Crumbling foundations?

Declining house prices, the death of the high street and Brexit uncertainty scaring off overseas investors are just some of the doom and gloom headlines you may have read surrounding the property sector over the last twelve months.

So, you might be a little surprised to hear that property was our best performing asset class in 2018 generating a positive return in what was a tough year for investors across nearly every other asset class.

Declining house prices, the death of the high street and Brexit uncertainty scaring off overseas investors are just some of the doom and gloom headlines you may have read surrounding the property sector over the last twelve months.

So, you might be a little surprised to hear that property was our best performing asset class in 2018 generating a positive return in what was a tough year for investors across nearly every other asset class.

The retail sector, particularly the high street, has received the most negativity. Falling demand has led to store closures as consumers purchase more and more goods online. Supermarkets however are one part of physical retail that has bucked this trend. Just 7% of grocery sales occur online, and IGD are forecasting that UK grocery spending is to increase by 15% over the next five years.

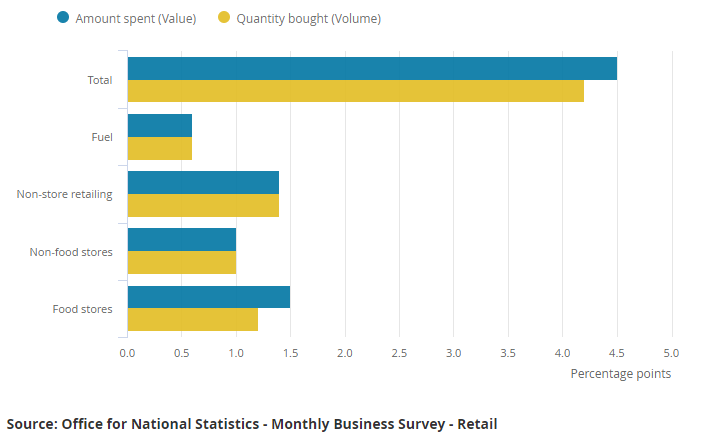

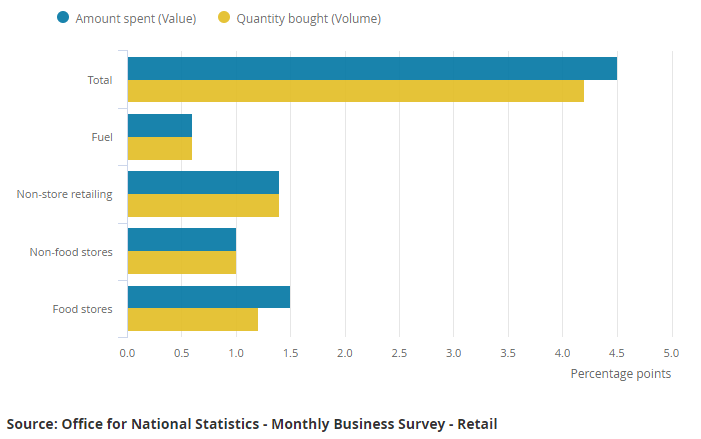

We believe this makes supermarkets a very appealing investment as they can be purchased on long leases, often with attractive inflation linked yields backed by very strong tenants. The Time Commercial Freehold fund that we recently added holds 22% of the fund in supermarkets with an average lease of 21 years with inflation linked rental income. The chart below from the Office of National Statistics is further food for thought (sorry!) showing how food is accounting for nearly all the increased spend across retail.

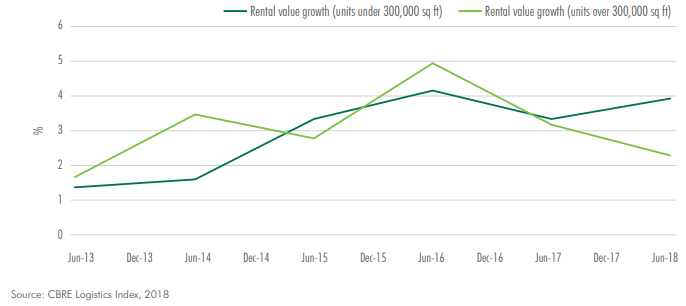

With increased online sales, there has been incredible demand for industrial units that will allow companies to ship quickly and efficiently to consumers. Primary locations for these are near to good transport links. What’s interesting about these moves is that the units are getting bigger and bigger with the online migration seeing no signs of slowing down. Here in the North West, Amazon have pre-let a 361,000 square foot warehouse in Haydock with Chart 1 showing the rental growth in these huge units.

Chart 1: Rental growth in UK warehouse units

At the other end of the spectrum is ‘destination shopping’. When consumers purchase goods they buy less frequently, such as clothes, shoes and accessories, they tend to do so from high end locations such as city centres. King Street in Manchester is a prime example of this. This has also seen less of a migration online as when consumers spend large sums of money they generally want to ensure they are purchasing exactly what they are after.

Nearby to King Street in Manchester is the Corn Exchange, home to a number of exciting restaurants, bars, a 114-room hotel and an escape room that we own in our funds through the Aviva UK Property Fund. We believe this is an excellent example of a purpose-built location that will naturally have huge footfall through the area to drive sales.

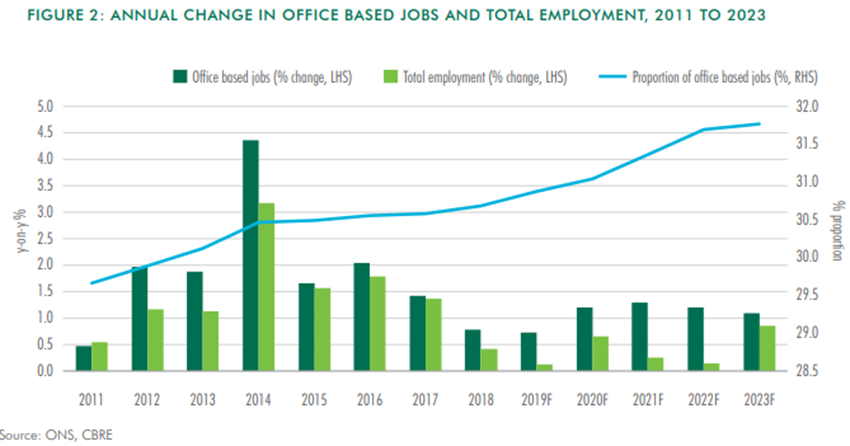

In addition to property being the best performing asset class last year, you may also be surprised to read that the UK has enjoyed nine continuous years of economic expansion. What this has meant for the economy is near record low unemployment with the highest job creation coming from professional administration services and technology related jobs. This increase in office-based jobs has naturally led to an increase in demand for offices. The chart 2 below shows how office-based jobs are forecast to continue this growth into the future making it an attractive area of the property market for us.

Chart 2: Annual change in office-based jobs and total employment 2011 – 2013

The Kames Property Income Fund that we invest in holds 46% of its assets invested across regional offices.

While the sector has grabbed headlines for all the wrong reasons over the last 12 months, we feel that there are some excellent opportunities within property for those that are selective. With yields currently comfortably in excess of gilts, corporate bonds and equity dividends, whilst there are never any guarantees, we continue to see opportunities in property and believe that when there is more certainty surrounding Brexit we will see flows into the sector from investors, both domestic and overseas, who have sat on their hands post referendum.

The content contained in this blog represents the opinions of Equilibrium Investment Management. The commentary in this blog in no way constitutes a solicitation of investment advice. It should not be relied upon in making investment decisions and is intended solely for the entertainment of the reader. You should be aware that the value of an investment can go down as well as up, and no guarantees can be made as to the future performance.