Managing expectations

Streaming giant, Netflix, recently reported a big drop in subscribers, with nearly one million people cancelling their accounts in the last quarter.

This was the second quarter in a row that subscriber numbers have fallen, after many years of double-digit annual growth.

So, how did markets react to this apparent reversal in growth? The shares went ‘up’ more than 7% after the results were announced. (Source: Financial Times)

The reason for the rally is that investors were expecting the results to be much worse, with analysts predicting that Netflix may lose over two million subscribers in the period, double the real number.

When expectations are so low, it sometimes only needs the actual data to be just slightly less bad than expected, for a stock or other investment to rally.

This illustrates a phenomenon we can see elsewhere in the market. Sentiment in general is incredibly poor, with investors feeling very pessimistic given the recent combination of high inflation and rising interest rates, together with fears of an economic slowdown.

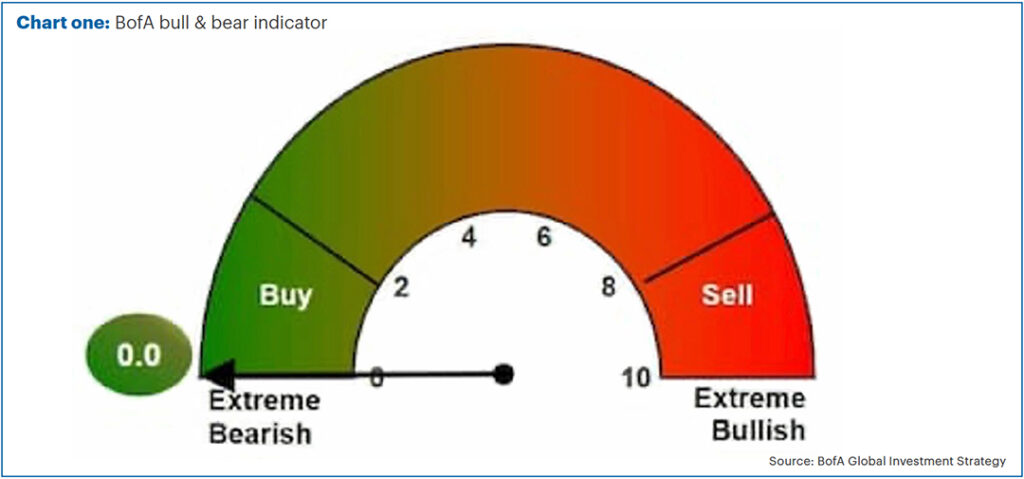

There are various ways we can look at sentiment. One we’ve featured before is Bank of America’s (BofA) ‘bull & bear’ indicator. This looks at various market-based metrics and says how bullish or bearish investors are on aggregate.

Chart one shows the latest indicator, as of 1 July 2022, whereby investors are at ‘maximum bearish’ levels.

Bank of America say this can be used as a contrarian indicator. When everyone is extremely bearish, their indicator tells them to buy. On the flipside, when it shows extreme bullishness, they would advocate selling.

Currently, their indicator shows that market sentiment is the lowest it can possibly be. The last time it reached this level was back in 2020 during the lows of the pandemic. Interestingly, this was just before markets recovered strongly.

Bank of America carry out a regular survey of fund managers, asking various questions about their positioning and their expectations for the future. The most recent survey shows that fund managers are generally very underweight in equities relative to cash, which again, can be read as a contrarian signal.

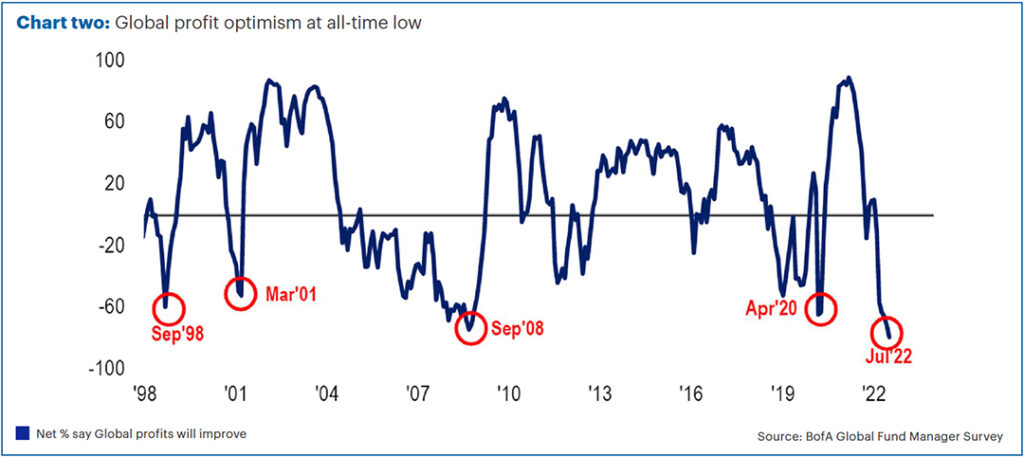

It also shows that most fund managers expect global profits to fall. Chart two shows the percentage of managers who say they think profits will improve and how this has changed over time.

Fund managers have never been more certain than they are now that profits will fall. You can see from the chart, the percentage of fund managers who believe profits will improve is lower now than in April 2020 and September 2008, periods when markets were also near their relative lows.

This might seem slightly odd if you’ve been reading the financial press recently. The consensus is that markets have fallen because of rising interest rates; and the possibility of a recession causing earnings to fall is yet to be factored into prices. This survey implies the exact opposite.

The reason some believe this, is because analysts who monitor the companies who make up the market, have yet to really cut their earnings expectations. Often analysts can be slow to change their views on the companies they cover and can have an overly rosy view on their own specialist sector.

Furthermore, when looking at market-level earnings expectations, it can hide what is going on under the surface. For example, in general terms, profit expectations for energy companies have risen, whilst expectations for consumer discretionary companies have fallen.

The fund manager survey tells us that professional investors appear to be significantly more bearish about profits than is implied by analyst expectations.

Turning back to Netflix, it has of course already fallen a long way, with its market capitalisation dropping from over $300bn in November, to around $90bn, making it the worst performer in the S&P 500 over this period. (Source: Financial Times)

However, this came after an incredible period of performance where the share price essentially doubled from the beginning of 2020, driven by huge growth in subscribers during the pandemic.

Whilst this is an extreme example, it is worth reminding ourselves just how well the market has performed coming out of the pandemic. Arguably, it did get a little ahead of itself, with investors anticipating the likes of Netflix could continue this high level of growth into the future. This was unlikely to be sustained.

It’s now possible that markets have overshot in the other direction and investors are too pessimistic about future growth. Like Netflix, perhaps it may only need for other companies to report results that are slightly less bad than sentiment would suggest, for the market to rally quite hard.

Other potential catalysts might be inflation data which shows price increases are slowing, or that the economy is proving more resilient than expected.

Recent falls in commodity prices such as energy and food have provided some reassurance, which has helped markets to stabilise. We think we need more such evidence for a true bounce in markets. However, when it does come, any movement could be rapid.

Communicating in a crisis

Whenever we are dealing with unusually difficult markets, we try to step up our communications with clients.

We recently held a briefing at Mere Golf Resort & Spa, where Colin and I presented on a few topics, such as what’s going on in markets and portfolios, past bear markets and recoveries, as well as Equilibrium’s performance relative to various benchmarks and competitors.

The event was designed to try and answer some of the key questions raised by our clients:

- “Am I going to be ok?”

- “What actions are you taking?”

- “How are Equilibrium performing?”

- “What might the future look like?”

We realise not everyone is able to attend these events so the presentations are available online as a series of videos: Communicating in a crisis

Our recent investment bulletin also answered these questions in written form: Short-term pain for long-term gain

Unfortunately, bear markets like we’ve experienced this year do happen from time to time. It is not possible to generate long-term returns without taking some level of risk, which means short-term losses will happen on occasion.

Whilst most of us understand this intellectually, that doesn’t necessarily make it any more comfortable when those periods do arrive.

However, we firmly believe that none of our clients will have to make lifestyle adjustments as a result of short-term market movements. The key is making sure the portfolios you hold are appropriate for the expected time frame of the investment, something our advisers work very hard to ensure is correct.

This means that clients should be able to withstand short-term volatility and benefit from the long-term returns we expect from investing. Our portfolios are performing in line with long-term expectations and we firmly believe that the actions we are taking now will add to future returns.

We thank you for entrusting us to look after your hard-earned savings, a responsibility we take very seriously indeed. We hope you find these regular communications helpful, but as usual please do get in touch on 0808 156 1176 if you have any queries.

Past performance is for illustrative purposes only and cannot be guaranteed to apply in the future.

This newsletter is intended as an information piece and does not constitute a solicitation of investment advice.