A common issue that families seem to encounter is that they don’t discuss money, but this is often the key to unlocking the most value from your money.

One example that I am often reminded of involves two clients – a married couple in their 70s. The clients had always held the view that their children should ‘make it on their own’ and had only, at one point, provided funds to help with a flat purchase in London.

The problem with this outlook is, when you leave all your money to your children upon your death, you are actually just providing a lump sum on a random date with no opportunity to advise your child on how to spend these funds. Not to mention all the inheritance tax that would be due on a lump sum that could have been avoided had this money been gifted throughout their children’s lives.

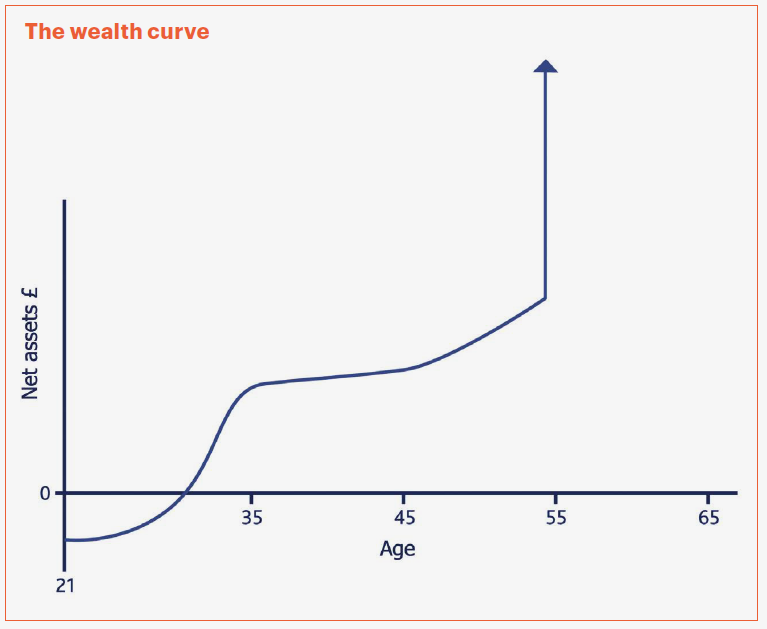

We call this “the wealth curve” as seen below.

This leads to one quite simple question: if you are uncomfortable gifting small amounts to your children whilst you’re still here to provide guidance and support, why would you leave everything to them on your death, when you have no influence at all?

After engaging with the clients in question and explaining this to them, they began to understand the benefit of flattening the wealth curve and decided to involve their children with their financial planning. We sent out a questionnaire to the children in order to gauge their hopes and dreams to identify which areas the parents could potentially help in.

Both children were in their 30s and recently married, and both wanted bigger properties so that they could begin planning to start a family. I joked that they had the room to make a baby, but not the room to store one!

As it turned out, our clients also desperately wanted grandchildren. So, we encouraged them to give full disclosure to the children on their income, expenditure, assets and inheritance tax position. Alongside this, we also encouraged them to explain how they had accumulated their wealth over the years – through one parent having a job with a good income and final salary pension and the other parent starting and selling a business.

We then held a family meeting, facilitated by Equilibrium, so that everyone could discuss the situation, the difficulties they each felt about gifting or receiving money and the emotions surrounding the topic. The result of this meeting was life enhancing for both the clients and their children.

The parents agreed to provide the funds for both children to move to bigger properties and hopefully start a family. Had they not provided this assistance and the children saved the funds by themselves, it is possible they could have been in their late 30s, early 40s (or potentially later) before they had the opportunity to start a family of their own.

Hopefully, they will now have children at least five years earlier, meaning our clients get an extra five precious years with their grandchildren.

Essentially, with just a simple discussion, the clients were able to use their wealth to help their children start a family, hopefully enjoy more time with their future grandchildren and save hundreds of thousands in inheritance tax as a result.

It really is incredible what a little open conversation can achieve.

Find out more

Our inheritance tax and intergenerational planning service is available as a standalone module for people who aren’t existing clients of Equilibrium.

This article is intended as an informative piece and should not be construed as advice.

If you have any further questions, please don’t hesitate to contact us. If you’re a client you can reach us on 0161 486 2250 or by getting in touch with your usual Equilibrium contact. For all new enquiries please call 0161 383 3335.