At Equilibrium, we want to help our clients look after those they love. Quite often this will have to involve conversations around money with family members other than our spouse or partner: such as children, grandchildren or even parents.

Unfortunately, talking about money with family can be really challenging (and that’s from someone whose career is based on talking to people about money!). In fact, research by Lloyds Bank found that 50% of Brits felt talking about money matters is a taboo subject; more so than sex, religion, and politics.(1)

However, the old adage, “every problem exists in the absence of a good conversation”, still rings true and in order to get the best outcomes – particularly across multiple generations – requires us all to have some courageous conversations.

The reason for this is that great planning always starts, not with the products, but with the people involved. It’s not about logic, tax or technical solutions, but rather the goals, desires, fears and concerns that we want to achieve or overcome for us and our families.

Unfortunately, doing this brings into the equation not only our own values and beliefs but those of our loved ones.

And herein lies the challenge. We are all the product of our own experiences. These experiences come from two key areas:

- The world we live in.

- The people we share that world with.

The experiences you’ve had throughout your lifetime, and the people you’ve shared your world with, will undoubtedly be different to that of your parents, your children or any other loved one. And with different experiences come different values, attitudes and beliefs.

When values, attitudes and beliefs differ, that’s where conflict can arise. Conflict doesn’t have to mean a full- blown, red-in-the-face shouting match – just a collision of values that stand in the way of solving a problem. In fact, more often than not, the end result of this conflict is inertia – you do the minimum and die with a big tax bill leaving your family with a large sum of money on a random date in the future.

By facilitating a “courageous conversation” across generations, we can get a better understanding of the barriers that stand in the way of our money having the biggest impact on those we love both now and in the future.

Taking a tip from Tinseltown

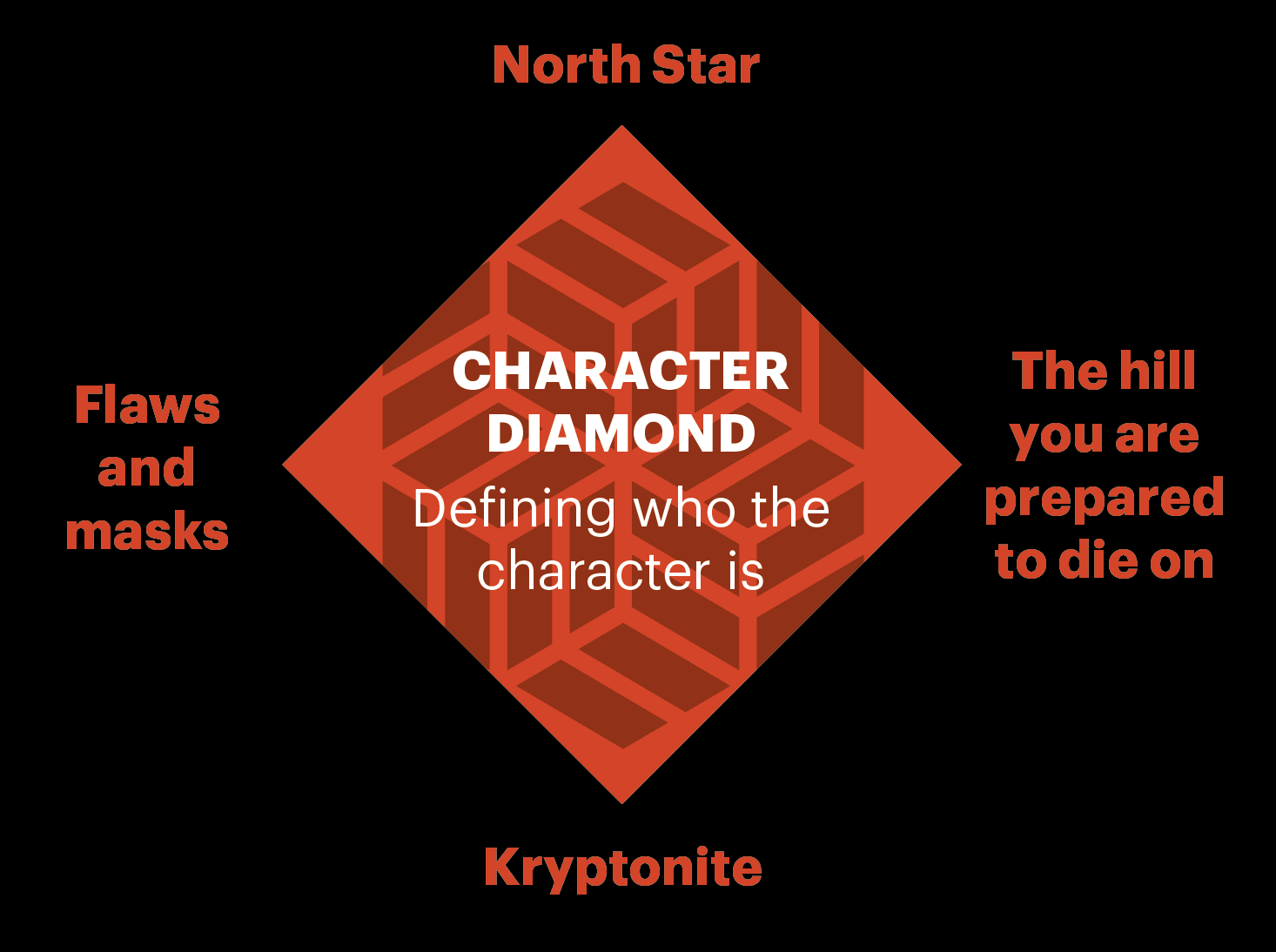

We use a variety of tools to help families identify conflicts – one of which is appropriated from Hollywood. It’s called the Character Diamond.(2)

It’s made up of 4 parts which are used by scriptwriters to define the key qualities of a main character.

- North Star – your superpower, the thing that makes you different and makes you, ‘you’.

- Flaws and masks – how you cover up your insecurities and vulnerabilities.

- The hill you are prepared to die on – what you will always stand for, no matter what.

- Kryptonite – the opposite of your North Star – in other words, what gets in your way?

All of our experiences help to shape our own financial character and how we make decisions with our money. We can use the Character Diamond to help identify not only our own financial character but also those of our family members (as shown in the example below).

Seeing them side by side, you can start to see where conflicts could arise but also where there are similarities.

There is no right or wrong answer. By understanding your experiences and how they have helped shape both yours and your loved one’s financial characters, we can get a better understanding of where conflicts might arise and how best to overcome them.

This is just one of many examples where, by exploring the values you hold, you can create a plan not just for your life, but for many generations to come.

An illustrative example of a family’s character diamond:

| Mr & Mrs Smith | Son | |

|---|---|---|

| Age | 75 | 40 |

| Family | Two children - son & daughter | Married with a 3-year-old daughter |

| Work | Mr Smith worked for a pharma-company for 35 years | Son is an accountant - his career has somewhat plateaued |

| Formative experiences | 1970s inflation, early 1980s unemployment, 1980/90s bull market, 2008 financial crisis | 2008 financial crisis, Covid-19 & lockdowns, cost-of-living crisis |

| North Star | Enjoyed a good job and income, lived within means, measured in expenditure, seeks value for money | Enjoys a good job and income, spending money on experiences is more valuable than things, sharing money is important and gives to charities and family |

| Kryptonite | Missed out on some things, experienced discomfort | Unnecessary/ wasted expenditure, occasionally stretches finances too far |

| Hill you are prepared to die on | Their own financial security and being able to help their family | There's more to life than work |

| Flaws and masks | Wasted time and energy on getting value for money, worries about running out of money | Impulsive decisions, worries about running out of money |

This article is intended as an informative piece and should not be construed as advice.

If you have any further questions, please don’t hesitate to contact us. If you’re a client you can reach us on 0161 486 2250 or by getting in touch with your usual Equilibrium contact. For all new enquiries please call 0161 383 3335.

Sources

(2) The concept originates from Hollywood screenwriter and teacher, David Freeman.