Size over substance?

Many of you reading this will have an understanding of the quantitative and qualitative process that we go through before investing clients’ hard-earned money, however, one of the least discussed factors we have talked about previously is fund size. You might be asking why it matters how big or small a fund is – if it performs, so what?

Many of you reading this will have an understanding of the quantitative and qualitative process that we go through before investing clients’ hard-earned money, however, one of the least discussed factors we have talked about previously is fund size.

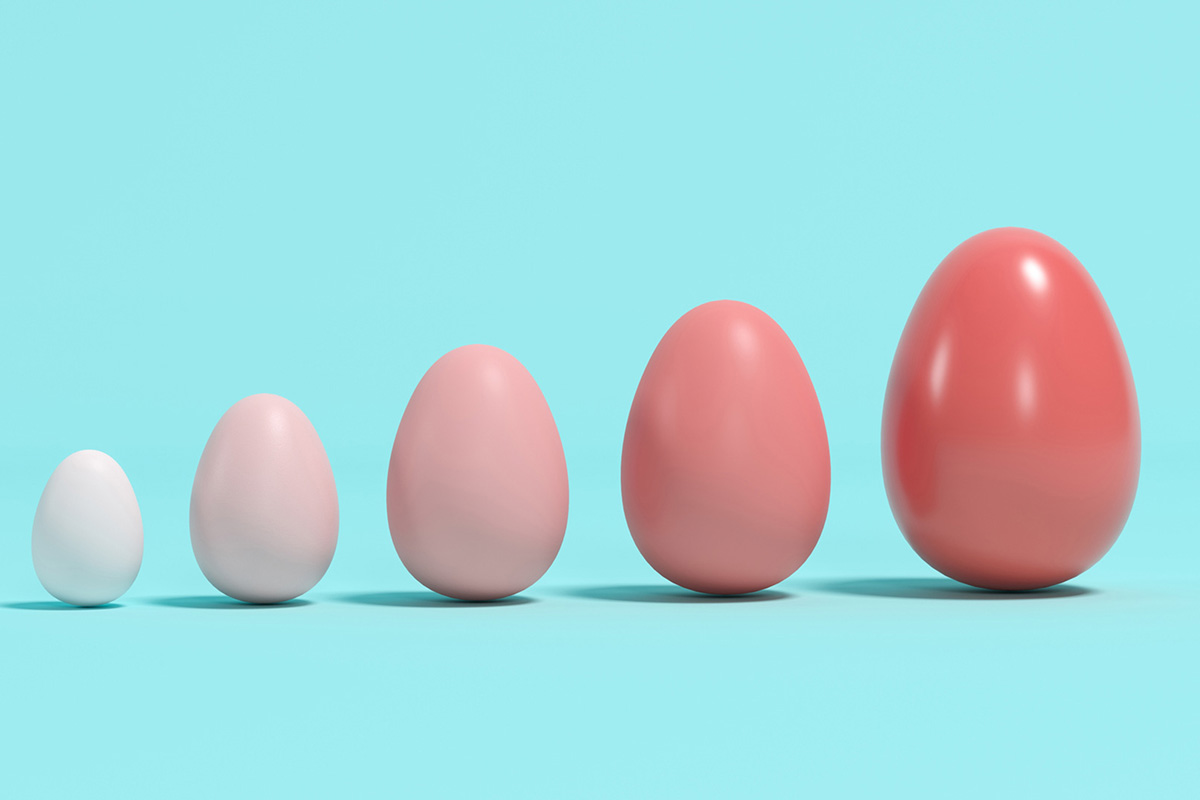

You might be asking why it matters how big or small a fund is – if it performs, so what?

The size of a fund largely dictates how it can invest and the types of investments it can make. This is critically important to us when deciding how it fits into our portfolios. If we use the smaller companies end of the UK Equity market for example, too large a fund could limit the investment universe into the larger more liquid names and too small could result in us owning nearly all the fund. Within our funds we recently added the Polar Capital UK Value Opportunities Fund, this is a small-to-mid-size market capitalisation value fund where one of the key points we discussed was fund size, which is around £930 million at present. To help protect performance, Polar plans to “soft close” (the fund will no longer be available to new investors, but existing holders can still buy it) should it grow much larger, meaning size should not impact investment decision making.

A natural question therefore is, “do bigger or smaller funds perform better?”. This can be a bit of a “chicken or egg” question as funds with good performance will naturally attract assets, whereas funds that are struggling can see assets fall.

The Lindsell Train UK Equity Fund is a good example of a large fund that has continued to outperform as assets have grown (and one that we hold in client portfolios). At present the fund is around £6.2 billion having been £2.1 billion three years ago. How has that additional £4 billion in assets impacted performance? In short, little to none.

Within the Investment Association UK All Companies Sector there are 264 different funds, Lindsell Train is the fourth largest with the two largest passive all-market trackers. The third largest is the Invesco High Income Fund. Over those three years where fund assets have grown by £4 billion it has been the sixth best performing fund. Interestingly the assets of the other nine top 10 performing funds add cumulatively to £5.2 billion, a billion pounds less than the Lindsell Train Fund!

If we continue with the Lindsell Train example, we can see that it was performance that has driven the asset growth of the strategy although existing client money will have grown and new money has been added to the fund. Using a ten-year view, it has outperformed the FTSE All-Share in every single calendar year apart from one (2016). Five years ago, fund assets stood at at £930 million, less than a sixth of what they are now.

The additional benefits of this increase in size are the economies of scale and the lower fees unit holders now pay; from 2013 to 2018 the institutional share class fees fell from 0.8% to 0.7%. The reverse can be said of one of our former holdings, the Woodford Equity Income Fund. At its peak, the fund stood at £10.2 billion however, due to some poor performance and outflows, the fund now stands at £4.3 billion. Larger funds can continue to perform as assets grow and smaller funds can continue to underperform and vice versa – investors cannot use fund size as a reliable indicator of potential future investment returns.

As we noted before, the style of the fund is so important in terms of the amount of assets the fund can absorb whilst still being able to perform. The Lindsell Train Fund predominantly owns large market capitalisation companies meaning, despite how concentrated and large the fund is, it can still trade freely in the stocks held in the portfolio, whilst maintaining some exposure to smaller names.

When looking at different sectors, the sheer size of some funds is incredible. Using the Investment Association global sector as an example, the largest is the Fundsmith Equity Fund at £17 billion, whereas the second largest is £9.8 billion. The 50th largest is a fraction of this at just under £1.3 billion. What’s even more interesting is that the top 10 performing funds have an average size of £3.45 billion, whereas the whole sector has an average fund size of £695 million. Fundsmith holds around 2% of assets in cash, so a whopping £340 million (or nearly half the sector average!). When stripping out Fundsmith, the sector’s average fund size drops to £643 million and the top ten performing funds drop to an average of £1.79 billion.

Interestingly, studying the size of the largest funds gives you an insight into the way investors are thinking and how they are allocating to different strategies. Given how hard the US market is to beat for active managers and the rise of passive US exposure over the past decade, it’s surprising to see that the largest market strategy is an active one rather than a passive one. The opposite is true in emerging markets where the largest fund is a passive one despite many feeling that active management could add value.

When carrying out the research for this piece I was surprised at just how well the larger funds had performed over the last three years as I was convinced that the smaller, more nimble funds would have outperformed their larger peers. There will be times when larger funds outperform smaller ones and vice versa, just as there will be times when different investment styles outperform. For me, the key takeaway from this is that unless the size of the fund is impacting the investable universe, investors should not be put off by how big or small a fund is.

The content contained in this blog represents the opinions of Equilibrium Investment Management. The commentary in this blog in no way constitutes a solicitation of investment advice. It should not be relied upon in making investment decisions and is intended solely for the entertainment of the reader. Past performance is never a guide to future performance, investments may (will) fall as well as rise.