Supermodels with No Style: 3 Ways to Avoid A Financial Fashion Faux Pas

Following on from New York, London and Milan, this week it’s Paris Fashion Week. According to our sources, this coming season you will want animal prints and yucky mustardy-coloured clothing. (Never let it be said that we are not a full-service wealth management company catering to all your needs.)

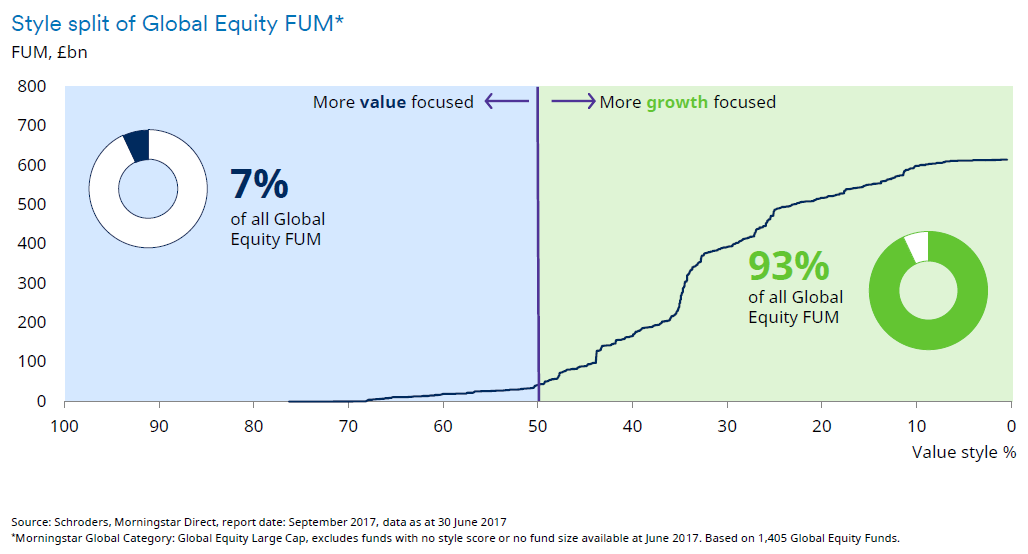

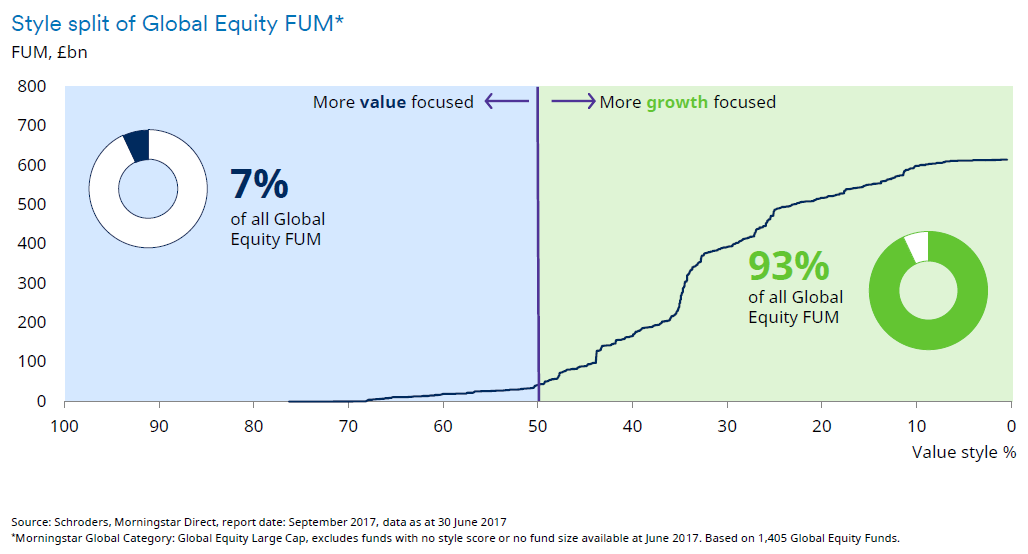

Source: Schroders

Like Ms Westwood, we would rather step away from that crowd and be a bit different, even contrarian. If the under-owned and undervalued part of the market starts to perform, our lack of style bias means our portfolios should also see the benefit.

3. Soooo Last Year

Picking an investing style that will drive good performance is one thing, timing it is another. Market trends can turn very rapidly and leave funds concentrated in one style high and dry.

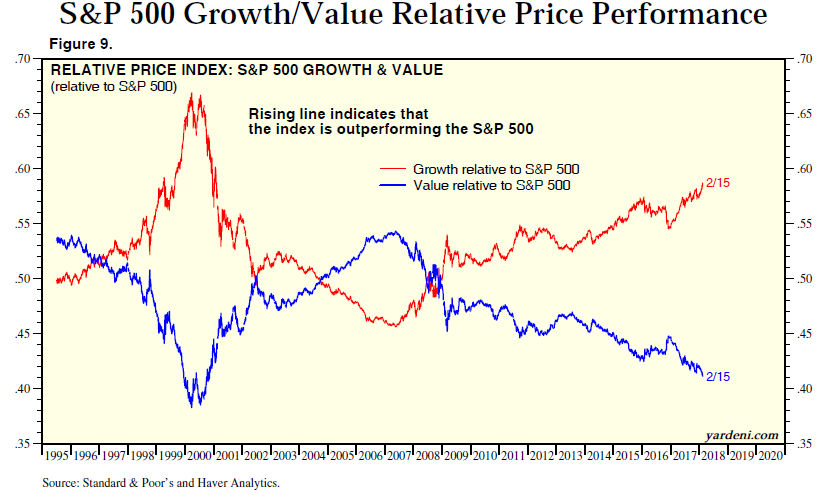

The preference for growth stocks shown in the graph above is reflected in the performance chart below which shows how growth stocks (in red) and value stocks (in blue) have performed against the benchmark stock market index in the US in recent years:-

How much longer would you expect the red and blue lines to continue their trajectory and would you be surprised if they suddenly reversed direction?

This issue is compounded by other factors too – imagine if you are a fund manager in today’s market and concerned about career risk, wouldn’t you choose to be in growth stocks too?

By remaining neutral and concentrating on picking the best funds that tap into the different styles we build our portfolios to have balance.

Ultimately, we think our lack of style will make our clients look good.

The value of your investments can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested. Past performance is never a guide to future performance. This blog is a summary of recent developments. It should not be regarded as a substitute for advice in any particular case. Equilibrium Investment Management is not responsible for the content of external website

By Neal Foundly, Investment Analyst (on behalf of Equilibrium Investment Management LLP)

Following on from New York, London and Milan, this week it’s Paris Fashion Week. According to our sources, this coming season you will want animal prints and yucky mustardy-coloured clothing. (Never let it be said that we are not a full-service wealth management company catering to all your needs.)

Style Counsel

In finance, there are a number of different distinct styles but the main ones when investing in direct shares are size, value, growth and momentum.

Size is pretty obvious, the larger the average size of the companies you hold in the portfolio, the larger is your size style. The growth style investor prefers companies that are expected to grow faster than the overall economy whilst the value style favours companies that are on lower valuations than the average. Momentum style investors, as the name suggests, pick stocks that are going up in the expectation that they will continue that trend.

Whilst our clothing fashion sense may be wanting, we would suggest three tips to avoid any financial fashion faux pas;

1. Better Primark than Prada

Many asset managers religiously adopt one style as they contend that it offers the best way of making money or that they have particular skills in that area. That’s all well and good until that investment style falls out of favour by the market and you end up with a portfolio with very disappointing returns.

Investments are always going to fall and rise, so we take a wider view. Last autumn, the Equilibrium Investment Team submitted our (super) model portfolios to industry-leading risk analysis and it spat out a conclusion that we are very happy with – they have no style. What this means is that they are not full of one investment variety or another but is evenly balanced with a bit of everything and no bias.

2. Don’t Follow the Crowd, Be a Bit Vivienne Westwood

Having no style means that our portfolios should not be caught out if one or more investment styles go out of fashion – if, for example, the stock market suddenly likes small industrial value companies or large technology companies we are less likely to be caught out with no exposure.

In fact, the latter style of high technology growth companies – think Apple, Netflix, Amazon, etc. – has very much been in vogue in recent years as investors have flocked to these companies that have demonstrated above-average growth.

However, what happens is that EVERYONE wants to get in on this fashion and it gets very crowded. The chart below shows how far this has gone with 93% of funds under management (FUM) by global equity funds tilting in that direction:-