Good tidings we bring

Executive summary

- The Societe Generale defined returns product held in most portfolios has kicked out.

- Over five years, this produced a return of 47.5% (9.5% p.a.) even though the FTSE 100 on which it is based only went up 2.3% in price terms over the same period. Including dividends, the FTSE went up 24.03% over the five-year term.

- For our more cautious portfolio funds, we have reinvested into short-dated corporate bonds. At present, these provide a yield of around 7% per year with an average time to maturity of around two years. We think this is an attractive potential return with comparatively low risk.

- For the more adventurous funds, we have reinvested at least part into UK equities. At present, UK stocks trade at a significant discount to international shares, which we think makes them look very attractive for investors who can afford to be patient.

We recently received an early Christmas present with the kickout of one of our defined returns plans.

The Societe Generale FTSE Autocall product had been running for five years and had often proved to be a source of frustration. However, whilst we may have had to be patient, it has turned out to be a remarkably successful investment.

The product was set up when the FTSE 100 was at 7,348 on 6 December 2017.

The terms of the product meant that we would receive a return of 9.5% p.a. provided the FTSE 100 was at or above 7,348 on any of the first six anniversaries of the start date.

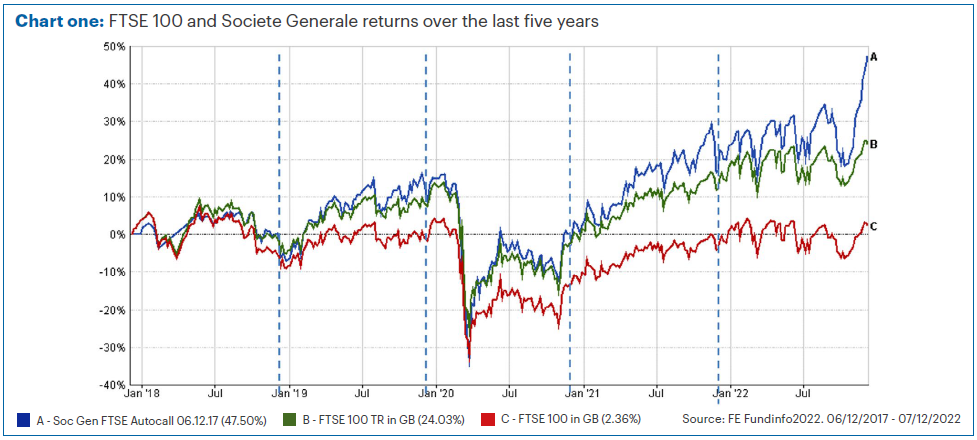

Chart one shows the FTSE 100 return over the past five years in red. The red line is the price return – the capital value of the market in index points. Over five years, the index has gone nowhere, up just 2.36% over that period.

The vertical dashed lines are the anniversary dates. Since it was set up, the product has had four previous chances for kickout to occur (had the red line been above zero).

On a couple of occasions, the market was well below the kickout level, but twice we just missed out on kickout. In both 2019 and 2021, the FTSE was above the kickout level prior to and just after the anniversary date but dipped below on the vital day.

Whilst this was frustrating at the time, every time the product missed out on a kickout, the potential return increased. For example, if it had done this on the first anniversary, we would have received just 9.5%. If it had kicked out on the second anniversary, we would have received 19% (2 x 9.5%).

In the end, because we had to be patient, we ended up with five lots of 9.5%, a worthy 47.5%.

Chart one also shows the total return of the FTSE including dividends, which is the green line. Had we bought a FTSE index tracker instead of the defined returns, this is what we would have received (24.03%). The blue line shows the return of the Societe Generale product, which returned almost double the total return of the market.

The product was held in all the IFSL Equilibrium funds, with the exception of the Defensive fund.

Patience is a virtue

Defined returns is an asset class where we can easily see the value of patience, because the products have fixed terms.

Had the Societe Generale product not kicked out, it could have run for one more year. If the market had remained below the starting level, then the in-built capital protection would have likely applied, and we would’ve just got back our original investment (unless the market dropped to 60% below the start value or lower).

However, because we can trade the products every day, they also have a market price at which we can buy or sell. You can see in chart one that in March 2020, the product price fell significantly as markets dropped during the pandemic.

The product was launched at £1 per share in 2017. At the lowest point (23 March 2020), the product had a price of 67p per share.

At the time, we said this was a potential bargain because it meant that even if markets had stayed at those extremely low levels until maturity, the capital protection would have kicked in and would have then been worth £1 per share.

In the event, the product returned £1.475 per share, more than double the price from March 2020.

A matter of time

Whilst the virtue of patience is obvious with defined returns, we think the same applies to other asset classes too.

In equity, whilst share prices go up and down, if the companies we invest in remain profitable, we will likely receive a positive return if we wait long enough. In the meantime, many of them pay out decent dividends, so we are being paid whilst we wait.

The value of patience is, however, even more obvious in fixed interest. A bond, like a defined return product, has a fixed term and a pre-defined pay out, but the secondary market price can move around.

Depending on the portfolio, much of the Societe Generale money is being reinvested into bonds.

Right now, we think bonds look, in some ways, more attractive than equities, at least on a risk-adjusted basis. For example, we are currently buying a short dated corporate bond fund, where we lend money to companies over an average of around two years, with a yield to maturity of around 7% p.a.

These are what we call “investment grade” bonds, where the companies are considered relatively secure (because the rating agencies rate them as BBB or above).

In the short term, the price of the bonds can go up or down. However, if we hold them to maturity and provided the companies we lend to don’t default, we should get roughly 7% per year, in line with the yield. This is a relatively high potential return in which we have a high degree of confidence.

By comparison, we could set up a new defined returns product, but the indicative potential return for a FTSE-only product is currently around 9.7%, based on a relatively high starting level of c.7,500. In the current uncertain environment, we prefer the greater certainty of our 7% yielding bond fund for all but our most aggressive mandates.

Right now, there is a particular opportunity in short-dated bonds, which in many cases yield more than longer-dated bonds. This is because investors think central banks will continue putting up interest rates for the next few months, so a one- or two-year bond for example, needs to factor in these higher rates.

However, markets then expect rates to be cut again as the economies enter recession. This leads to what we call an “inverted yield curve”, where longer-dated bond yields are lower than short-dated bonds, as these longer duration bonds factor in future rate cuts.

Double discount

Whilst for our cautious and balanced mandates we are going more into fixed interest, for the more adventurous funds, we can take a longer-term approach.

For our adventurous and global equity portfolios, we are therefore reinvesting some of the Societe Generale money (which was, of course, linked to UK equities) back into UK equity funds.

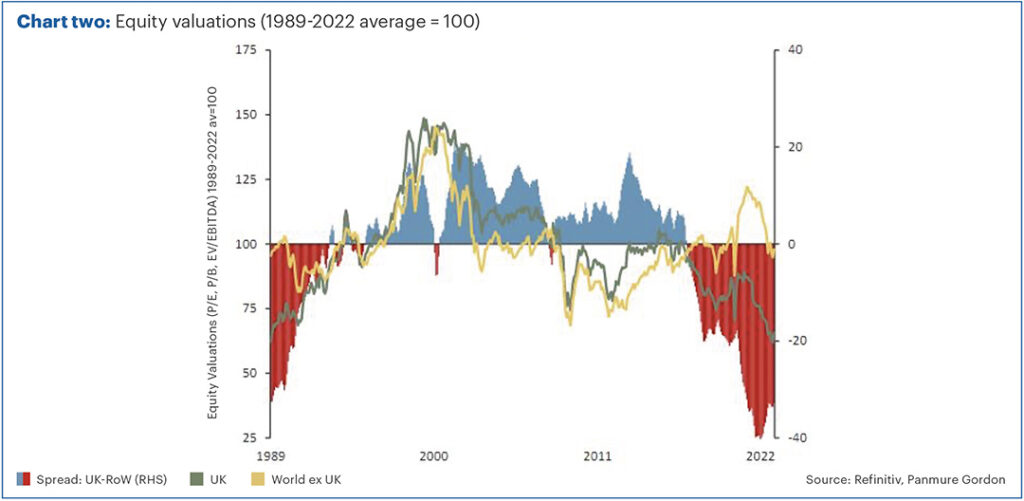

Chart two shows the relative valuation of UK equities compared to stocks in the rest of the world, based on various metrics such as price/earnings and price/book value.

For much of the 2000s, UK equities traded at a premium to the rest of the world – the stocks were in demand and were therefore more expensive than stocks outside the UK. This is partly because UK companies have always had a reputation for paying out stable dividends over time.

However, since Brexit, UK stocks have traded at a consistent discount to the rest of the world and are therefore much cheaper.

This discount has been consistently around 20% since the Brexit referendum, but has now reached extreme levels close to 40%, which we have not been seen since the early 1990s.

We believe that a bit more stability in the UK economy could see international investors start to reconsider the UK as they search for bargains. For overseas investors, UK stocks are trading at a ‘double discount.’ Not only are they cheap relative to the rest of the world, but the pound has fallen against other major currencies over this period.

We hear reports of large US private equity funds looking very seriously at UK assets, including private assets like real estate and infrastructure. Given current valuations, we think it likely that they may turn their attention to UK listed businesses in the near future too.

If the UK discount merely returns to the level it has been for most of the time since Brexit, we could see a period of strong returns.

We would like to take this opportunity to wish all our friends and clients a very happy Christmas and here’s hoping for a prosperous 2023!

Past performance is for illustrative purposes only and cannot be guaranteed to apply in the future.

This newsletter is intended as an information piece and does not constitute a solicitation of investment advice.

If you have any further questions, please don’t hesitate to get in touch with us on 0808 156 1176 or by reaching out to your usual Equilibrium contact.