One of the key points from the Autumn Statement was the reduction in the annual Capital Gains Tax (CGT) exemption from £12,300 to £6,000 per individual from 6 April 2023. The exemption is due to be further reduced to £3,000 from 6 April 2024.

Tax-loss harvesting

Temporary declines in asset values, which happen somewhat regularly, can offer the potential to undertake tax planning.

This process is known as tax-loss harvesting, when investments are sold at a loss and then carried forward to offset against future gains, thereby reducing future tax bills.

Under current legislation, it is possible for CGT losses to be carried forward indefinitely to be offset against gains in future tax years. In order for losses to be allowable they must be registered with HMRC no more than four years after the tax year in which the losses relate.

It can be useful if, for example, an investor is thinking of selling a separate asset at a gain in the future, such as selling a rental property or holiday home in 2 years’ time. It has also become more of a relevant planning tool in light of the aforementioned changes.

Don’t let the tax tail wag the investment dog

You may be wondering what happens if you don’t actually want to sell the investment.

Unfortunately, simply selling it one day and repurchasing it the next is not a solution. Sadly, this is called bed and breakfasting and isn’t permitted.

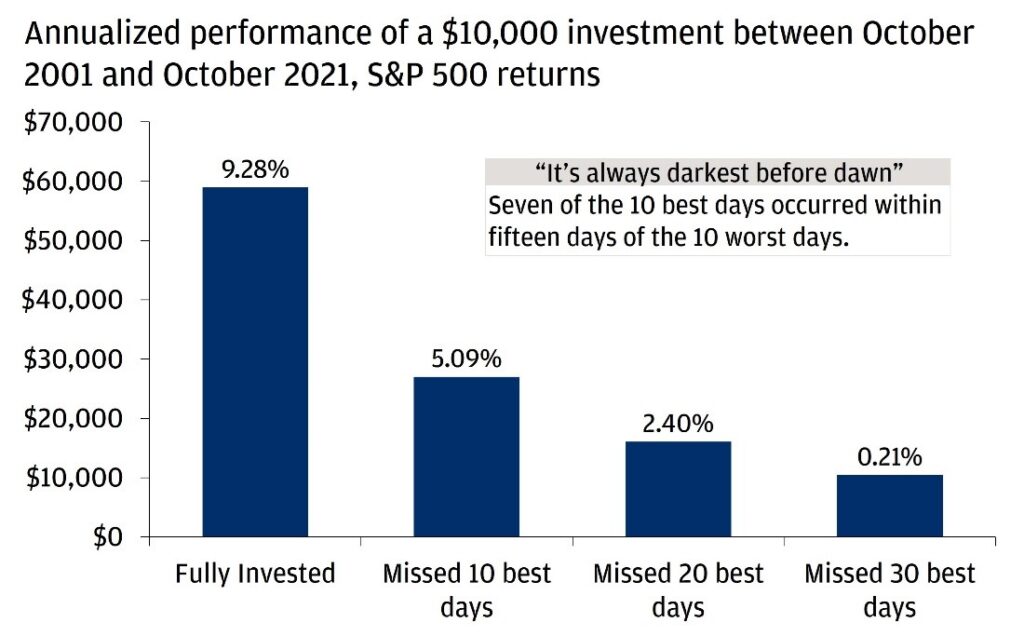

Instead, you must wait 30 days before you can repurchase the same asset. Whilst this might not seem a long time, a lot can happen if you are out of the market for 30 days. Take a look at the example below for instance:

Source – Source: J.P. Morgan Asset Management analysis using data from Morningstar Direct. Data is as of October 31, 2021. Analysis is based on the J.P. Morgan Guide to Retirement.

So, how do Equilibrium manage out-of-market risk?

We are holistic financial planners, meaning we review the whole picture when it comes to your finances, to ensure the tax tail doesn’t wag the investment dog.

In addition, we have our own in-house investment team who work alongside the financial planners to undertake tax planning whilst minimising out-of-market risk.

For example, if you are invested in the Equilibrium Balanced Portfolio, we can switch out of this fund and into the Equilibrium Cautious and Adventurous funds with a 70/30 split which replicates the same asset and risk profile as the Balanced fund. This reduces the impact of the time out of the market and ensures the overall risk profile of a portfolio is maintained. In the subsequent tax year, we can then switch out of the Cautious and Adventurous funds and back into the Balanced fund if appropriate.

If you have any further questions, please don’t hesitate to contact us. If you’re a client you can reach us on 0161 486 2250 or by getting in touch with your usual Equilibrium contact. For all new enquiries please call 0161 383 3335.

This blog is intended as an information piece and does not constitute a solicitation of investment advice.