In 1975, Labour under the stewardship of Harold Wilson, introduced Child Benefit and for the first time in history, all children were eligible for a payment to help them with their upbringing.

As with its predecessor, Family Allowance, it was not means tested but, in another groundbreaking move, it was to be paid directly to mothers and not fathers.

The world has moved on significantly over the last 50 years but to this day Child Benefit can be crucial to many families.

Back when it was first introduced, parents with a single child were entitled to a solitary £1 per week which if inflated using RPI to today’s value would only equate to £11.06.

Thankfully, the increase has been considerably above inflation and from April 2024 the benefit will amount to £25.60 per week. (1)

Whilst this cash is the lifeblood for many, especially during the cost-of-living crisis and high inflation for many families, for some higher earners who still qualify for the full Child Benefit payment (i.e. those earning less than £60,000 and therefore not subject to the high income Child Benefit tax charge), it is just absorbed into the general household cash flow giving no material ‘benefit’.

So, what if the money was ringfenced each month and put aside to give your child a real long-term benefit?

In a survey carried out by wealthify.co.uk in December 2021, 44% of parents plan on contributing between £10,000-30,000 towards the cost of a property for their children.

With the government also aware of this being a major expense, and offering incentives by way of lifetime ISAs, maybe this could be an option of how to use Child Benefit payments, but would it really make such a difference?

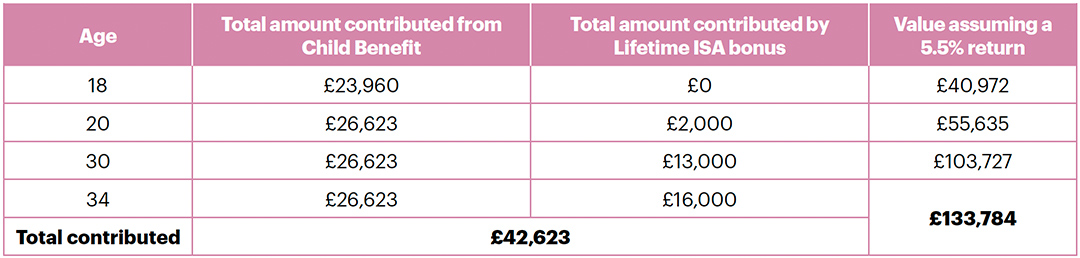

Let’s assume you invest the Child Benefit monthly (£110.93) from birth until they reach age 20 (the maximum timeframe a child will qualify for), into a fund made up of stocks and shares returning 5.5% per annum. This would be held in a designated general investment, which at 18 will revert to the child taking control of the investment. For simplicity, we’ve discounted inflation from all assumptions, and everything is based on today’s price. (2)

With the power of compounding, at the age of 18, the account is worth a staggering £40,972 for the £23,960 that has been invested.

At this point, the investment is now in the child’s name, but contributions carry on until they reach age 20. However, now they are 18 they can invest up to £4,000 into a lifetime ISA for which the government will top up by 25%! The only proviso to not be penalised is that it must be used for a first-time house purchase or as a pension. The figures are calculated based on the assumption that the capital gains tax (CGT) allowance remains at £3,000 per annum. Consequently, as the anticipated annual crystallised gain within the general investment account is not expected to exceed this threshold, it is unlikely that any CGT would be due.

The table below highlights that for total government contributions of £42,623, your child would have a fund of £133,784 at age 34 (the average age of a first-time buyer). (3)

Given the average property price in Cheshire, last year was £260,017 (4), this is a sizeable deposit of over 50%, which is definitely a benefit to your child!

We are here to help

If you would like to explore ways in which you could help your children, please contact us on 0161 486 2250 or by reaching out to your usual Equilibrium contact.

If you are new to Equilibrium and would like to speak with one of our experts, contact us here or call us on 0161 383 3335 for a free, no-obligation initial chat

This article is intended as an informative piece and should not be construed as advice.

Past performance is for illustrative purposes only and cannot be guaranteed to apply in the future. Investments will fall as well as rise.

Sources

(1) Equilibrium Investment Management

(2) www.gov.uk

(3) www.finder.com

(4) www.rightmove.co.uk