Executive summary

- Many asset classes fell in 2022 as inflation spiked and interest rates went up sharply. This included both bonds and equities which became very correlated.

- In 2023, these assets have mainly moved differently from each other, as we would expect in more normal circumstances, with equities generally outperforming bonds.

- However, in recent weeks, these assets have begun moving in the same direction again as central bankers emphasised their desire to keep rates at the current elevated levels for some time.

- This led to a sell-off in both assets, followed by a rebound as central bankers stressed that rates are unlikely to rise significantly beyond their current levels.

- The 5% increase in rates we saw over the past two years, with 3% occurring in the past 12 months alone, is very unlikely to be repeated.

- This was an extraordinary response to exceptional circumstances as we came out of the pandemic.

- Smaller, more typical increases in interest rates would have a less significant impact on the markets. If current signs of a slowing economy continue, then rate cuts look more likely in our view. If so, we think this would be very positive for many asset classes.

Matterhorn or Table Mountain

Significant moves have occurred in both the equity and bond markets over the past few weeks, echoing patterns reminiscent of last year.

In 2022, equity and bond markets – which normally move very differently – became very correlated and both fell in tandem. This hurt portfolios as diversification didn’t help mitigate losses last year, in the way we would normally expect in a bear market.

The falls were of course largely because of higher-than-expected inflation and the rapid increase in interest rates to combat this.

Throughout most of 2023, equities and bonds exhibited a renewed divergence in their behaviour. Generally, stock markets had recovered somewhat while bond markets continued to struggle, as inflation has come down, but rates have continued to rise.

In recent weeks, both asset classes have started moving in the same direction again in response to changing interest rate expectations.

In September, both the Bank of England and their US equivalent, the Federal Reserve, chose not to carry out any further interest hikes. You might think this would be good news!

However, it was not so much what they did as what they said. Both stressed that although they are “pausing” further rate hikes for now, their intention is to keep them at the current elevated levels for a long time.

In the words of Huw Pill, the Bank of England’s chief economist, if you were to graph interest rates in the future, he’d like the shape of the chart to resemble more of a “Table Mountain” rather than a “Matterhorn”.

Historically, central banks have tended to keep hiking rates until something ‘breaks’, and the economy takes a sharp downturn. They are then forced to cut rates, perhaps even more rapidly than they raised them, leading to a sharp Matterhorn-like profile on a chart.

This time, they are determined to pause before reaching that breaking point (easier said than done!) and then leave rates at current levels for an extended period, much like the shape of Table Mountain.

Markets have had to adjust their expectations, which particularly affected what we call “long-duration” assets, such as long-dated bonds and certain types of stocks.

For example, on 20 September 2023, the 10-year gilt had yielded 4.2%. This yield largely reflects what investors anticipate rates will be for the next 10 years. With current interest rates at 5.25% in the UK, this suggests that investors expect rates to be lower in the long term than they are at present.

After these announcements, gilt prices fell, causing the yield to rise to 4.65% by 8 October. We saw similar movements in the US bond market. (Source: LSEG Datastream)

Significantly, stock markets also dropped at the same time as bond prices fell.

However, in the past few days, many of these movements have reversed, with both equities and bonds rallying sharply.

We have also seen some weaker economic data and better-than-expected inflation numbers. As a result, various Federal Reserve officials have made it clear that they believe interest rates have now reached their peak.

Depressed sentiment

This mini-sell-off and subsequent bounce were largely caused by a few comments from central bankers. After 2022, investors remained nervous about anything related to rates and inflation. It demonstrates how jittery they were that a few words, rather than actions, could cause such sharp market movements.

It’s worth remembering just how extraordinary the time has been since the pandemic. Three years ago, inflation was nearly zero, and it took just two years to surge to 10.8%, as it did in 2022.

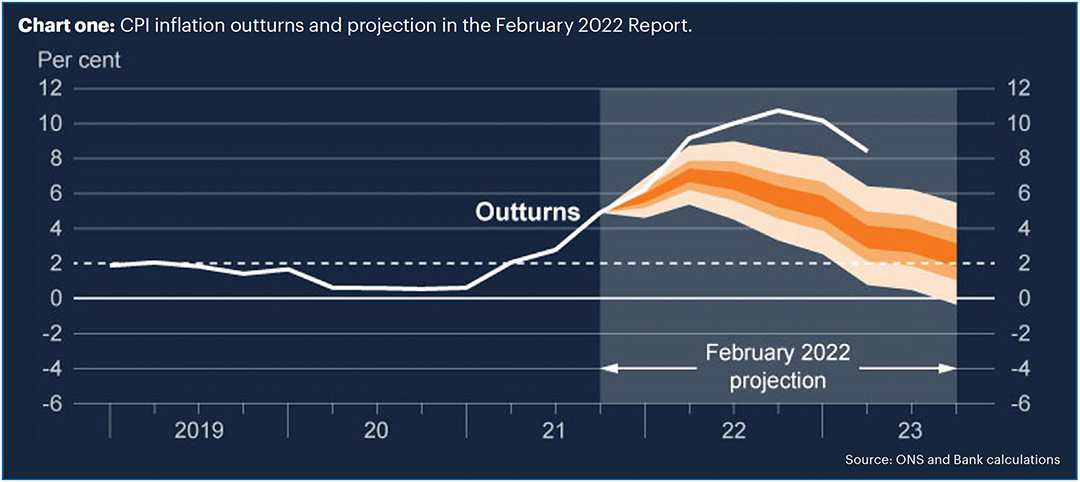

This far exceeded even the most pessimistic expectations. For example, chart one is from the Bank of England’s latest Monetary Policy Report. It compares what the Bank thought would happen to inflation back in February 2022 with what happened.

The dark orange area is their central expectation, while the lighter orange areas show where they thought inflation could realistically reach in more extreme outcomes. The white line represents what happened, and it significantly exceeded even their most pessimistic calculations.

Chart one: CPI inflation outturns and projection in the February 2022 Report

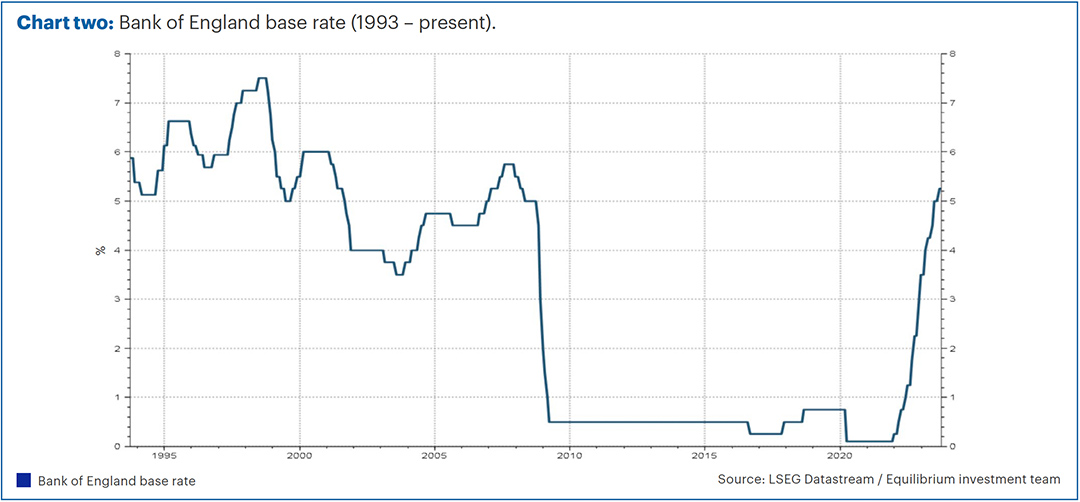

It is also worth remembering how substantial the changes in interest rates have been. Chart two illustrates rate movements over the past thirty years, highlighting a rapid upward shift in the final two years of the chart.

Interest rates were 0.25% just two years ago and are now at 5.25%. They have risen by 3% in the last 12 months alone.

Chart two: Bank of England base rate (1993 – present)

These are huge moves and it’s no wonder they caused such turmoil in markets.

In hindsight, it seems highly likely that the primary cause of inflation (exacerbated by factors like the war in Ukraine) and the reason for the substantial rise in interest rates has been all the economic stimulus provided by central banks and governments during the pandemic – essentially pumping huge amounts of money into the system.

While investors remain understandably nervous, we think moves of this magnitude are extremely unlikely to be repeated as they are the result of an extraordinary situation. If we are correct in our assessment, we believe there are some attractive returns to be found in selected assets.

We expect that inflation is likely to continue decreasing, and interest rates have probably reached their peak. However, we could be wrong of course, and our approach is always to assess the potential impact on our portfolios should we be incorrect.

For example, we could easily imagine a scenario where rates are 1% higher in a year’s time. It is a considerable stretch to imagine them being 2% higher, as we think this could trigger a sharp economic downturn. However, a repetition of movements seen in the past two years – another 5% increase – is, in our view, almost unthinkable.

We’ve recently expressed our optimism about certain types of bonds. Following the declines in their values, their yields are now much higher.

While this asset class is the most sensitive to further rate hikes, we’re confident that the funds we hold would still perform well even if rates were to rise by, let’s say, an additional 1% beyond our expectations.

Moreover, we are also seeing signs of economic slowdown, which leads us to believe that the next interest rate move is just as likely to be cut as increased. Rate cuts tend to benefit bonds, often resulting in capital gains on top of the yield we are receiving.

With sentiment so low, small changes in outlook can have a big impact. However, with such depressed expectations, this increases the likelihood of outcomes being better than expected. If so, we think this would lead to strong gains in many asset classes.

This newsletter is intended as an information piece and does not constitute a solicitation of investment advice.

Past performance is for illustrative purposes only and cannot be guaranteed to apply in the future.

If you have any further questions, please don’t hesitate to contact us. If you’re a client you can reach us on 0161 486 2250 or by getting in touch with your usual Equilibrium contact. For all new enquiries please call 0161 383 3335.