What goes up, must come down

“Let me get this straight; my heating bill has gone through the roof, so to counter this you want to make my mortgage more expensive?”

To the average man or woman on the street, this might be the reaction to the Bank of England putting up interest rates this month. When news headlines are all about a “cost-of-living crisis”, the massive increase in the energy price cap and the upcoming increase in National Insurance, it might seem questionable that the Bank feels it needs to make borrowing more expensive too.

The Bank is of course trying to control inflation and get it back towards their target of 2% p.a. Often, inflation happens when the economy is booming which means there is increased demand for goods and services. Increasing the cost of borrowing can take the heat out of the economy by reducing the amount of money available to spend and therefore reducing demand.

But this current inflation is different

Our energy bills have not gone up because we’re all so flush with cash we’ve decided to crank the heating up. By and large, people’s energy usage has stayed fairly static, but the price has gone up for external reasons: the switch away from coal, geopolitical tensions with Russia, the lack of wind last year, and so on.

Used car prices have gone up because of supply chain issues in new cars. Petrol prices reflect the fact that the oil price is up 73% in the past 12 months as it bounces back from the pandemic lows. It seems very unlikely it will increase by another 73% over the next 12 months too.

The Bank putting up interest rates will have virtually no impact on these causes of inflation. It might have a minor benefit by helping strengthen the currency, but when other central banks are moving in the same direction this is very limited.

We have been consistent in saying that many of the causes of inflation appear to be temporary and caused by the pandemic. We still believe that this is the case for the most part and expect the headline inflation figures to come down towards the end of this year.

However, inflation is starting to feed through into other areas such as food prices. High energy costs have a knock-on effect to such areas, and the Chairman of Tesco John Allan said last week that “the worst is yet to come” when it comes to food prices.

When inflation is in electronic goods, restaurant bills or used car prices (for example), this is not too much of a problem. People can simply not buy that new telly or motor, and not go out for a meal.

When inflation is in energy and food prices, things are different. It could have a genuine impact on the amount of money consumers can spend on other areas of the economy, especially when combined with tax and interest rate hikes.

What pay rise?!

The Bank’s governor, Andrew Bailey, upset a lot of people when he suggested they should not be asking their boss for a pay rise. Whilst this came across as somewhat tone deaf, it is worth pointing out that the pay rise companies can offer their staff will be lower than it might have been. This is because employer National Insurance Contributions are to increase in April as well as employee contributions.

In essence, workers may get 1.25% less of a pay rise than may have otherwise been the case because the company will have to pay this in tax instead.

This is why we believe that interest rates here in the UK may not have room to go up much further. There is a danger that rate hikes are not just ineffective in fighting inflation, but counterproductive and help push us towards an economic slowdown.

Whilst we remain optimistic that we’ll see decent economic growth this year, especially if we can avoid further Covid-related restrictions, the risk that we see something of a slowdown has increased in our view.

Depressed markets

The rising energy prices are one reason the FTSE 100 has gone up so far in 2022, with the likes of BP and Shell being a big part of the index. However, it’s pretty much one of the only asset classes that has produced a positive return this year.

The increase in interest rates has had a very negative impact on most other markets and regions. Most major equity markets, as well as other asset classes like bonds, are down this year, in some cases quite a lot.

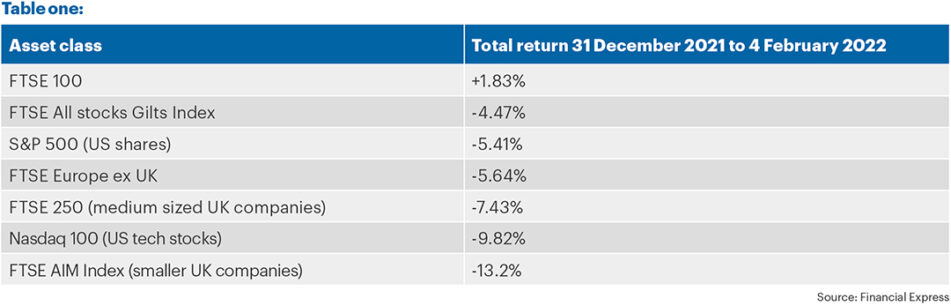

Table one (below) shows the returns of some selected asset classes since the end of December 2021 to date.

Our portfolios vs our peers

As discussed in last month’s “The Pulse”, we invest in all these asset classes and so unfortunately our portfolios have fallen in value so far this year. For example, the balanced portfolio has dropped 2.53% from 31 December to 4 February. By comparison, the average mixed asset fund that has a similar amount in equities to our funds has fallen somewhat more, at -2.79% (FE Mixed Investment 20%-60% shares sector).

Previously the FTSE 100 Index may have been a reasonable indicator of equity returns generally. It has also been the one that clients are most familiar with and so historically we often referred to it in our client reporting. However, over time the FTSE has started to look quite different to many other markets.

It has high levels of exposure to oil and gas companies which have long-term challenges related to climate change. It also has lots of exposure to slow-growing financial stocks like banks, and very little new industries like technology.

Over the long term, the areas of the market which make up the FTSE are not necessarily where we’d like to be invested and we have very little exposure to the top 100 in our equity holdings. We do however have exposure via defined returns.

The good news (potentially!)

Last month, one of our defined returns products kicked out on its second anniversary, providing a return of 22.1% over the life of the product.

This product was based on the FTSE 100, which returned only 9.62% over the same period including dividends (31 January 2020 to 31 January 2022). The defined return product therefore returned more than double the index.

We have largely reinvested this into a new defined return product from Credit Agricole, which is based on both the FTSE 100 and the S&P 500 index. If both these indices are above their starting level on the first anniversary of the product’s inception, it will kick out and give us a 10.95% return.

Best guess

Whilst we think equities will still provide some reasonable long-term returns, our best guess is that this might be a bit lower than 10.95% pa. We therefore still find these products attractive, despite the long-term structural challenges for the FTSE 100. (Please get in touch if you would like a full description of how these products work).

Looking forward, we still think interest rates will go up somewhat, particularly in the US where they’ve not yet started increasing. However, we believe much of these expected hikes are already reflected in market prices.

Whilst we’ve recently tilted portfolios slightly more towards stocks that benefit from economic re-opening, and less in those stocks more sensitive to interest rates, it remains a difficult balancing act.

There is a danger that economic growth turns out to be more fragile than first thought, and if so, we might need to tilt the portfolio back in the other direction.