The global dollar drought and the 3 big consequences

The US dollar currency may be going from strength to strength, but Investment Analyst Neal Foundly has looked beyond the numbers to see what consequences this may bring global markets.

Sssssshhh…… if you’re very quiet you can probably hear it – a monstrous sucking sound coming from across the Atlantic.

America is vacuuming up the dollar both at home and abroad. This is having consequences for the domestic economy, but the ripple effects are being felt globally.

The Dollar Dyson

Why is this happening? A decade ago the onset of the global credit crisis led to the US central bank, the Federal Reserve (Fed), to furiously pump dollars into the banking system and the general economy to prevent them from spiralling downwards. Since 2008, the Fed has injected $2,000,000,000,000 ($2 trillion) into the economy which, combined with historically low interest rates, did the trick of saving the country from financial Armageddon.

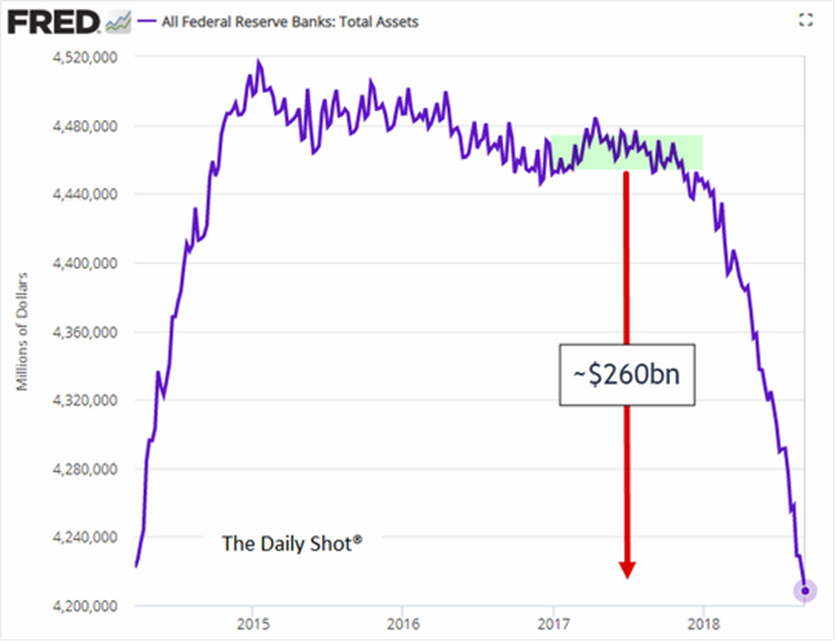

The patient was saved but almost a decade later, it was still hooked on the dollar drug. So, last year, the Fed declared that the economy was in such good health that the monetary drugs could be withdrawn. This meant reversing the flow of new money into the economy and ultimately reducing (or ‘tightening’) money supply. As Chart One shows, this slowdown in supply has been fairly dramatic, amounting to $260 billion so far this year:-

Chart One

Source: Wall Street Journal, Daily Shot

This isn’t the only reason dollars have been funnelling their way back to the US.

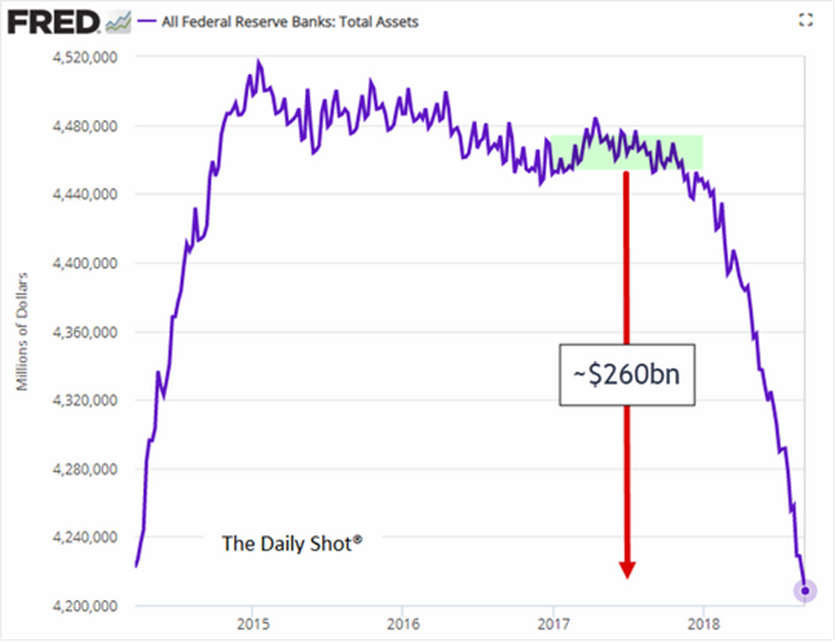

Last December, President Trump passed the US Tax Reform Act which, amongst other things, lowered the tax charge on the repatriation of overseas revenues and cash holdings held by American companies abroad. Overall, US corporates hold around $3 trillion overseas, so this had a large and immediate impact as you can see from the spike up in the first quarter of 2018 in Chart Two, below:-

Chart Two

Now we have a situation where US dollars are being withdrawn internally and from abroad whilst all the time, demand continues to grow. As with anything in high demand, the price has responded by rising.

This rise in price is reflected in three very important ways.

Big bond bombshell

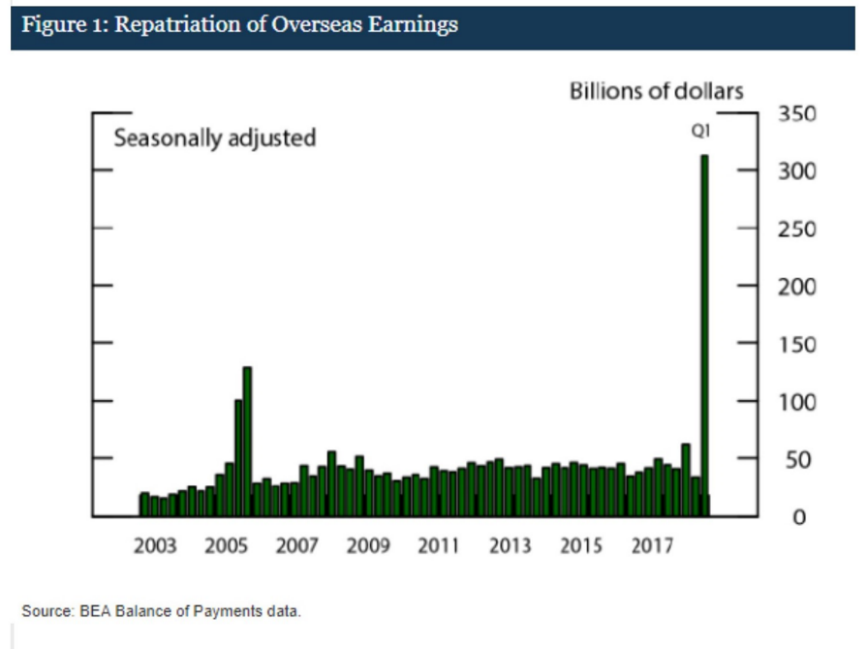

Firstly, within the US economy, fewer dollars means higher interest rates and bond yields. The yield on 2-year US government bonds a year ago was 1.33%, today this is more than twice that level at 2.76% (as of 14 September, see Chart Three below). This filters through the economy in the form of higher costs of borrowing for both companies and households. For instance, the average 30-year mortgage rate in the US has risen from 3.83% to 4.54% over the same period.

Chart Three

Source: www.bloomberg.com

Curses of currencies and commodities

Secondly, as US interest rates rise, this attracts more investors to put money into US bonds. To pay for them, they need to acquire dollars and thus drive up demand even further. This has the effect of pushing up the relative international value of the dollar, making it stronger than other currencies. This has caused significant issues in many countries.

Because most major commodities are quoted and paid for in US dollars, the cost of such products such as oil, copper and iron correspondingly rises in local currency terms. For example, since the start of this year the dollar price of oil has risen 17.2% but if you live in South Africa, the Rand price of oil has increased by a whopping 43.3%. This starts to push up inflation.

Dollar debt dilemma

Life becomes very tough if you are country that is reliant on external financing to balance your budgets and you have issued debt denominated in US dollars. Not only has your currency gone down in relative value, making it hard to attract new investors, but you still need to get hold of expensive dollars to pay the interest on your existing debt.

As we have seen in Turkey, Argentina and many more emerging economies, this has resulted in sharp falls in their currency values. In response, some have raised their interest rates to stem the selling of their currencies and attract new investors. The problem here is that there is a danger of choking off internal growth if you raise interest rates too high – in Argentina interest rates are now 60%.

Dollar death spiral?

So, is there no end to this dollar drought nightmare? Well, yes there is.

Rising mortgage rates in the US are already biting with home sales growth slowing rapidly. Indeed, the US ‘Homebuyer Affordability’ index recently hit a 10-year low as the cost of borrowing for a new house hit a new high. The same applies to credit card, personal loans and most lending to households.

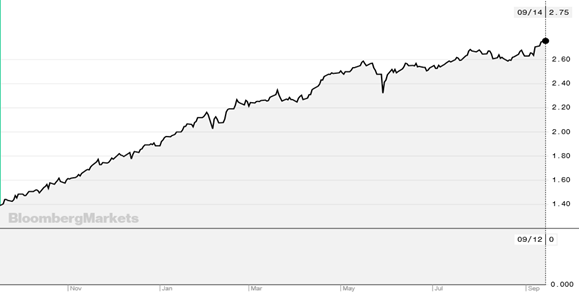

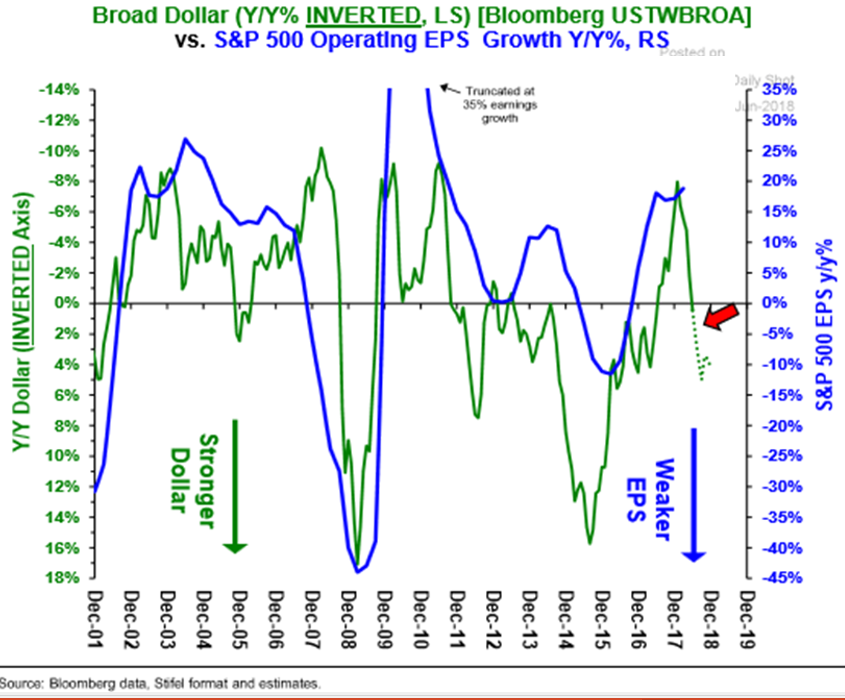

For the corporate sector in America, the strong dollar means weaker values of overseas earnings. US global titans, from Amazon to Xerox, will see lower revenues from foreign markets – notably including many countries where they expect significant growth. Chart Four shows this relationship between the earnings growth of the S&P 500 Index companies (blue line) and the strength of the dollar (in green, inverted so when it is strong, it falls below the line):-

Chart Four

Interestingly, whilst around 40% to 50% of the average S&P 500 company’s earnings are from overseas, for high-flying technology stocks the number is around 60%. These key drivers to the strong performance of the US market may be hit worst.

If these factors combine in an economic slowdown, the Fed will need to warm up the dollar printing press once more, reversing many of these trends.

Sting in the tale

The President of the United States, in his inimitable manner, summed up this situation in a recent tweet, declaring “Money is pouring into our cherished DOLLAR like rarely before, companies’ earnings are higher than ever… “.

We have seen many headlines about distress in economies such as Turkey and Argentina but as the effect of the dollar drought increases, we expect to see more column inches or tweets bemoaning the negative consequences of this currency corral for the US too.

Disclaimer: The content contained in this blog represents the opinions of Equilibrium Investment Management. The commentary in this blog in no way constitutes a solicitation of investment advice. It should not be relied upon in making investment decisions and is intended solely for the entertainment of the reader.

Definitions

Central Bank: A national bank that provides financial and banking services for its country’s government and commercial banking system, setting interest rates and lending money to other banks.

S&P 500: Stands for the Standard & Poor’s 500, the main US stock market index based on the top largest 500 companies.