This article is taken from the spring 2025 edition of Equinox. You can view the full magazine here.

At Equilibrium, we strive to produce great multipurpose funds. We aim to combine a diverse mix of assets, from simple government bonds to high-octane private equity funds, into portfolios with a variety of risks and returns.

Of course, we cannot be all things to all people. We understand that different people have different perspectives and priorities. That is why, over time, we have put together a number of smaller, niche portfolios that tap into particular markets and themes.

Going viral

Back in 2020, during the initial stages of the Covid pandemic, all stock markets around the world fell sharply. However, something strange happened – the shares of some of the major technology companies were doing something different. In the first three months of that year, the US stock market fell 20%, but Amazon shares were up 5% and video conference company Zoom’s share price rose over 120%.(1)

This was a point of realisation for many as it became apparent why we needed online ordering, video conferencing and other technologies. Covid changed the way we lived and worked, but technology allowed us to maintain some semblance of continuity.

Clearly, something big was going on. Some of our clients recognised this and asked us to put together a portfolio of technology funds. They rightly saw this as not just a Covid-era phenomenon, but the start of a wider, deeper integration of technology into all our lives.

As a result, Equilibrium’s Technology Portfolio was created later that year.

The challenge for this portfolio was to offer a diverse mix of technology holdings because, yes, Microsoft and Apple are good companies, but who are tomorrow’s winners? As we know, video conferencing was hot back in 2020, and artificial intelligence is hot now… what’s next?

We took the deliberate decision to reduce the concentration in a few larger stocks in favour of a broader span of technologies, encompassing a wide range of rapidly developing areas. These include AI, quantum computing, robotics, gene editing, cybersecurity and so on. All these areas are growing rapidly, though we simply do not know which will be the next ‘hot thing’.

The problem with ‘hot’ investments is that they attract a lot of headline attention, but invariably by the time they become big, most of the large gains have already been made. For example, recently, a few clients have asked about a ‘defence’ portfolio, but we would point out that since the invasion of Ukraine in 2022, this sector has risen sharply, with some stocks up 300 – 500%.

Buying into technology when many stock markets were fearful of the impact of Covid made sense, but we do caution against chasing some assets after strong rises. We understand the interest in these headliners, but you can rarely escape the investment truism that the higher the valuation at which you buy an asset, the lower the returns you can expect from it.

Gilt-y pleasures

One asset that some clients occasionally ask about is gold. Gold prices have been influenced by various factors over time. In 1869, two investors cornered the market and drove prices up. During the 1960s, an agreement, known as the London Gold Pool, was made between the US and several European countries to stabilise the price of gold. From 2010 to 2018, several major banks were fined for manipulating gold prices for over a decade.

Recently, traders have been arbitraging price differences in the US and UK. Traders buy gold at a lower price in London and sell it at a higher price in New York, profiting from the gap. Further arbitrage opportunities have also arisen due to the expected US tariffs on gold imports. The process, however, is not without logistical challenges due to the US trading in 100oz gold bars whilst the UK trades 4000oz bars. This means the gold must be flown first from London to the refineries in Switzerland for resizing, before reaching the shores of New York!

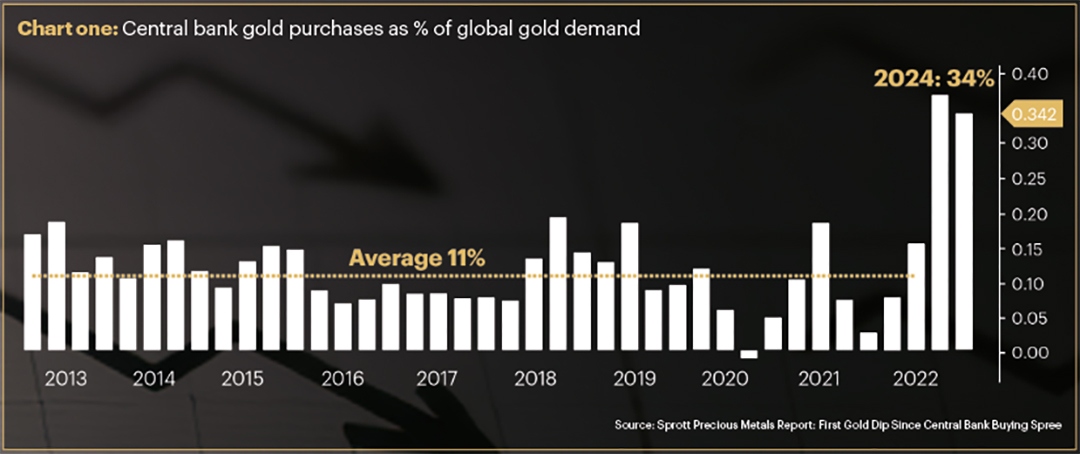

Lately, central banks have been large buyers of gold. In particular, demand ramped up in 2022 as banks, especially the Chinese central bank, built up their reserves following the Russian invasion of Ukraine, and many nations seized Russian assets held abroad. Chart one shows how central bank gold purchases changed in 2022 (the year of the invasion) and how this represented over a third of gold demand by the end of that year, three times the average in the previous decade.

On the day of the invasion, gold was $1,903 per troy oz*. Today, it is $2,900 – a rise of 52%.(2)

This is an impressive return, roughly the same as the return on the US stock market. The difference is that we know the valuation of the US stock market, which gives us a guide for buying or selling. Unfortunately, we have no insight into whether the Central Bank of China will buy more or sell any gold.

Nevertheless, gold can have some merit as a diversifier for an investor’s portfolio. We understand that clients may wish to hold such assets as part of their overall wealth, and if enough clients request this sort of portfolio, we can facilitate it – provided they recognise the associated risks.

Here to help

If you have any further investment questions, please don’t hesitate to get in touch with us on 0161 486 2250 or by reaching out to your usual Equilibrium contact.

New to Equilibrium? Call 0161 383 3335 for a free, no-obligation chat or contact us here.

This article is intended as an information piece and does not constitute investment advice.

Sources

- (1) Refinitiv

- (2) Refinitiv, as of 17 February 2025

*unit of measure used for weighing precious metals like gold, silver and platinum.

Neal Foundly

Neal Foundly