The best time to address an inheritance tax liability (IHT) is now. The earlier you start planning to avoid inheritance tax, the better chance you have of eliminating it.

Unfortunately, inheritance tax planning and inertia go hand in hand. However, with the meteoric rise in house prices, more and more people are finding their available nil rate bands and allowances used up by their home – everything else they’ve worked so hard for and carefully safeguarded, is potentially subject to 40% inheritance tax.

I have worked with many clients over the years to minimise tax, reduce charges and increase returns to achieve their targets and ultimately their long-term goals. Quite often, these goals include passing as much wealth to the next generation as possible. By not addressing a potential inheritance tax liability now can be extremely costly.

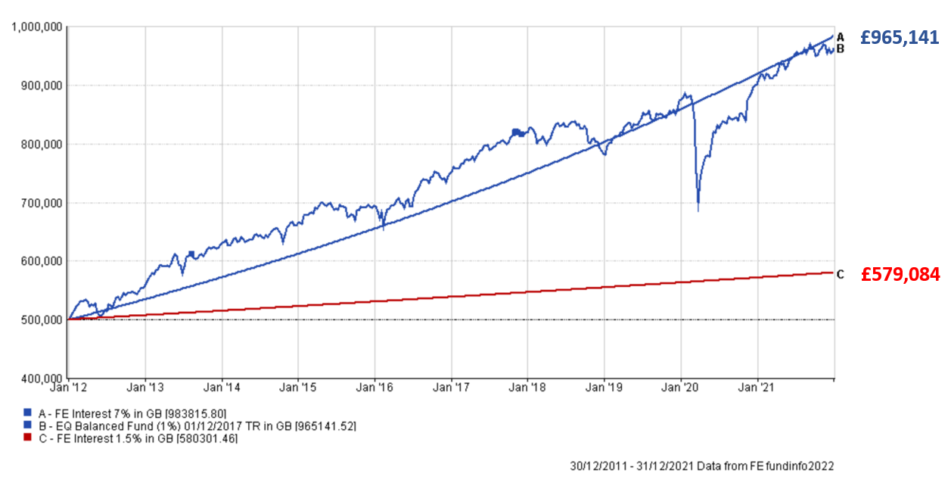

The chart below illustrates the impact of IHT on a portfolio of £500,000 invested into the Equilibrium Balanced Portfolio after fees and charges.

Over the last 10 years, the fund within the Equilibrium Balanced Portfolio (blue performance line) achieved an average annual return of just under 7%, turning £500,000 into £965,000 (blue indicator line). Then along comes the IHT sledgehammer and crushes the legacy to £579,000 (red indicator line) – which is the equivalent of a 1.5% return (over the same period) for the estate.

It must be heart-breaking to experience such a harsh blow, especially when your loved one has worked hard all their life to protect and grow their money. Often, beneficiaries cannot understand why their parents were so careful with money during their lifetime, yet so careless with it on death.

The good news is there are a wide range of planning options that can help avoid the inheritance tax sledgehammer and it doesn’t have to involve reducing accessibility to the pot itself. If you’d like to explore how you can minimise your potential inheritance tax liability, our friendly experts are here to help.

Alternatively, you may wish to book one of our upcoming Inheritance Tax & Intergenerational Planning seminars here.

Warning: Investment values can fall as well as rise, performance is not guaranteed.