Climate change is going to be one of the largest areas of public and private sector investment for at least the next 25 years.

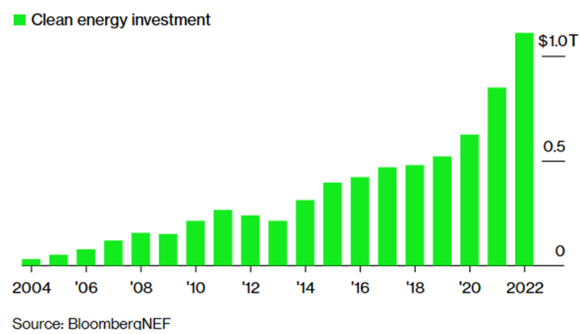

The reason we can say this is that the proverbial train has already left the station. According to a recent report by Bloomberg, global investment in the low-carbon energy transition has already reached a record $1.11 trillion in 2022 (see Chart one below), matching the level of investment in fossil fuels: –

Chart one

To put the numbers into some sort of perspective, the quantity of capital committed to decarbonisation by the global coalition of leading financial institutions (GFANZ)(1) is $130 trillion, which is….

- more than 50% of all financial assets worldwide, or

- six years of US GDP, or

- more than 300,000 times the capital needed to rebuild Ukraine (World Bank estimate)(2).

In other words, big. These investments encompass a massive array of infrastructure and technologies required to replace existing energy sources.

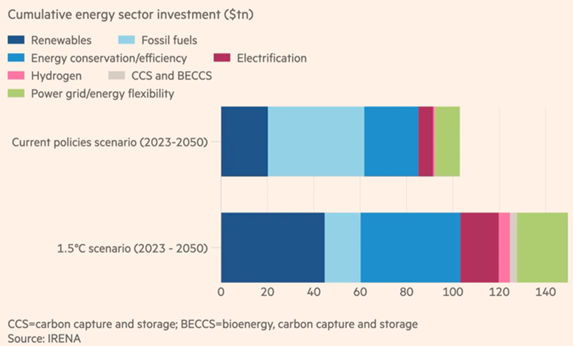

Chart two, below, gives a flavour of the investment mix required that encompasses not only renewables but energy efficiency programmes, energy source switching to hydrogen and the upgrading and extending of power grids: –

Chart two

Source: Financial Times, Opec takes the reins, April 4 2023

These are not just wish-list numbers. As well as the projects currently in development, just last year the US government committed a further $370bn for incentives for renewable energy in its Inflation Reduction Act (see related article below).

Even so, the size of the ambition is still dizzying. In the recent World Energy Transitions Outlook report by the International Renewable Energy Agency(3), they noted that although renewables accounted for 26% of global power generation in 2022, to achieve the 90% target by 2050, investment in renewable energy needs to rise from $0.3 trillion to $1 trillion per year and for energy efficiency measures, needs to rise from $0.3 trillion to $1.5 trillion per year. That’s a 5x increase in spending for every year over the next quarter of a century.

The good news is that these investments are making more economic sense.

Renewable power generation technologies today are typically the cheapest sources of new electricity generation. The global weighted-average cost of electricity of new solar power projects fell by 85% between 2010 and 2020, onshore wind by 56% and offshore wind by 48%. Indeed, all solar and wind technologies fall in the range of, or even undercut, the cost of electricity from new fossil-fuel plants.

Opportunities vary significantly by country. In the UK, for many years we had government subsidies that supported the roll-out of renewables such that they now comprise 62% of total energy capacity and subsidies were discontinued in 2017.

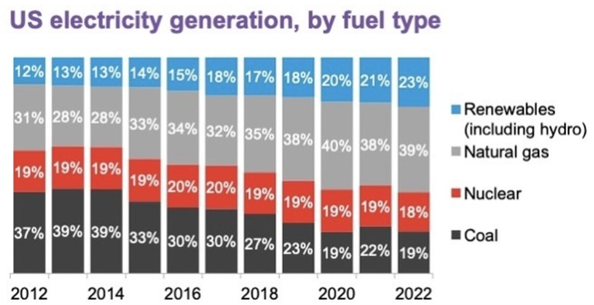

In the US, as can be seen in Chart three, below, renewables are only 23% of overall electricity capacity and government tax credits effectively subsidise the costs. That said, the US market is 12x the size of the UK power market and offers a wealth of opportunities for new investment.

If we go further afield to the continent of Africa, only 9% of energy is generated from renewables, most of that from hydropower, leaving plenty of scope for future growth (Note: all data from the World Economic Forum, Energy Transition Report).

Chart three

Source: World Economic Forum, Energy Transition Report, March 2023

The range of investment opportunities is also extremely wide. In Equilibrium’s portfolios, we have investments in operators of solar and wind farms which produce relatively stable and secure (due to long term contracts) income streams and dividends.

At the other end of the spectrum, there are the highly speculative ‘frontier’ companies that are trying to develop new green energy sources such as green hydrogen, biomass and even nuclear fusion. This paves the way for investors with very different risk appetites to participate.

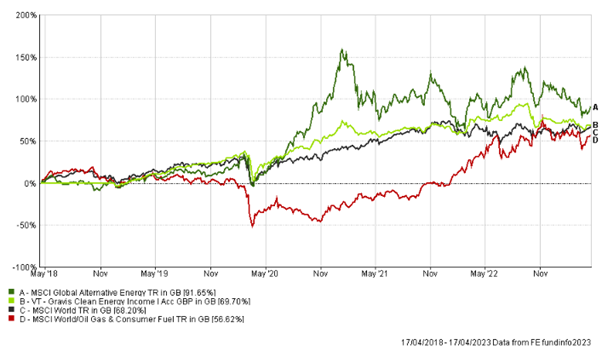

We can see this mix of opportunities in terms of share price performances.

In Chart four, below, you can see how in comparison to the wider global equity market (black line), over the last five years the fossil fuel stocks shown by the red line have generally underperformed whilst ‘alternative energy’ stocks (dark green line) have done better but are much more volatile and a fund held in our portfolios which holds more of the mature, income-producing renewable energy assets (light green line) has done less well but generally better than the broader market:-

Chart four

Source: FE Analytics

One very visible area of change is in electric vehicles (EV).

Despite concerns about ‘range anxiety’ and access to charging points, in 2022 EVs accounted for nearly 15% of global car sales, up from 5% just two years earlier. The International Energy Agency has recently reported that at the current rate of EV sales, by 2030 they will avoid the need for 5 million barrels of oil per day. Indeed, the report points to a peak in all transport fuels in 2025 and a decline thereafter.

This has important geopolitical implications too. As the Russian invasion of Ukraine highlighted, energy security has become a much higher priority for most nations and building out a domestic renewable energy infrastructure will be an important cornerstone to this policy.

With so much focus and attention on reducing carbon emissions to zero by 2050 and keeping to the global temperature rise of 1.5°C, it would be understandable to believe that the die has been cast and it’s ‘all in the price’. The reality is that this mammoth shift is subject to both growth spurts and delays and derailment.

In the UK, a recent Ernst & Young report showed that despite about 80% of UK large companies having plans to achieve net zero emissions by 2050, only 5% would comply with the framework set up by the UN COP26 climate summit.

Of course, companies and countries have every right to step up or reduce the pace of investment and transition. That said, the rate of velocity may change but the long-term direction has been set.

In the Equilibrium portfolios, we hold a fund specifically focused on energy transition assets, which has around 70% in wind and solar businesses and the rest in areas like energy storage, hydroelectric and biomass. Whilst this fund comprises only around 2% of the Balanced Fund portfolio, the span of investment directly or indirectly involved in this theme includes segments of our equity and infrastructure portfolios, as well as a holding in a sustainable forestry fund.

You do not need to be a dye-in-the-wool environmental activist to realise that this is an enduring, long-term theme and one we will be watching for investment opportunities as it evolves.

This blog is intended as an information piece and does not constitute a solicitation of investment advice.

Past performance is for illustrative purposes only and cannot be guaranteed to apply in the future.

If you have any further questions, please don’t hesitate to contact us. If you’re a client you can reach us on 0161 486 2250 or by getting in touch with your usual Equilibrium contact. For all new enquiries please call 0161 383 3335.

Sources:

(1) Glasgow Financial Alliance for Net Zero, Boston Consulting Group 2021, US Department of State and Bureau of Economic Analysis

(2) https://apnews.com/article/ukraine-russia-war-damage-world-bank

(3) World Energy Transitions Outlook 2022: 1.5°C Pathway (irena.org)

Article of interest:

What’s in the Inflation Reduction Act (IRA) of 2022 | McKinsey