This article is taken from our spring 2021 edition of Equinox. You can view the full version here.

After all the costs of the pandemic, total UK government debt now amounts to around £2,198bn. With 67,886,000 people in the country, that’s £32,378 each, please.

Fortunately, there is no need to pay all this debt off in one go, but we do need to pay the interest on the loan and start to pay down some of the principal.

Whilst not at a critical level yet, Britain has become more dependent on “the kindness of strangers”. The country is increasingly reliant on funding from foreign investors, which offsets our high trade deficit (whereby we import more than we export) but which could cause us bigger problems if they no longer do so and debts spiral out of control.

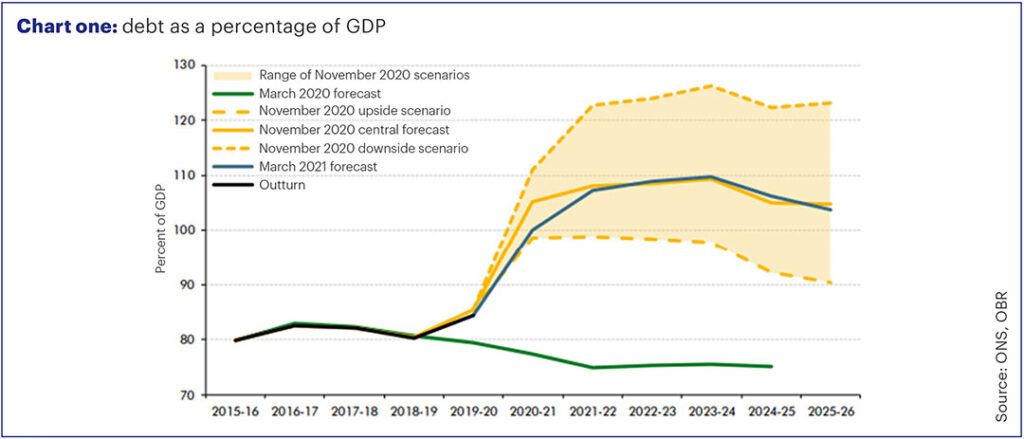

The problem is that the debt figure is now almost 100% of income and climbing; as a nation we have around £31,400 per capita of debt which is almost up to the level of the country’s annual income of around £32,400 per capita. As we know, the lockdowns have meant the UK’s income, measured by the Gross Domestic Product (GDP), has been hit hard and fell by 10% overall in 2020 – the largest annual fall since the Great Frost of 1709.

The good news is that ever since the Global Financial Crisis (GFC), interest rates have been falling in order to stimulate growth and so this is helping to reduce the interest on the debt. As a result, currently the UK’s government pays only 1.7% per annum in interest charges.

However, the story does not end there. The picture is worsening as debt continues to mount and income growth is reduced. As we can see in chart one, the Office for Budgetary Responsibility is expecting that over the next two years, debt as a percentage of income could rise to 110%.

Whilst interest rates could go to zero or even negative, at the current 0.5% in the UK (a 320-year low) the country cannot rely on continually falling costs of debt to offset the rising debt pile.

How do we get out of this predicament?

The Chancellor of the Exchequer, Rishi Sunak, has made it clear that public finances are on an “unsustainable” path, so how is the UK going to tackle this growing debt mountain? There are three key solutions:

- Reduce spending

- Raise taxes

- Print money

The first option is untenable. The UK adopted austerity following the GFC and is widely viewed as policy error rather than a solution to the country’s economic sluggish growth. Indeed, the Prime Minister has pledged not to go back to the austerity of 10 years ago, although last November’s Spending Review revealed that the government is planning to spend £14 – £17 billion less on public services each year after 2021 than was planned pre-COVID.

The second option of raising taxes is a racing certainty, although Mr Sunak’s options are limited now that he has committed to keep the election manifesto pledge not to increase the rates of income tax, National Insurance and value added tax – the “triple lock” as it is known. These three taxes alone account for 60% of total UK revenues.

Nonetheless, the government still needs to raise taxes and should grasp the opportunity to simplify the Byzantine UK tax system at the same time.

One of the obvious candidates is corporation tax on company profits. This rate was reduced from 28% in 2010 to 19% in 2017, but in the recent budget the Chancellor announced an increase to raise the rate significantly to 25% in 2023.

At present, the UK raises less from taxes on corporate income than the Organisation for Economic Co-operation and Development (OECD) average (2.6% of GDP compared to the OECD average of 3.1%) but this move will raise the UK figure above that average. However, the government needs to balance the need to raise tax revenue against the priority of making the UK an attractive place for business after Brexit.

Other areas of taxation that are being explored are changes to National Insurance for the self- employed, capital gains tax rises and, more controversially, a wealth tax, property taxes on homes to replace the council tax and stamp duty (all politically toxic) and green taxes on fuels.

Whilst the Chancellor’s key changes in the recent budget were to freeze income tax thresholds and raise corporation taxes, we would expect the Treasury to expand tax measures in the future.

Ways to go

OK, after all that nastiness about tax, what about the third option of printing money to get us out of this mess?

In the past, the government has issued bonds to pay down large debts, but at current yields they do not offer attractive returns to investors; if you buy the 10-year gilt today, for example, it pays only 0.45% yield per year.

When it comes to debt, the key difference between you and I and the government is the government owns a bank – the Bank of England – and it can create money by borrowing through the bank it owns (effectively printing money).

Since the GFC, it has done this by using its bank to buy the bonds that it has issued, in a programme called ‘quantitative easing’ (QE). The government issues bonds to raise money to spend in the economy and the Bank of England buys the bonds and receives the interest and principal on maturity – effectively, loans issued by the government that it owes itself. Simple.

In fact, it could be simpler. Why doesn’t the government just borrow the money directly from the Bank and bypass the issuing of bonds altogether? It’s a good point and in this emergency pandemic situation it is exactly what they are doing through a little-used account called ‘Ways and Means’. The Ways and Means originated back in 1694 when the Bank provided a loan

to the government to fund the Nine Years’ War with France but is now being used as a source of emergency government funding.

Both the Bank and the Treasury claim the Ways and Means account loans are a “temporary and short term” measure to support the economy through tough times. However, at £200bn and rising this “short-term” debt is likely to become longer term in nature as the economy struggles back onto its feet.

As long as the UK government does not overcook this position by going on a spending binge, it should be able to shoulder the additional debt without the danger of run-away deficits as we have seen before in several South American countries when investors took fright. Remember, all nations of the world are left with higher debt after the pandemic and so it is more important the UK does not do anything to relatively disadvantage itself.

Ultimately, some combination of this form of money creation, tax raising and the issuance of very long-term bonds, effectively spreading the burden over future generations, will be the primary ways in which these very large debts will be managed.

Disclaimer: The content contained in this blog represents represents the opinions of Equilibrium Investment Management LLP (EIM) and Equilibrium Financial Planning LLP (EFP). The commentary in no way constitutes a solicitation of investment advice. It should not be relied upon in making investment decisions and is intended solely for the entertainment of the viewer. Past performance is never a guide to future performance. Investments may (will) fall as well as rise and you may not get back your original investment.’