Make the most of tax – really!

Tax gets a bad rep – and tax planning certainly isn’t a phrase that usually sparks excitement! But there are actually lots of ways that, with careful planning, tax can make your life better.

Don’t believe us? Read on to find out more…

Turbo-charge your giving

Often people choose to leave gifts to their favourite charities in their wills, and it is widely known that any bequests will go straight to the charity free from inheritance tax.

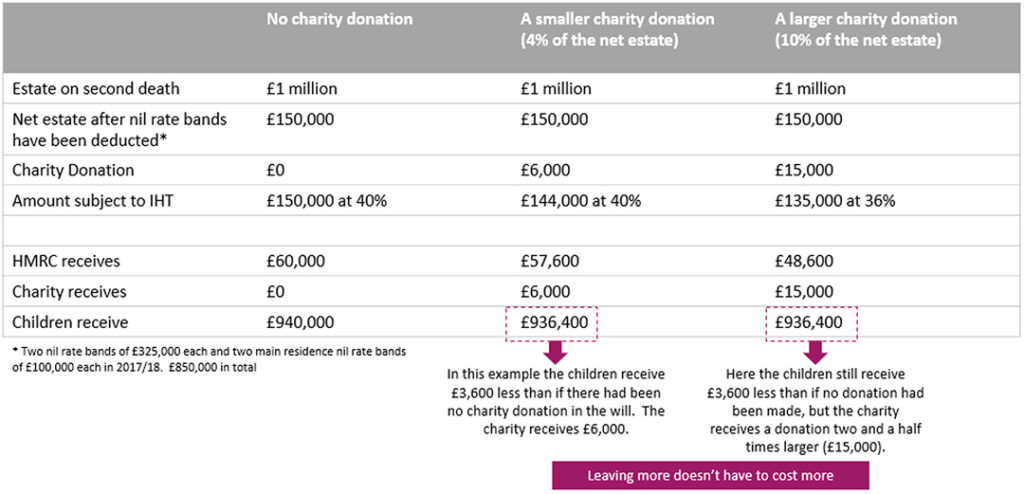

A less well-known fact is that by gifting to charity you can reduce the rate of inheritance tax that you pay on the rest of your estate from 40% to 36%.

The rules are relatively straightforward. If you leave at least 10% of your estate, after any exemptions, to charity then your inheritance tax rate becomes 36%.

You might imagine that this won’t apply to you as you are planning on leaving what you consider to be a modest amount to a charity with your remaining assets going to your children. However, the scenario in the example below demonstrates that the donation does not have to be as large as you might think.

With careful planning, children can potentially end up receiving exactly the same amount, even though a much larger charity donation has been made – with it being HMRC that picks up the tab.

*Two nil rate bands of £325,000 each and two main residence nil rate bands of £100,000 each

Because leaving 10% of the net estate reduces the rate of inheritance tax to 36%, upping the charitable bequest in our hypothetical client’s will from £6,000 to £15,000 has no effect on the amount that their children eventually receive, even though the charity is being given more than two and a half times as much. If this is something that appeals to you, make sure to speak to your adviser who will be happy to work through some examples based on your existing will. It is also worth remembering that a will can be altered after death by a deed of variation.

How to benefit from your child benefit

For those with children under 16, the government will provide, for the 2021/22 tax year, a statutory payment as follows:

- £21.15 per week for your first child

- £14.00 per week for any further children

If your income is more than £50,000, rather than give you less, HMRC will continue to pay it to you and kindly ask that you pay it back.

Once you have £60,000 or more coming in, the charge you’ll pay back is 100% of your entitlement, essentially meaning you won’t get any benefit (but would still be required to complete a tax return). This has caused many to simply stop claiming to avoid the arduous task of completing a tax return.

For those with income that remains above £60,000, there are options available to ensure you can ‘benefit from the benefits’.

One of the most efficient ways to do so is to make a personal pension contribution. Let me explain how this would work with a nice example:

- Sarah earns £55,000 a year and her child benefits are therefore reduced by 50% to £549.90 per year. Sarah could contribute £4,000 (net) to a pension which will immediately attract £1,000 of basic tax relief and will be applied at source. Her £4,000 contribution immediately becomes £5,000.

- Sarah will also be eligible for an extra £1,000 in higher rate tax relief which can be claimed via her tax return. So, at a cost of £3,000 she now has £5,000 in her pension.

- But here is the kicker. In addition to the tax relief, Sarah’s adjusted net income will be reduced to £50,000 and she will now be eligible for the full child benefit – £21.15 per week. That’s an extra £549.90 a year!

So, through a combination of tax relief and restoring the child benefit, Sarah has £5,000 dedicated for her long-term future at a cost to her of just £2,450.10.

Inheritance tax – a voluntary tax?

Former Chancellor Roy Jenkins once said: “Inheritance tax is, broadly speaking, a voluntary levy paid by those who distrust their heirs more than they dislike the Inland Revenue.”

While the quote is a little harsh, if you start planning early enough, inheritance tax can be significantly reduced, if not eliminated entirely.

One of the most straightforward ways to reduce a potential inheritance tax bill is through gifting.

The inheritance tax treatment of gifts can vary depending on the value of the gift and your personal circumstances and there are certain gifts that can leave your estate immediately without causing a tax liability. These include:

- Gifts to your spouse or civil partner.

- Annual gift allowance up to £3,000 a year. Should the allowance not be used in one tax year, it may be utilised in the next. However, you can only go back one tax year, making a maximum per individual of £6,000 in any one year.

- Small gifts of up to £250 per recipient are also free from inheritance tax.

- Gifts can be made in consideration of marriage up to the amount of £5,000 per child, £2,500 per grandchild or £1,000 for any other individual.

- Where an individual has income in excess of their needs, they may be given away free from inheritance tax as long as certain conditions are met.

Other gifts made directly to individuals, that are not immediately tax free, are classed as potentially exempt transfers (PET). There is no limit on how much you can gift, however, you need to survive for a minimum of seven years before these gifts leave your estate completely and are free from tax.

If you die within seven years of making a PET, it will reduce the value of the nil rate band available on your death, meaning there may effectively be inheritance tax to pay on it.

For more information on how to reduce your inheritance tax liability and make the most of your wealth book a no-obligation chat with one of our advisers.

The value of your investments can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested. Rates of tax, tax benefits and allowances are based on current legislation and HMRC practice and depend on personal circumstances. These may change and are not guaranteed.