Equilibrium AIM portfolio update

What’s going on?

Conviviality PLC, a stock held in the EQ AIM Portfolio, has issued a major profits warning and uncovered liabilities very material to its value and the shares, which have already fallen by around three-quarters, may still fall further – they are currently suspended whilst they talk to their banks.

What is Conviviality?

The company comprises 3 main businesses involved in beverage wholesale and retail:-

- Conviviality Direct (66% of sales) is the largest distributor of drinks to the ‘on trade’, around 25,000 restaurants, pubs and cafes. The division is made up of 2 businesses, recently acquired Matthew Clark and Bibendum.

- Conviviality Retail (24% of sales) comprises the Bargain Booze, Select Convenience and Wine Rack retail chains with 713 stores in total.

- Conviviality Trading (10% of sales) which provides drinks and other merchandise for major events.

What has gone wrong?

The trouble started on 8 March when the management announced that profits for the current financial year, ending 31 March 2018, would be approximately 20% below expectations due to weaker trading conditions but also, more worryingly, a “material error in the financial forecasts”. This, they revealed two days ago, was due to an arithmetic error.

Even worse, they also announced that they owed Her Majesty’s Revenue and Customs £30m which is due payable also by the end of the month. The company at this stage had a market capitalisation of around £180m with around £120m of net debt.

The company is now working with the accountancy firm PwC to remediate the situation and they have cancelled the payment of the interim dividend, which will save around £8.4m.

What happens now for Conviviality?

The company has suspended trading in the shares and so investors are unable to buy or sell. Clearly, this is a major issue with regard to the management and governance of the company and we would expect to see change at the top-level management. In addition, the company may need to raise additional capital from a share issue to boost short term liquidity.

What impact has this had on the EQ AIM Portfolio performance?

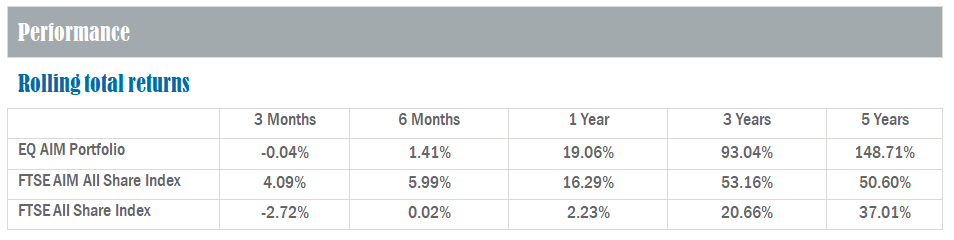

To close of business on 14 March, this is the performance of the Portfolio against the FTSE AIM Index:-

All performance statistics are on a total return basis from Financial Express Analytics with income reinvested. Data prior to March 2015 is calculated using a backtested model portfolio.

As it can be seen, the Portfolio has had weak performance against the AIM Index over the last 3 and 6 months although has outperformed the wider FTSE All Share Index. As a diversified portfolio of 30 stocks with regular rebalancing, the complete loss of any one stock should not hit capital by much more than 3.3%. Indeed, in the last month, the Portfolio has returned a positive return of 2.58% as compared to 3.28% for the AIM market and 0.16% for the FTSE All Share.

What is the Portfolio going to do with the shares?

The temptation would be just to sell the stock once it is un-suspended. We may well do so but it will depend on the prevailing share price. We keep an open mind because often there is a point of maximum bad news when it would be wrong just to sell a share because you don’t like it anymore. We will be looking to sell at the right value, not crystalise an unnecessarily large loss just to get it off the books.

Going forward, we will replace Conviviality in the model portfolio with a new company to maintain the 30 stock diversification. For existing Portfolio investors, we can review the situation as it develops, selling if it is appropriate, or revert to a 31 stock portfolio at the rebalance in early July with the holding kept until value returns.

Important information

All data is at 14 March 2018 and provided by Equilibrium Investment Management LLP unless otherwise stated. The views expressed herein should not be taken as statements of fact or relied upon when making investment decisions.

Past performance is never a guide to future performance. Investments may (will) fall as well as rise and you may not get back your original investment. Changes in currency exchange rates or interest rates may have an adverse effect on the value of your investments.

Performance is stated after a 1.5% Equilibrium charge and 0.30% platform charge. Please note that from 1 December 2017 all future performance will be stated after a 1.25% Equilibrium Asset Management fee and 0.25% plus VAT Equilibrium Investment Management fee. The platform charge will remain as 0.30%. The performance shown is based on the portfolio being held via Seven Investment Management (7IM). The figures include dividends that may not yet be credited to your account.

The Portfolio consists of stocks quoted on the Index that pay a dividend and that we believe qualify for Business Property Relief, although this cannot be guaranteed. This fact sheet should be read in conjunction with our Inheritance Tax Planning Using Business Property Relief fact sheet which sets out the key risks of investing in AIM stocks

.