The business owner exit map

This article is from a previous Equinox magazine, which you can view in full here.

Most owner managed businesses don’t consider their exit options until it’s too late. Here, Steven Lindsay, Corporate Finance Partner of accountancy firm Kay Johnson Gee – experts in advising on business sales – looks at the options available.

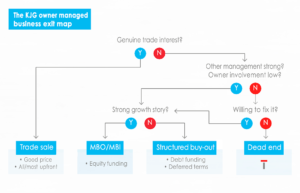

When a business owner is considering exiting their organisation, they will be faced with many decisions and dilemmas. The team at Kay Johnson Gee (KJG) use the map diagram – below – to put important questions to business owners in a methodical manner. Importantly, the map does not cover all options but is intended to be a helpful guide – allowing business owners to consider the questions they may need to ask of themselves. I’m going to go through some of these in more depth.

Q: Is there genuine trade interest?

First, is there a demand for the business and could a trade (i.e. corporate) buyer be easily found? If a business owner can sell to a trade buyer they normally will because the deal value and structure will usually be financially superior. At KJG, we use a 10-point evaluation of ‘sellability’ to quickly help business owners assess how likely this option is. However, we find that the majority of businesses cannot go down this path and instead they have to consider the alternatives. If this is the case, this brings us to our next big questions;

Q: Is the business’s management strong? And how involved is the owner?

Here we are basically asking whether the non-shareholder management team are strong enough to run the business after the owner(s) exits. We also want the owner to challenge themselves and determine how involved they are to the running of the business. These questions are crucial in deciding if the owner can consider handing the reins over to their colleagues and ultimately if the business is ready for them to exit.

Unfortunately, if management isn’t strong and the owner is still very involved then the business is not in shape for sale. There is usually no quick fix for this and the owner will have to realise at that point their exit plan is at a ‘dead end’ (as you can see on the diagram!). However, if this isn’t the case, then we have another question for the owner;

Q: Does the business have a strong growth story?

So, if the management team is able to run the business without the current owner then it needs to be established if the firm’s growth story is strong enough to attract equity investors to help facilitate a buy out. If this is the case, then a complete exit is possible.

Some still mistakenly believe that a management buyout team join together and pool resources to gather the required amount. However, in the vast majority of cases, the management team will not raise the full funding from their own personal means. Even for a moderately sized business, this would probably not be possible. And if the business was small enough to make this theoretically viable, it would still probably represent too much personal risk for the management team.

If the management team needed additional funds for a buyout, the rest of the capital could be raised from third party sources. These can include:

- Private equity or venture capital

- Bank debt

- Invoice based (or asset based) finance Another option can be a vendor deferred consideration (also sometimes known as a structured deal), where the vendor agrees to a proportion of the payment being delayed, sometimes subject to future profit levels. This can help make a sale possible if the right amount of funds aren’t immediately available at that moment in time. These kinds of deals can depend on an array of different criteria being met but they can offer flexibility to help get a sale over the line.

Again, it is important to note that the map described above does not cover all options. Other possibilities include a voluntary winding up order or an employee ownership structure.

Whatever the journey and wherever these questions take the business owner, it is important to consider professional advice when considering a business exit. KJG are experts in the evaluation of exit options and can help owners consider the best way to achieve this.

Risk warning: the content contained in this blog represents the opinions of Equilibrium Investment Management LLP (EIM) and Equilibrium Financial Planning LLP (EFP). The commentary in no way constitutes a solicitation of investment advice. It should not be relied upon in making investment decisions and is intended solely for the entertainment of the viewer. Past performance is never a guide to future performance. Investments will fall as well as rise and you may not get back your original investment.