In this month’s newsletter, Investment Manager Mike Deverell examines the economic recovery from the pandemic.

Feeling peaky

Right now, we are probably somewhere near the peak of the economic recovery from the pandemic. In terms of the actual level of GDP, there is still some way to go with the UK economy still 3.1% smaller than pre-COVID, and many services still to fully re-open.

However, in terms of the pace of this recovery, we’re probably already past the peak.

Lots of the indicators we consider important in the financial world measure the pace of change rather than the absolute levels. When we talk about GDP (gross domestic product) we generally talk about GDP growth; the change from one quarter or one year, to the next.

Inflation figures are always looking at prices compared to the previous year.

Given how depressed economies around the world were a year ago and how depressed prices were, it is not surprising to see high levels of growth in both these measures as we get closer to normality.

However, for them to increase at the same rate over the next 12 months would be pretty extraordinary, as we would be starting from a higher base. This is one reason why we think inflation is likely to moderate.

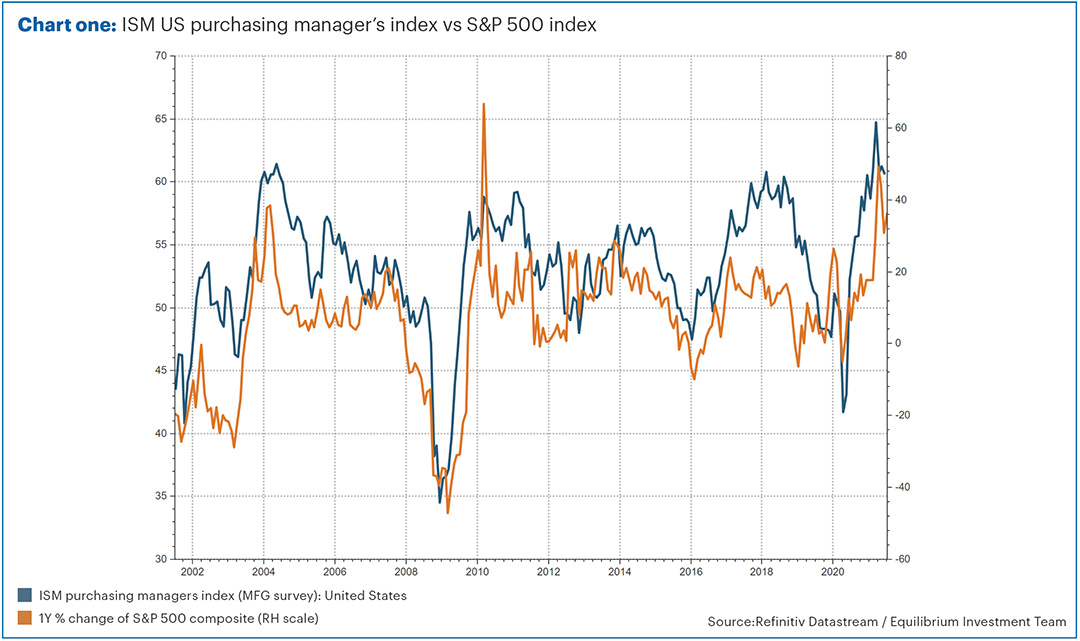

For markets however, the pace of change is pretty important. The blue line on chart one shows the ISM US purchasing manager’s index (PMI) on the left hand axis, going back for 20 years. On the right-hand axis is the year-on-year change of the S&P 500 index (orange line) over the same period. As you can see, the two lines tend to follow each other.

The PMI is a survey of businesses which is published monthly and generally gives a good indication of how much economic activity is going on. If the number is above 50, it means that more than half of the businesses are seeing growth, and generally that means the economy is growing.

Peak stimulus

Another area which is going to slow over the next year or so is the stimulus which has done so much to prop up the economy and markets.

The huge amounts of quantitative easing (QE) will likely be reduced towards the end of this year or early next.

Government spending is likely to be lower next year than this year, as they no longer need to support the economy so much. Fiscal stimulus will turn into “fiscal drag” whilst monetary stimulus will at least slow. Interest rates might even increase. This is another reason to be slightly cautious for certain parts of the market, in our view.

We still think it’s likely we’ll see some growth in stock markets over the next year or so, but wouldn’t be surprised if we experienced a short-term correction along the way,

Anomalies…

The focus on the pace of change in economic data from one year to another does sometimes have some strange effects. Lots of things are linked to measures like inflation, such as rail fares and student loan repayments. The short-term increase in these measures could therefore be painful for some.

We are particularly seeing some anomalies in wage inflation. Average wages fell by 1.5% over the 12 months to June 2020 and are now bouncing back strongly. Some firms are even finding it hard to hire enough staff.

As a result, wage growth is predicted to hit about 8% annual growth in the next month or so. Whilst we’d expect this measure to fall back again later, the short term “spike” potentially has a big implication for the state pension.

The so-called “triple lock” means that the state pension increases in line with the higher of wage inflation, price inflation, or 2.5%.

Because of wage deflation and very low price inflation in 2020, pensions went up by the minimum 2.5%. If they go up by 8% this year – meaning more than a 10% increase in two years – this seems pretty generous given the state of the economy and government finances! We therefore think it likely that the government may change the rules, at least for this year.

Freedom day at last! (sort of)

One area where the pace of growth is picking up again is unfortunately the number of COVID cases. The good news is that the vaccine rollout seems to have worked, as the increase in the number of deaths and people needing hospital treatment is growing much more slowly. As a result, the government has decided to press ahead with “freedom day” on 19 July.

This is, of course, good news from both an economic and personal perspective, but with a few caveats! Firstly, it is worth noting that until 16 August people will still have to isolate if they come into contact with someone with COVID. Many of us at Equilibrium have experienced this effect recently, either directly or through our children!

According to the Department of Health, we should expect COVID cases to hit 50,000 per day very soon, perhaps increasing to as many as 100,000 a day. A back-of-a-napkin calculation says that even the lower 50,000 cases a day works out as 1.5 million cases over a 30-day period.

If each of those come into close contact with four other people (the rough average), that could mean perhaps six million having to isolate between now and mid-August

This is important to consider from an economic point of view and illustrates perhaps why recent growth has been disappointing. Rather than expecting a “big bang” where everything suddenly gets back to normal, the change will be more gradual. As a result, perhaps we should expect a more drawn out and less sharp recovery.

The other caveat is around the new variant and the vaccines. Data from a recent study in Israel – who have been the world leader in terms of vaccine rollout – shows that two doses of the Pfizer vaccine is only 64% effective against symptomatic cases of the new variant; some double-jabbed people are still going to get sick.

However, the good news is that the vaccine appears to be 93% effective against serious illness and hospitalisation.

Nothing is ever simple where this virus is concerned, just as nothing is ever simple in markets! As usual, it is important to weigh up the risks and rewards and try not to be too reliant on any single outcome.

Factsheets

To see the long term strategic allocations for each of our funds, along with the latest monthly factsheets please click here.

These represent Equilibrium’s collective views and in no way constitutes a solicitation of investment advice. The value of your investments can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested. We usually recommend holding at least some funds in all asset classes at all times and adjusting weightings to reflect the above views. These are not personal recommendations, so please do not take action without speaking to your adviser.