The only time to plan for inheritance tax is now

The earlier you start planning to avoid inheritance tax, the better your chance of avoiding the seven-year trap.

‘Inheritance tax is, broadly speaking, a voluntary levy paid by those who distrust their heirs more than they dislike the Inland Revenue’

This is my favourite quote on inheritance tax (IHT) planning from former chancellor Roy Jenkins.

While the quote is a little harsh, I sympathise with his thinking. I point out to most clients that, if they start planning early enough, then inheritance tax can be significantly reduced, if not eliminated entirely.

Like many people, I am loath to pay taxes that I don’t have to. Having worked hard all my life and paid my fair share, I do not want to lose 40% of my entire estate in tax on death. I know that it only applies above £325,000 per person currently or £650,000 for a married couple. However, I am also planning to live in a house that is at least equal in value to two nil rate bands, which currently stand at £175,000 each (increasing in line with Consumer Prices Index from 2021 onwards), so it will be 40% of everything else that I have ever worked for.

Some people may think that to achieve the goal of paying no IHT, I would somehow have to calculate my expenditure, the growth on my portfolio and work out the date of my ultimate demise.

Clearly that is not possible and nor is it possible to solve most people’s IHT issue overnight. Inheritance tax planning is a long and continuous journey. But I do promise that, for the majority of clients, by embarking on that journey early enough in life, you will not have to pay any tax unless you want to.

The most common objection to addressing the problem is simply that some people believe that it is ‘not their problem’. I find this frustrating as in many cases I will have worked with clients for years trying to minimise tax, reduce charges and increase returns – and, in doing so, achieve the targets to meet their goals.

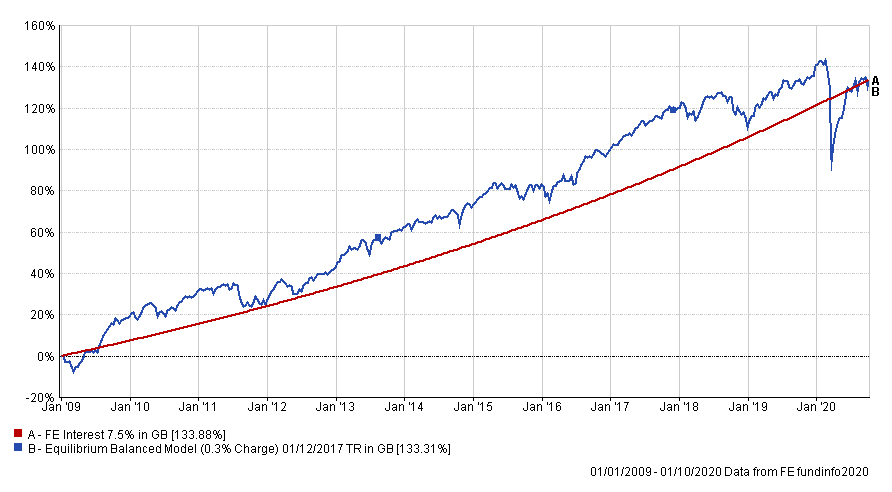

The chart above illustrates the impact of IHT on a portfolio of £500,000 and assumes that, we achieve an average annual return of 7.5% (investment value can fall as well as rise, performance is not guaranteed). Over 15 years, this could turn £500,000 into £1.5 million. Then along comes the IHT sledgehammer and crushes the return to just 4.5%. It costs the beneficiaries £600,000 in tax, which is more than the original investment amount.

It is almost heart breaking to watch that killer blow arrive after the client has worked hard for 40 years, and together we have worked hard for 15 years to protect and grow the money.

Beneficiaries often cannot understand why when their parents were so careful with money during their lifetime, they were so careless with it on death. Let us be clear, giving 40% of an entire portfolio to the tax man is careless.

The seven-year trap

Whilst the government is constantly making it more difficult to reduce IHT, there are solutions available, regardless of your circumstances.

The key is to start early because a number of schemes rely on you surviving for seven years after they begin. The frustration with the rule is that clients seem to believe that they will live for much more than seven years until the point they suddenly realise that they will not. There seems to be no gap in between.

That is why the seven-year rule is so clever. Many people fall in to the trap of believing that it is too early to start and then wait until it is too late. The only right time to deal with inheritance tax planning is now.

The best plan is to create a timeline highlighting the strategies that will be considered at different ages and what the triggers are for taking action. The plan will change as circumstances change. But ‘failing to plan is planning to fail’ – when it comes to IHT this cliché is true.

The value of your investments can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested. Rates of tax, tax benefits and allowances are based on current legislation and HMRC practice and depend on personal circumstances. These may change and are not guaranteed.