Financial Toolkit for Millennials: Investment 101

All investment comes with risk. Even holding cash in the bank has risk. This is because prices generally rise over time inflation and unless you are getting interest above that, your money is losing value.

As you seek out more return on your investments you will undoubtedly be taking on more risk. This is the risk-reward relationship and it appears in every investment. If someone is selling you an investment without risk, it’s probably a scam.

Understanding what risk you’re taking is the key to smart investing. This blog will hopefully explain some key concepts that can help you manage the risk you’re exposed to.

Diversification

Diversification can be summarised by the phrase; “don’t put all your eggs in one basket”. Essentially, it is spreading your money across a number of different investments. By doing so, you are less exposed to the risk of one particular investment wiping out your whole portfolio. Let’s look at the following example.

Both Sarah and Laura have £1,000. Sarah invests all her money into Company A whilst Laura splits her investment between Company A and Company B. Over the next 12 months, Company A loses a major supplier and their share price falls by 20%. Company B on the other hand sees its profits grow and the share price rises by 30%. We can see the impact below;

This is a very simple example but it demonstrates the concept. By splitting your money between different investments, you can reduce the impact each individual investment could have on your overall portfolio.

Diversification in Practice

Diversification goes a lot further than just buying more than one investment, For instance, if you take two US-based online retail companies and the US government decides to put a tax on online shopping, it doesn’t really matter which company you hold, they’re both likely to fall in value. However, if you held shares in a bio-tech company this would likely be largely unaffected. You can also diversify by investing in different countries, using the same example as above, a French based online retail company would not be subject to the same tax as the US companies.

You can also diversify into different asset classes; known as asset allocation. Consider the risks when investing in property – rental void periods, house price crash, interest rates rising, damage to the property. These particular risks are likely to be very different to those faced by a multinational company (although there can be overlap).

There are many tools to choose from when creating a portfolio and for those lacking time or interest, there are funds for nearly every asset class, style and allocation strategy. Regardless of where you invest, values will always go up and down but, it is about knowing how much risk you are potentially open to via your investments.

Investment 101 – Pound Cost Averaging

One of the biggest dilemmas faced by all investors is timing. Even for professional investors it is impossible to pick the very top and the very bottom and time markets perfectly.

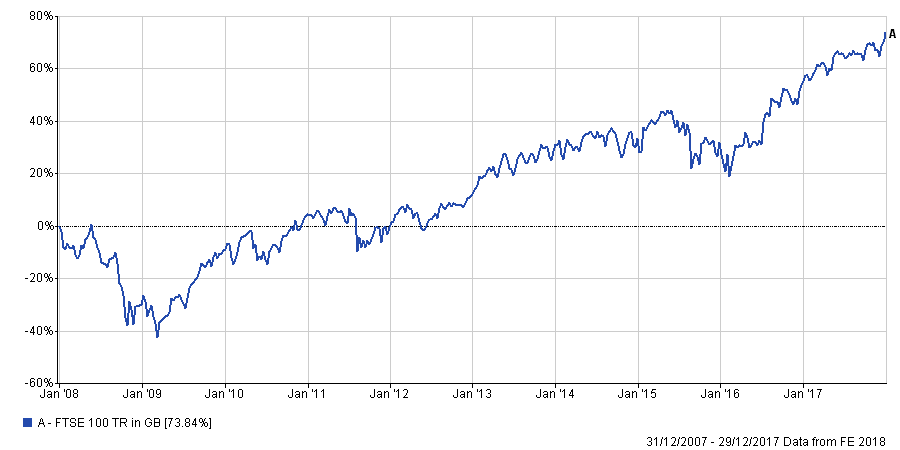

Looking at the Chart 1 which shows the FTSE 100 (an index of the largest 100 companies listed on the London Stock Exchange), you can see that investing is never a smooth journey.

Chart 1

The idea of Pound Cost Averaging is to make small investments on a regular basis. Chart 2 shows the same FTSE 100 index over the same period. The only difference is that this time you invest £200 at the beginning of each month.

Chart 2

By drip feeding money into investments it means that you buy more as it falls and the price is lower. You also buy less as the price rises so the cost at which you enter the market is averaged out over time. This helps limit your exposure to day to day volatility in markets. Ultimately, the biggest impact on your investments will be you and your behaviour and it takes discipline to find a strategy and stick to it.

Disclaimer: The information provided through the Equilibrium website is based on our opinion and is for general information purposes only. It is not, and should not, be construed as financial or investment advice. The value of your investments can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested