Executive summary

- Some of the main global stock markets experienced significant fluctuations in recent weeks, including the S&P 500, Nasdaq 100 and the Topix, which saw a dramatic decline of almost 25% from its peak.

- The UK’s FTSE 100 Index dropped a little over 4% before rebounding.

- Despite the volatility, many portfolios held up well due to effective hedging strategies, and markets recovered quickly.

- The recent market falls were a result of a combination of factors such as the Japanese central bank raising interest rates above zero for the first time in years which impacted the “carry trade”, the stronger Yen negatively affected Japanese stocks, US economic data raised concerns about a potential recession and interest rate cuts, and Warren Buffett’s Berkshire Hathaway sold a large holding in Apple.

- We remain slightly cautious due to expensive valuations and the possibility of another market dip – however, we are also confident in the positioning of our portfolios.

- Our holdings are well diversified, and we employ portfolio insurance products to cushion some of the equity losses which has worked particularly well in recent weeks.

- Within our adventurous portfolios, we have used some of the proceeds to top up Japan and increase our defined returns products.

- Our high-yield bond holdings are now worth more than they were prior to the stock market fall, whilst equities haven’t quite returned to their high point.

Volatility and value

It has been a volatile few weeks on the markets.

Stocks fell sharply in the first couple of weeks in August but have since recovered much of their losses.

The main US stock market – the S&P 500 – dropped just less than 10% from the recent high which is defined as an official “correction”, whilst the tech-heavy Nasdaq 100 was down 13.5% from its peak.

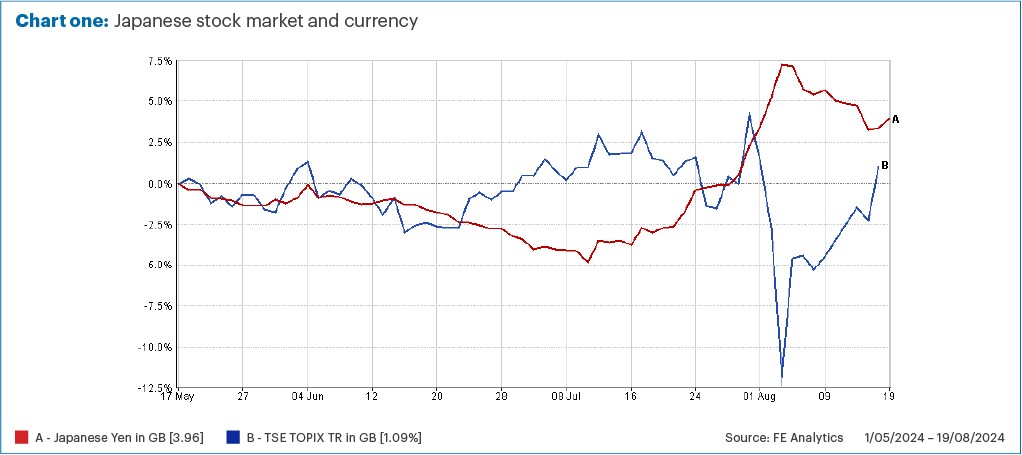

In Japan, things were more dramatic with the Topix (Tokyo Stock Price Index) briefly falling almost 25% from its peak. For UK-based investors, this was partly cushioned by a sharp rise in the value of the Yen at the same time, reducing the fall to around 15%.

Chart one shows the returns of the Japanese market and the currency over the past three months.

Chart one: Japanese stock market and currency (Source: FE Analytics)

The UK saw significantly less volatility compared to other markets, with the FTSE 100 Index dropping a little over 4% before rebounding. (Source for all market returns: FE Analytics).

For the most part, our portfolios held up well, with many of the “hedges” in the portfolio gaining, offsetting some of the falls in equities (more of which in a moment).

We have been warning for some time about a likely short-term market correction, however, we weren’t expecting something as short term as we’ve just seen, with sharp falls lasting just a couple of days followed by an almost as sharp rebound.

A mere technicality

This recent drop in markets was likely caused by a combination of issues.

A major factor was the Japanese central bank increasing interest rates above zero for the first time in many years. This was significant due to what’s called a “carry trade”. Essentially, over the past few years, many investors have been borrowing money in Japan at low rates and using this to invest in other regions.

The increase in Japanese interest rates came when markets were expecting other central banks to CUT interest rates. This led some investors to unwind their carry trades and bring money back to Japan, causing a sharp increase in the currency.

Japanese stocks tend to move in the opposite direction to the Yen, as exporters tend to benefit from a cheaper currency. A stronger currency, therefore, often means a weaker stock market.

At the same time, we saw some marginally weaker US economic data, which made some investors worried there could be a recession around the corner and increase bets on interest rate cuts.

Finally, it also emerged that Warren Buffett’s Berkshire Hathaway group had sold down its large position in Apple, which at one point was close to 7% of the US market. All these concerns, combined with thin trading during the summer months, helped to cause the US market to sell off too.

We’d describe this as a “technical” event in markets rather than anything with longer-term implications. The fact that markets have regained most of the lost ground confirms this, in our opinion.

However, the reason we have been warning that markets could be due a correction was because they are now relatively expensive, and we felt investors were too optimistic about future earnings growth.

The recent volatility does little to change our minds, and we still think it possible markets could take a further dip. In fact, we think investors may now be a little more jittery and could react strongly to any further bad economic news.

Hedging the risk

We always try to include plenty of diverse positions in portfolios, which should hopefully help cushion short-term losses on equities.

For example, we expect government bonds to do well when people are worried about the economy. This is because they are seen as ultra-secure, and interest rates tend to be cut when the economy takes a downturn. This makes the yield on the bonds look more attractive, and so the price tends to increase (given the inverse relationship between yields and prices).

The Bank of England has just cut interest rates, and investors are convinced that the US Federal Reserve will follow suit next month. As a result, government bonds have done well recently, which has particularly benefited our more cautious portfolios.

We have also tried to put other hedges in portfolios, including assets that are specifically designed to gain when stocks fall. We describe these as “portfolio insurance”.

Our portfolio insurance products produced strong gains as markets fell, which helped cushion equity losses. However, as you might expect, they have since given up much of these gains as equities have largely recovered.

Despite this, we feel this event demonstrates the value of such holdings. In a longer downturn, we would potentially see even stronger gains and would have the ability to switch out of such products and buy into stocks at relatively low levels.

In the recent volatility, we did do this to a small extent on our more adventurous portfolios, using the proceeds to top up Japan at the lows, as well as adding to some of our defined returns products.

Another point we’ve been making in portfolios is how attractive high-yield bonds looked relative to equities, as we felt they had at least as attractive potential returns but would be less volatile.

Again, over the past couple of weeks, this has worked well, and our high-yield bond holdings are now worth more than they were prior to the stock market fall, whilst equities remain slightly below where they were.

Whilst the recent dip in markets was short-lived, it has confirmed our slightly cautious view and given us confidence in the positioning of the portfolio.

Past performance is for illustrative purposes only and cannot be guaranteed to apply in the future.

This newsletter is intended as an information piece and does not constitute a solicitation of investment advice.

If you have any further questions, please don’t hesitate to contact us. If you’re a client, you can reach us on 0161 486 2250 or by getting in touch with your usual Equilibrium contact. If you are new to Equilibrium and would like to speak with one of our experts, contact us here or call us on 0161 383 3335 for a free, no-obligation initial chat.

Mike Deverell

Mike Deverell