Have you ever asked yourself…

These are just some of the many financial decisions which can be made easier with the right tools.

At Equilibrium, we believe a robust financial plan, bespoke to your circumstances, can empower you to make better financial decisions so you can:

- Live the life you want

- Look after those you love

- Leave a powerful legacy

In order to do this, we use cash flow modelling as a key element of our service which is essential to the work and advice we provide.

It applies a scientific approach to a subjective area of financial planning, providing a ‘road map’ that illustrates how likely you are to achieve your objectives, and what planning, if any, may be required to make these objectives more achievable.

What is a cash flow forecast?

Put simply, it’s a projection of your finances, showing money coming in and going out with a resulting cash balance.

It involves looking at your assets, investments, debts, income and expenditure. We then project these values forward over a set timeline using assumed rates of investment growth, inflation, and interest. It can be simple or complex but this will depend on your circumstances and objectives.

As such, a cash flow forecast is an interactive plan that accounts for all these factors and makes the future tangible by plotting the direction you wish to go.

How does it work?

The cash flow plan is a dynamic model that we review at least annually to see how its playing out in reality and as a means to check you are on track to meet your objectives.

Let’s take a closer look at the steps we take:

The first step is to collect the information about your monthly income, expenditure, savings and other assets.

Determine your future goals and financial requirements taking account of your desired lifestyle and retirement age.

Your financial planner will analyse your information, expected life events and future goals.

A projection of your finances enabling you to visualise how sustainable your standard of living is.

Your financial planner can model different scenarios and address any potential surplus or shortfall identified in the projection.

Create a financial plan based on your cash flow model to help achieve your objectives and minimise tax liabilities.

Cash flow forecasting is a way of showing how finances can change over an extended period of time accounting for probable life events.

Beware of GIGO

GIGO stands for ‘garbage in, garbage out’.

A cash flow model is only as good as the information that goes into it, therefore it is important to consider all your financial circumstances (positive and negative) and ensure these are kept updated with any changes to your circumstances.

In order to rely on the outputs for important decision making, it is essential the data which is added and the assumptions upon which the projections are based on are correct and realistic.

For many, seeing the financial future mapped out provides great peace of mind (see one of our testimonials here).

Firstly, it eliminates the initial ‘stuck’ feeling that comes with uncertainty. Knowing whether or not your current income and expenses are sustainable will allow you to make life-changing financial decisions with confidence. It will also shine a light on any current shortcomings, helping you to better prepare for the unexpected.

Focusing on the short-term alone makes it difficult to consider opportunities that stretch out into the future. When financial security is not guaranteed, decisions such as taking a year of annual leave, investing in property, going on a dream holiday or making gifts to your loved ones become even more challenging.

These complex situations require tailored solutions. Having a proper plan in place can provide greater clarity about your financial position, enabling you to make more informed decisions, and seize any unique opportunities available to you.

We use a cash flow modelling system called ‘Voyant’ which provides clear visual models of your financial future.

Below is an example of the type of visuals we can produce :

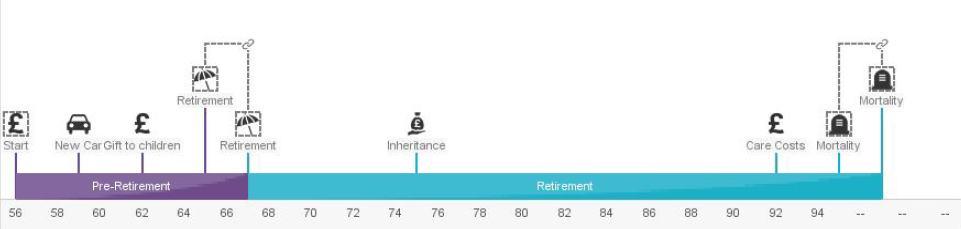

We start by building up a timeline, such as adding life events, a retirement age and/or any inheritances.

Source: Voyant

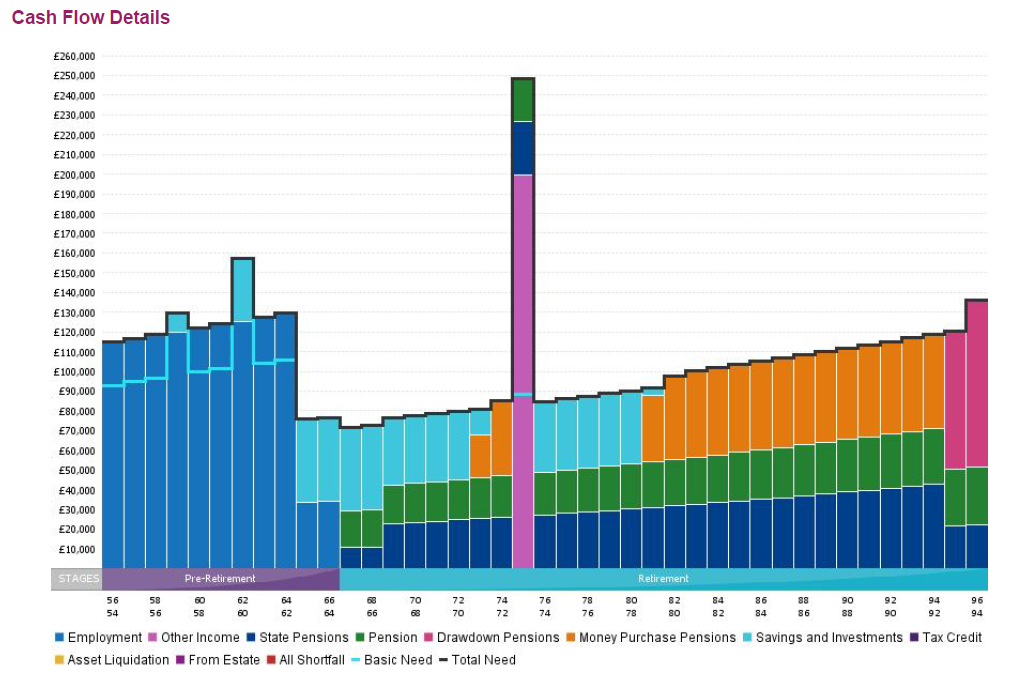

Once we have added all the monthly income, expenditure, savings and other assets, we can view in the form of a bar chart as shown below:

Source: Voyant

Forecasts, by definition, are based on estimates, as no-one knows for sure what the future will look like.

Assumptions like inflation and investment growth rates are uncertain which can and will change over time. Personal circumstances may also change and this can significantly alter the planning assumptions used.

Employing inaccurate assumptions may lead to a financial plan that is unrealistic and incapable to meet your desired goals and objectives.

There are no set rules about which assumptions to use however we are very prudent at setting our assumptions and these are regularly reviewed.

Inflation Rate Assumptions

Inflation affects both income and expenses. We believe a realistic inflation assumption over the long term is 1.5% per annum.

Investment Returns

To calculate the growth of your investments over time we need to apply an estimated rate of return, which is currently set at 4.5% per annum (after investment fees are taken). In other words, the assumed investment return is 3% per annum above inflation.

Returns vary across different asset classes and the underlying tax structure of the investment held. The assumptions used are based on a review of the likely long-term returns for each of the main asset classes that we invest in, and our research into the relationships between valuation metrics and returns over various periods.

They are by no means guaranteed and are based on the research we have undertaken for future returns over the next decade.

Life expectancy

People tend to underestimate their life expectancy and will often anchor on the age a parent or grandparent died. Life expectancy has been increasing over the past few decades and the average life expectancy is often higher than the age you may have in mind.

We based our life expectancy assumption on historical data provided by the Office for National Statistics. We tend to err on the side of caution therefore most of our plans are based on a mortality age of 95.

Tax rates and Allowances

The government has repeatedly shown that you cannot rely on things to stay the same, especially when dealing with tax rates and allowances.

Despite personal allowances and tax bands being frozen for some years, most assumptions allow for annual increases in line with inflation.

Tax rates are typically held at current rates for planning purposes, however these assumptions will be amended in accordance with any government tax rate changes.

Once the initial plan is built and forecast for the future, we go a step further by stress testing your plan for various ‘What if’ scenarios and identifying the potential consequences.

Examples of this could include a period of high inflation, the loss of a spouse or period of unemployment.

We look at how the decisions made today will affect short, medium and long-term wealth, as well as how circumstances out of our control can have an impact.

As a result, it can help answer questions like:

- Will I have enough income to achieve my desired retirement lifestyle if I give up work five years earlier?

- Will my expected retirement income sustain my required levels of spending over the longer term?

- Will my partner be able to cope financially if I were to pass away?

- How much can I expect to leave to my loved ones as an inheritance?

- What if my investments under-perform?

- How would taking a lump sum out of my pension at 55 affect future retirement income?

- Should I sell our investment property or keep the rental income coming in?

- What effect will downsizing the family home have in later life?

- Will we be able to afford a holiday home in later life?

- What if we want to spend £20,000 per annum on holidays from the age of 60 to the age of 70, what effect will this have on our assets?

- How much will I need if I want to make provisions for Long Term Care to be provided in our home?

We know there is no set script for life and that sometimes curveballs may come your way.

The cash flow model is not intended to be a work of art, but rather a work in progress. Its purpose is to guide rather than dictate financial decisions. If your circumstances change in any way, we will add this to your plan at the earliest opportunity to see what impact it has made.

A key point to note is that even seemingly small changes in circumstances or assumptions can result in a better path towards meeting your financial goals.