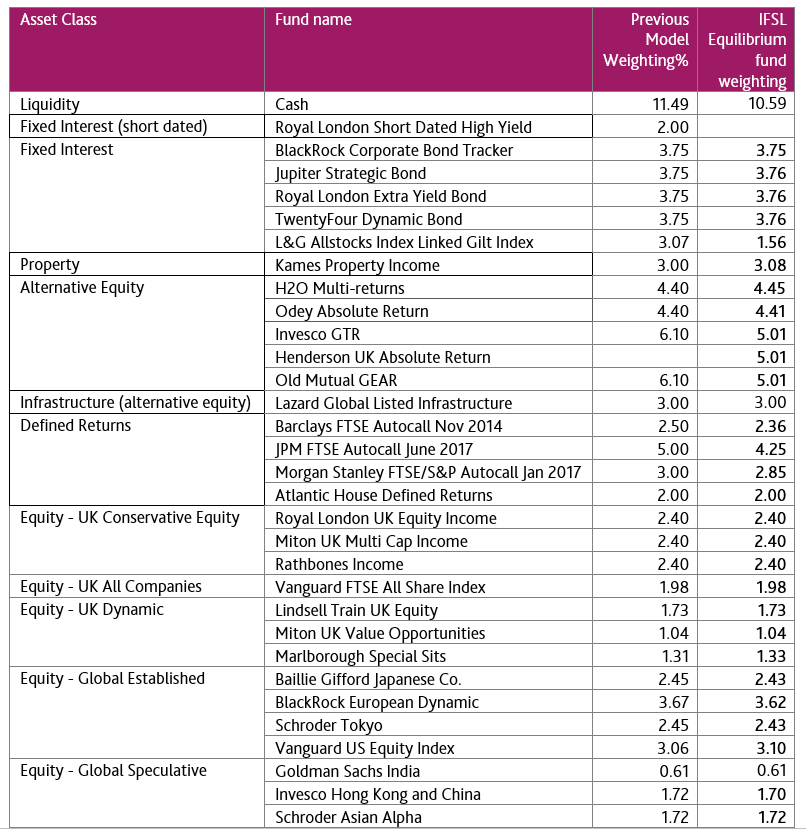

Balanced

Fund weightings as of 12 noon on 16 November 2017

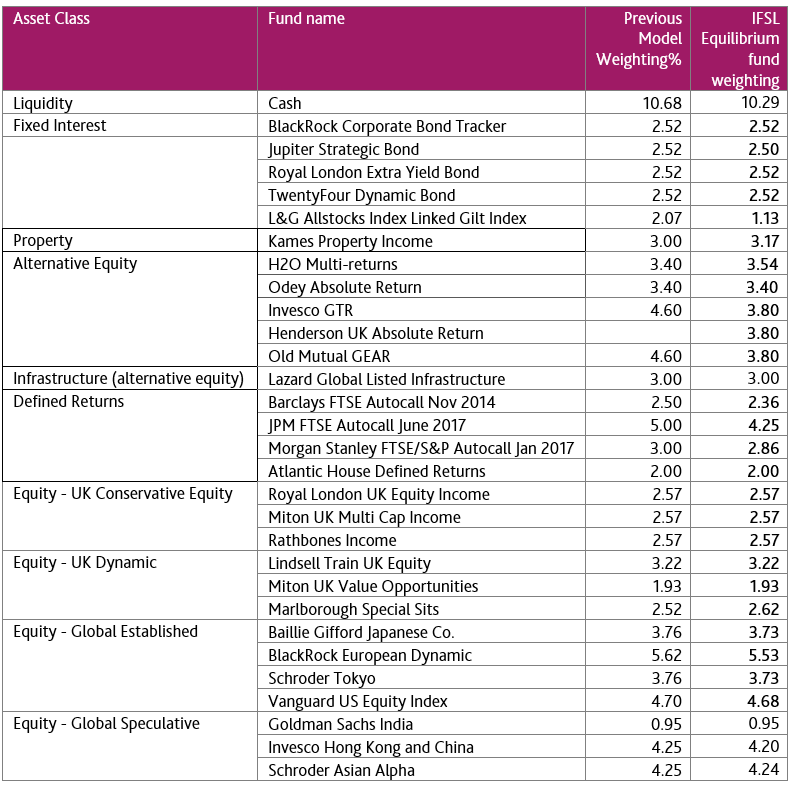

Adventurous

Fund weightings as of 12 noon on 16 November 2017