Goldilocks and the stag

Last week, the Financial Times featured the headline, “The global rebound from the coronavirus recession appears in danger of stalling”. (FT, 11th October).

The recovery from the depths of the pandemic last March was sharp and significant, fuelled by the cash directly injected into the economy by governments and central banks. As we emerge from lockdowns and this support is withdrawn, there is a question mark over the sustainable rate of economic growth – can it return to the levels seen prior to the pandemic?

This question is even more important in this time of inflation.

As we know, several factors have come together to drive up the rate of change in prices in recent months. Much of this is to do with finely balanced supply chains that have been severely interrupted but also commodity and energy price rises due to the confluence of political and random factors such as low windspeeds for wind turbines, low rainfall for hydroelectric dams, and so on.

Our view is that the many of these issues are one-offs that will be resolved, that the random elements will revert to long term norms and therefore this is not a permanently higher level of inflation that we will all have to live with. That said, as forward-looking investors, we always look at different potential scenarios in our thinking and, in this case, we examine the risks of stagflation.

Stalking the stag

Stagflation is when an economy suffers from both high rates of inflation and weak economic growth. The term was originally coined by Conservative minister Iain Macleod in 1965, “We now have the worst of both worlds – not just inflation on the one side or stagnation on the other, but both of them together,” he said, “We have a sort of ‘stagflation’ situation.”

As well as the mid-1960s, stagflation happened again in 1973 when the OPEC oil embargo triggered the worst period of stagflation in both the UK and the US. The soaring price of fuel choked economic output and pushed up the cost of goods and services, causing high wage demands and spiralling inflation.

We are a long way away from the 11% inflation rates seen in 1975 but how would a milder bout of stagflation affect us?

For the average household, stagflation can be brutal. Rising prices means that spending becomes tighter and there is a need to try and push for higher wages, which becomes more difficult as anaemic economic growth weakens employees’ bargaining power.

In the asset markets, fixed-income bonds are most vulnerable as their real returns are eroded by high inflation whilst the prospect of greater supply rises as governments look to fund stimulus programmes to get the economy kickstarted again.

Equities are no safe haven either. Companies struggle to pass on the higher raw material and wage costs and as a result profit margins become squeezed whilst the weaker demand slows revenue growth.

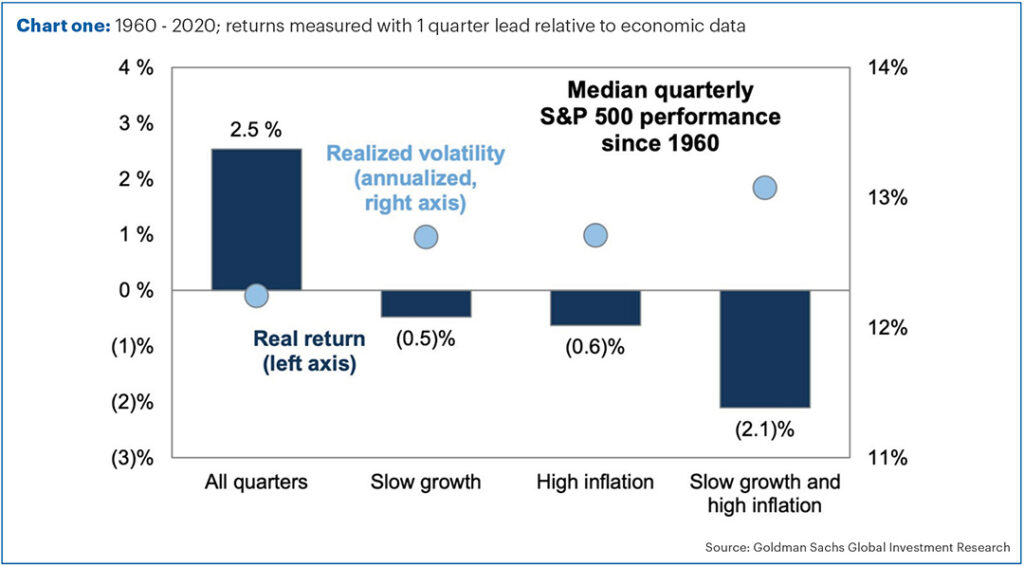

During times of mild inflation, companies can balance rising costs and even push through a little extra pricing to boost profits, but this becomes much harder as inflation picks up. Equities perform poorly during bouts of stagflation, and they become more volatile as uncertainty increases.

Chart one shows the returns for US equity investors in different economic environments showing that when inflation is high and growth is slow (far right bar), real returns are weakest and volatility (the blue dot) is highest.

So, what can be done to avoid stagflation?

This is a particularly tricky question for governments, largely because the source of much of the inflation is usually out of their control – energy prices and global commodities, for instance, are driven by global factors. Both governments and central banks would have a challenge in trying to stimulate growth without pushing up prices. Given their mandate to keep inflation at around 2%, in the normal course of things the Bank of England would raise interest rates to cool price rises but in these circumstances this would also act to snuff out what little growth there is.

Large-scale traditional fiscal or monetary stimulation will almost always push up prices and so become self-defeating and would not solve the underlying problems. In the UK today, for instance, lowering the interest rate or reducing income tax is not going to increase the number of HGV drivers or lower the international gas price.

Goldilocks vs bear

From our point of view, we think stagflation is unlikely.

Yes, there are supply bottlenecks and energy shortages are propelling prices up. Yes, these pressures are likely to be around for the next few quarters. But do we think this the beginning of an upward spiral of inflation and stalling growth? Not likely.

Unemployment is relatively low, household savings are generally good, capital investment is increasing and wages are rising that should support decent economic growth this year and next. As lockdowns unwind and supply systems get back on track, some of the ‘pinch’ points that have forced up prices should ease.

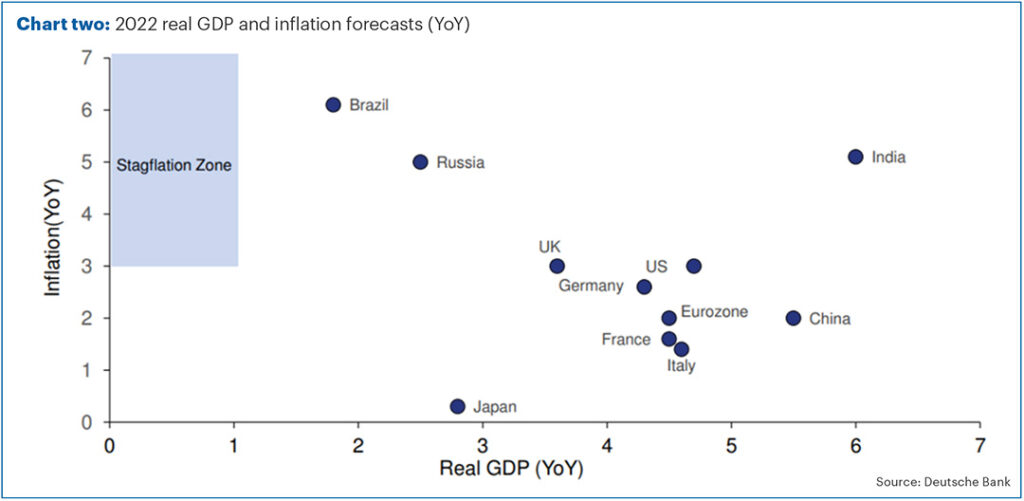

Our central case is therefore that growth and inflation will normalise to a Goldilocks not-too-hot and not-too-cold state. This accords with most forecasts in the market. In chart two, you can see UK growth expectations for next year (horizontal axis) are around 3.5%. Even with a forecast of 3% inflation, we are still some way away from the ‘stagflation zone’ where we see growth of less than 1%.

Source: Deutsche Bank

Source: Deutsche Bank

That said, we have some safeguards in our portfolios if we are wrong. In our equity funds, for instance, we have a strong bias to quality companies.

What this means in practice is that our portfolios hold many of the well-financed companies that have must-have or high demand products and services that confer pricing power, the ability to pass on the rise in costs onto their customers. Strong consumer brands (e.g., Coca Cola), pharmaceuticals companies and business-critical services (e.g., Microsoft) are the types of businesses that will be resilient in the event of stagflation.

Elsewhere in our portfolios we have ‘real assets’ that have incomes linked to inflation which allows them to pass through the price rises.

Good examples of this would be the toll roads and water companies held in our infrastructure funds whose regulators allow prices to rise by inflation. Similarly, the properties in our real estate property investment trust (REIT) portfolio, such as supermarkets and care homes have leases with inflation-linked rents.

Overall, the different scenarios that may play out over the next year or so vary from the upbeat, high growth emergence from the pandemic gloom (which would see strong stock markets); a Goldilocks environment of more modest but decent growth, and with the gloomy scenario of stagflation being – hopefully – a much less likely outcome.