This article is taken from the spring 2025 edition of Equinox. You can view the full magazine here.

The Autumn Budget announced significant changes to pensions and inheritance tax (IHT) to increase government revenue. Starting April 2027, unused pension funds and death benefits will be subject to IHT. Steve Hitchiner from the Society of Pension Professionals acknowledged that pensions were not intended for estate planning, while the opposition argued it might deter retirement savings. This certainly complicates matters for retirees aiming to pass on their wealth as tax efficiently as possible. Here, Head of Delivery, Sam Patterson, explores the impact of these changes and how, by planning ahead, your financial plan can be adapted to ride the waves of change.

Meet Mr and Mrs Smith

Mr and Mrs Smith, aged 78 and 76 respectively, have been living the retirement they always dreamed of. After decades of hard work, they finally had the freedom to travel, enjoy their hobbies, and, most importantly, spend time with their growing family. Their days are filled with seeing their grandchildren, long lunches with old friends, safe in the knowledge they are supported financially due to their past hard work and current financial plan. Life, as they see it, is to be savoured.

Their careful planning had always included a clear financial strategy: live comfortably while preserving their pensions and home as a lasting legacy for their daughter, Ellie, and her children. The pension freedoms introduced in 2015 reassured them that their savings could be passed down without heavy tax burdens, offering their family a financial boost they themselves never had. It was a comforting thought – knowing that their hard-earned money wouldn’t just support their retirement, but would also create new opportunities for the next generation.

Their estate planning was relatively simple:

- £2m non-pension assets and £800,000 pension assets, meaning a total of £2.8m in assets.

- Non-pension assets are deemed taxable for inheritance tax purposes, while pension assets are considered outside of their estate.

- The first £1m of Mr and Mrs Smith’s taxable estate would be passed to the next generations free of inheritance tax.

- The remaining £1m would be subject to inheritance tax of 40%, meaning a total tax liability of £400,000.

- This would mean their daughter Ellie would receive a legacy of £2.4m.

That sense of security was shaken in October 2024. The headlines were alarming: from April 2027, pensions will be included in the estate for inheritance tax purposes. Mr and Mrs Smith, like many others, felt a disquieting sense of uncertainty. Their well-laid plans, built on assumptions that had seemed rock solid for nearly a decade, were now in doubt. Though they knew they were financially stable, the feeling of having the rules changed mid-game left them uneasy.

Where are we now?

We are still awaiting crucial clarity from the Government regarding pensions. A recent technical consultation, titled ‘Inheritance Tax on Pensions: Liability, Reporting and Payment’, closed on 22 January, with summary findings to be released this summer. The proposals outlined in this consultation suggest that the vast majority of pension funds paid out after death will now be included in the deceased member’s estate for inheritance tax purposes – unless the benefits are paid to a surviving spouse, civil partner, or charity.

This change means that Mr and Mrs Smith’s plan to use a pension as a tax-efficient legacy benefit once they pass away is no longer possible. The impact of these changes can be broken down into what we’re calling the ‘Pension Triple Dock’.

Now let’s look at how this change will impact Mr and Mrs Smith, considering they have £2m in non-pension assets and £800,000 in pension assets:

- £2.8m total estate (assets of £2m plus £800,000 pension) – £650,000 (two nil rate bands of £325,000) = £2.15m (net estate after nil rate bands).

- As their estate exceeds £2m (including pensions), they will lose their Residential Nil Rate Band (RNRB) – an allowance of £175,000 per person (£350,000 per couple). This is the first step of the triple dock caused by pensions being moved into the estate for inheritance tax purposes.

- The net estate of £2.15m x 40% inheritance tax = £860,000 inheritance tax due.

- The combined pensions of £800,000 represents 29% of their taxable estate and their non-pension assets represent the remaining 71%.

- The inheritance tax liability of £860,000 would be appropriately apportioned across pension and non-pension assets. This means £249,400 (£860,000 x 29%) would be payable from the pension and £610,600 (£860,000 x 71%) would be payable from non-pension assets. This is the second step of the triple dock.

- This results in the pension being worth £550,600 and non-pension assets being worth £1,389,400.

- Ellie, who earns a salary of £80k p.a. and is a higher-rate taxpayer, withdraws the remaining pension, which will be subject to income tax of £245,513 (£18,056 higher-rate income tax + £227,457 additional rate income tax), which is the final step of the triple dock.

- After tax, Ellie will receive pension assets of £305,087 in her pocket.

- The total net amount Ellie will receive from both pension and non-pension assets amounts to £1,694,487 (£1,389,400 + £305,087) – considerably less than £2.4million!

No wonder Mr and Mrs Smith, like many others in a similar situation, are feeling a sense of frustration.

What can we do?

The above is an illustration of what will happen post-April 2027 when the proposed changes in pension legislation would come into effect. This may seem doom and gloom, and by no means will I attempt to show the changes in pension legislation as a positive for individuals such as Mr and Mrs Smith. But there is an opportunity if we reassess the way we have treated pensions for the last decade. It can still be a tax-efficient benefit for the next generation, the only change is passing on assets before you pass away!

Let me explain:

- Mr and Mrs Smith each have a pension of £400,000. Currently, they are drawing £15,000 each from their respective pensions, which, in addition to State Pensions, meets their expenditure each year.

- Mr and Mrs Smith could commence an additional income of £12,500 from each of their pensions, with the intention of gifting this to their daughter Ellie (who is a higher-rate taxpayer). This additional income will be taxed at 20% (£2,500 income tax per person), meaning a net payment of £10,000 to Ellie.

- Income from pensions is also immediately outside of the estate if it’s gifted away on a regular and habitual basis, meaning collectively, Mr and Mrs Smith will move £25,000 from their estate for inheritance tax purposes each year, saving £10,000 in inheritance tax liability.

- Ellie wants to purchase a larger home in the future. Saving for this home is therefore taking priority for her, rather than saving for her retirement.

- Due to the £20,000 gift from her parents (after income tax), Ellie is able to immediately contribute this into her own personal pension. This £20,000 contribution receives automatic tax relief at the basic rate of 20%, making a total contribution of £25,000. As Ellie is a higher-rate taxpayer, she is also able to claim back an additional 20% tax relief of £5,000 through notifying HMRC.

- By making the pension contribution, Ellie is also eligible for Child Benefit (as her relevant income will be £55,000), and current Child Benefit rates are £25.60 per week for the first child and £16.95 per week for each additional child (tax year 2024/25).

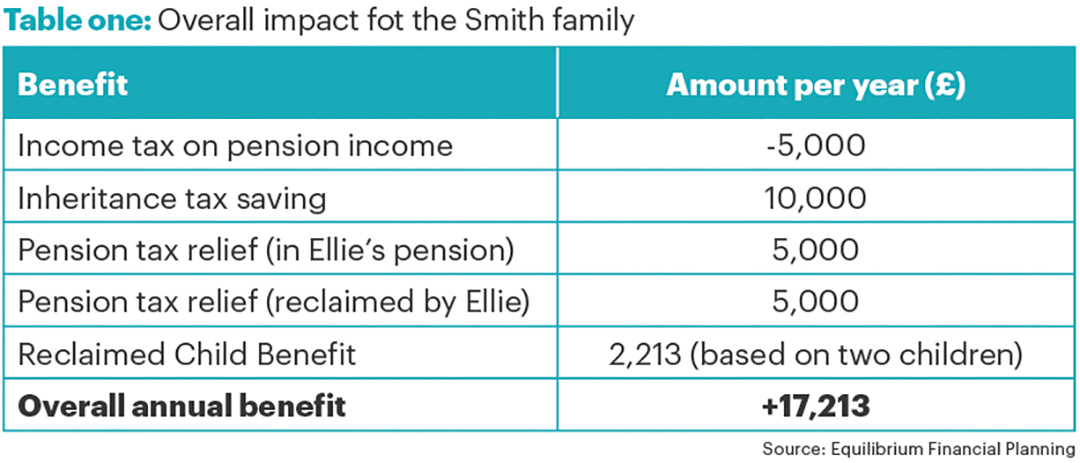

- The Smith family as a collective unit will be £17,213 better off each year (see Table one).

But what if things change again?

As mentioned, the proposed pension changes are scheduled to take effect from April 2027, but the financial planning profession is already pushing back. In January 2025, the CEOs of major pension providers, including AJ Bell, Quilter, Hargreaves Lansdown, and Interactive Investor, sent a joint letter to the Chancellor. Their message was clear: “There are better ways to achieve the stated policy aims”. The letter highlighted the complexities of the proposed system, warning of increased administrative burdens, additional costs, and potential delays in the already difficult process of probate.

At this stage, no one can predict whether the Chancellor will reconsider or soften these changes before they come into effect.

However, with implementation nearly two years away and growing resistance from financial experts, there is already speculation that adjustments may be made.

For now, the uncertainty lingers, and retirees like Mr and Mrs Smith are left wondering how best to adapt. They remain hopeful that their legacy plans can stay intact, but they know they must stay informed. As the landscape shifts, seeking professional advice will be crucial to securing their family’s future. One thing is for certain – change is coming, and preparation will be key.

This is where Equilibrium comes in as your trusted financial planner. We cut through the noise and the headlines, concentrating instead on what we know and how best to prepare. For now, the message is clear, change is coming to pensions in April 2027 but what exactly that entails remains to be seen.

Find out more

If you have any further questions, please don’t hesitate to contact us on 0161 486 2250 or by getting in touch with your usual Equilibrium contact.

If you’re new to Equilibrium, call 0161 383 3335 for a free, no-obligation chat or contact us here.

This article is intended as an informative piece and should not be construed as advice.

This case study reflects our understanding of the legal position as of March 2025. Tax law is complex, and HMRC may have different interpretations. Future legislative changes could also impact tax mitigation measures—legal position as of March 2025.