This article is taken from our autumn 2022 edition of Equinox. You can view the full version here.

You’ve just finished a wonderful day on the golf course, returned home from a trip of a lifetime, a weekend with your family or afternoon tea with some of your dearest friends.

How do you feel at that moment?

Comfortable, happy, healthy?

Having these same feelings plus confidence in the relationship we have with our finances is a significant contributor to our overall state of well-being, including our mental and physical health, and even our relationships.

Money doesn’t (always) buy happiness

To ensure that we can do it brilliantly, we are partnering with the Institute for Financial Wellbeing (IFW) as we become one of the first financial planning and wealth management businesses in the UK to place financial wellbeing at the centre of what we do. For us, it is a natural fit.

Financial wellbeing goes beyond money basics, it’s about understanding what brings joy to your life and how to use your money to do those things. Sound financial wellbeing means not just feeling secure in your future but also being able to make the choices that create enjoyment in the present. And it isn’t based on our income.

We experience financial wellbeing – or lack of it – regardless of our income.

Let us read that again. We experience financial wellbeing – or lack of it – regardless of our income.

In research carried out by Salary Finance (Backing your people through the cost-of-living squeeze – 2022), their findings confirmed there was little correlation between rates of pay and levels of financial worry, meaning that higher salaries don’t necessarily mean fewer money troubles.

Why?

Because we associate money with a huge amount of feelings, emotions, and beliefs.

This is something evidenced by the IFW, a leading not-for-profit organisation. The IFW helps those in the financial sector to improve their clients’ financial wellbeing by helping them become happier and more fulfilled, not just wealthier. And the Institute cites some universal truths around financial wellbeing.

One such universal truth is that money, in isolation, doesn’t make us happy. According to research, the value of accumulating wealth for its own sake is in direct contradiction with happiness. (Source: https://initiativeforfinancialwellbeing.org.uk/what-is-financial-wellbeing/)

Owning a level of assets which far exceeds yours and your family’s needs, even beyond your lifetimes, doesn’t necessarily mean that you feel a sense of contentment and are free from financial anxiety.

Selling a successful business may result in securing the financial future of your family, but the move from a lifetime of ‘working and earning’ to ‘early retirement and spending,’ may change the relationship you have with your money, bringing an unfamiliar sense of unease.

When markets change, it is not uncommon for those who dedicate time and energy to building the value of their assets, to worry about their portfolio. Thinking ‘this time is different’ and that the market will continue to fall, may well fuel anxiety – despite the hard facts and statistics evidencing otherwise. Source: This Time Is Different: Eight Centuries of Financial Folly – Carmen M. Reinhart and Kenneth S. Rogoff (2009)

Financial wellbeing – like any relationship – is different for everyone.

It is a highly personal state and not something that can be described or evaluated in objective financial measures. Good financial wellbeing is not linked to or measured by the value of assets or the performance of your portfolio. It is linked to our intrinsic motivations around money.

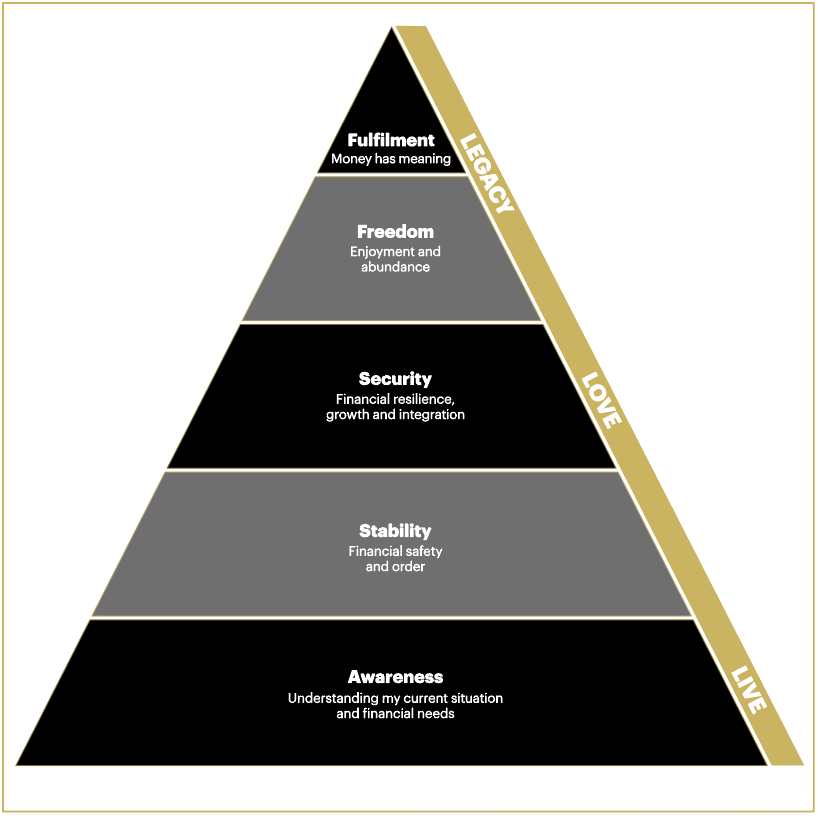

Only by taking the time to discover and articulate how we want our money to help us, are we able to build a meaningful financial plan, capable of supporting our wellbeing. How is our money helping us to live the life we want, look after those we love and leave a powerful legacy? These are just three elements that we already pose to clients to ensure that their financial objectives are built around what’s important to them.

As a business, our purpose is to ‘Make People’s Lives Better,’ and we see the ultimate outcome of that being to support and promote the financial wellbeing of our clients.

This remains our ambition.

The Equilibrium way to financial wellbeing, offers the opportunity for clients to reflect on their current level of wellbeing and to consider how, by working with our advisers and their financial planning process, they can plan their path to a state of fulfilment.

What value can we put on financial wellbeing?

The benefits of high levels of financial wellbeing reach beyond the individual. There is unmistakable evidence of the way it supports communities and the economy. A financially healthy nation means a country with better physical health. Employees who experience financial wellbeing are more productive at work. Over 500,000 private sector workers have had to take time off in the last year due to financial distress, leading to a loss of 4.2 million days of work, yielding a cost to employers of £626m each year. (Source : https://www.aegon.co.uk/content/dam/ukpaw/documents/financial-wellbeing-CEBR-condensed.pdf)

Of course, it is with our individual client’s that we can make the biggest difference and ultimately, make their life better. Welcome to financial wellbeing…The Equilibrium way.

If you have any further questions, please don’t hesitate to get in touch with us on 0161 383 3335 or by reaching out to your usual Equilibrium contact.