Party like it’s 1999. Again!

As I write this, the FTSE 100 index is hovering around the 6,990 mark.

I entered the investment profession back in 1999 as a fresh-faced 22-year-old, in the midst of what we now call the “tech bubble”. I vividly recall the UK market being at a very similar level to today, and we were expecting it to break the 7,000 barrier at any moment.

In fact, the market peaked at 6,930 on the last day of 1999. In 2000, the bubble burst and the market fell sharply.

In the summer of 2007, the market again got close to 7,000. This time, we had a full-blown financial crisis which caused a deep sell off before this level could be reached. It took until March 2015 before the market finally broke through that psychological 7,000 barrier, nearly 16 years after I began my career.

A further six years later and it’s starting to feel like Groundhog Day. I’ve been working in investments for the best part of 22 years and the market is back where it was when I started.

On the face of it, you might think this has been a poor time for investors, but you’d be wrong!

UK investors quite often get hung up on what “points” level the FTSE is at. In points terms, the market has returned roughly zero since the start of the millennium. However, if you’d taken the dividends and reinvested them, you’d in fact be sitting on a 113% gain – still well ahead of inflation and cash in the bank.

If you’d, instead, invested globally and followed the MSCI World index, your total return would have been a much more impressive 255%.

If you’d decided to keep your money in the UK but instead you invested into the FTSE 250 index – the 250 largest companies outside of the top 100 – you’d be sitting on a very healthy 519% total return!

(Source: FE Analytics 31 Dec 1999 to 14 April 2021).

Old fashioned

There are very few of the leading technology companies – who have been big beneficiaries of the pandemic – listed in the UK. Instead, the FTSE is full of old industry and more cyclical areas such as oil and gas, basic materials and banks. These are areas which are extremely sensitive to the ups and downs of the economy.

However, many of those areas which have been hard hit by the downturn perhaps have more to gain from the recovery. The good news is that a recovery does indeed seem to be well underway, certainly judging from how busy shops and beer gardens have been in the last week!

This circumstantial evidence is also backed up by more hard data, with businesses expressing great optimism in the surveys, and other data like credit card spending increasing.

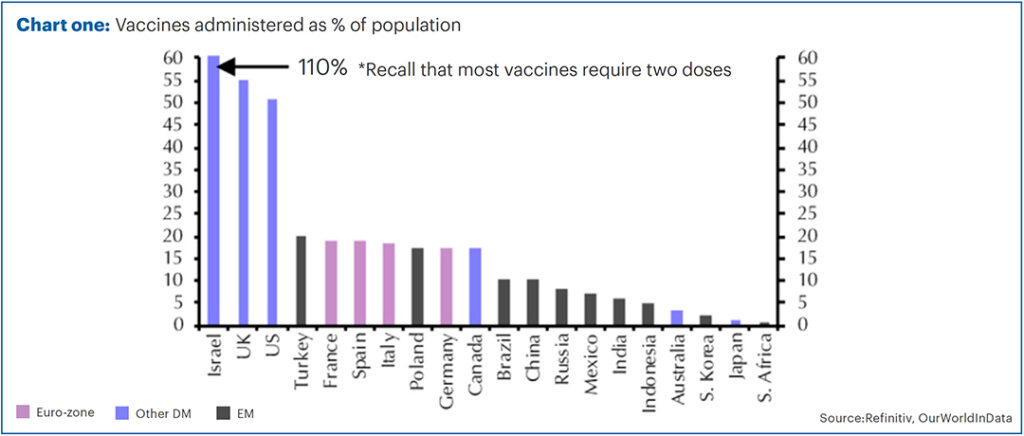

The UK has done particularly well in terms of its vaccine roll out as can be seen in chart one. In terms of % of population, only Israel has vaccinated more. Virus case numbers have dropped away sharply and so this certainly appears to be having an impact. This should be reflected in faster economic growth than those areas still struggling with the virus.

Given the likelihood of a UK economic recovery and the make-up of the market, should we now see a period of outperformance for the UK?

It is worth pointing out that much of the revenues of the top 100 companies come from overseas and so it is not just the UK we need to consider. However, from a global economic point of view, the fact that the US (the world’s largest economy) is also doing well at vaccination is another positive.

The UK market is also a bit cheaper than some other regions, albeit less cheap than it was. We therefore do think that we could see a positive period for UK stocks. The top 100 should hopefully do well, but we are even more optimistic about small and mid-sized stocks.

Smaller companies generally make more revenue from the UK and so are more exposed to the recovery here. That domestic exposure has also meant that many international investors have avoided this part of the market due to their concerns over Brexit. This makes them relatively cheap in our view.

So, we might not be partying like it’s 1999, but we remain optimistic that our UK based funds can do well.

Balancing act

We do need to be careful, of course. Whilst things are looking good, there is always the potential for setbacks.

We know that certain variants of COVID-19 are more resistant to vaccines. There have been a few instances of such variants being detected in the UK, and there have also been larger clusters in parts of France.

It is important that we keep a lid on the spread of the variants until such time as (hopefully) the vaccines can be tweaked to protect against them too.

As investors focus on a recovery, this has meant that some of the winners from the pandemic such as the technology stocks, have sold off a bit. These were looking pretty expensive in our view, and we felt they were due a correction, which is why we had slightly reduced exposure to the US market.

However, we will keep some exposure to such companies to give a balance to the portfolios, rather than moving wholly into “value” stocks. In the event of any economic setbacks, such stocks should hold up well.

It is the same argument in the bond market, where we have seen government bonds such as gilts sell off somewhat. As the economy recovers, so the chance of future interest rate hikes increases and therefore the yields have increased (and prices have fallen).

Again, having seen something of a sell off, bonds have become more attractive in relative terms. Whilst we’re still not particularly keen on government bonds, as the yields move higher such bonds give more of a potential cushion against any further economic setbacks.

(Written on 15 April 2021)

These represent Equilibrium’s collective views and in no way constitutes a solicitation of investment advice. The value of your investments can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested. We usually recommend holding at least some funds in all asset classes at all times and adjusting weightings to reflect the above views. These are not personal recommendations, so please do not take action without speaking to your adviser.

Factsheets

To see the long term strategic allocations for each of our funds, along with the latest monthly factsheets please click here.