EQ Weekly Roundup 13-3-19

This week’s roundup includes news of the upcoming vote by MPs on whether to block the UK from leaving the EU with no deal, an estimated third of students have gone without heating or running water and RBS are trialling biometric fingerprints.

This week’s roundup includes news of the upcoming vote by MPs on whether to block the UK from leaving the EU with no deal, an estimated third of students have gone without heating or running water and RBS are trialling biometric fingerprints.

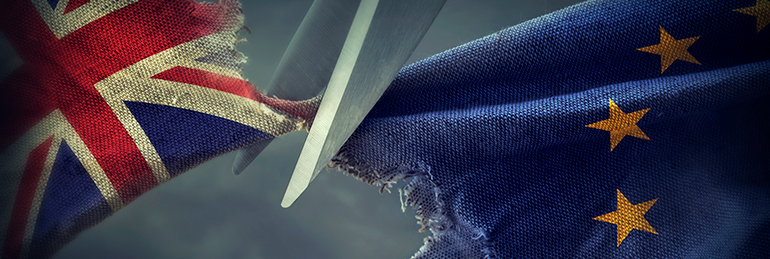

MPs to vote on blocking a no deal Brexit

Meanwhile the UK government has said it will cut tariffs on a range of imports from outside the EU and introduce measures to avoid a hard border in Northern Ireland in a no-deal scenario.

The EU said no deal plans were ‘more important than ever’ after the defeat.

On Wednesday morning the government announced that most imports into the UK would not attract a tariff in the event of a no-deal Brexit. Under a temporary scheme 87% of imports by value would be eligible for zero-tariff access – up from 80% at present.

Tariffs would be maintained to protect some industries, including agriculture.

The government also announced it will not introduce any new checks or controls or require customs declarations for any goods moving from across the border from Ireland to Northern Ireland if the UK leaves the EU without a deal.

The decision to drop all checks to avoid friction at the UK’s land border with the EU will be temporary while longer term solutions are negotiated.

One third of UK students have gone without heating or running water

The state of accommodation dominates the list of 10 biggest concerns among young tenants, the research by website Save the Student suggested.

The findings also suggested that typical upfront costs, including fees, the deposit and a month’s rent in advance, totalled £970.

Average rent stood at about £125 a week, of which parents contribute an average of £44. One in five students receive more than £100 a week from parents to help cover the cost.

Two in five turned to overdrafts, loans, and credit cards to pay the rental bill, Save the Student said.

RBS trials biometric fingerprint bank card

Those taking part in the trial will not need to use a PIN code to verify transactions of more than £30.

RBS said the technology was designed to increase security and make payments at tills easier.

The trial, involving 200 RBS and NatWest customers in the UK, is due to start in April and last three months.

The bank cards are fitted with a built-in sensor, which is powered by payment terminals.

When users place their fingerprint on the sensor, a comparison is performed between the scanned fingerprint and biometric data stored in the card.

RBS, which described it as ‘the biggest development in card technology in recent years’, is working on the project with digital security company Gemalto, as well as Visa and Mastercard.

The technology has been trialled previously in Cyprus and elsewhere, but it is thought this will be its first test in the UK.

Fourfold rise in Wonga compensation claim estimates

The total is four times the previous estimate, accountants Grant Thornton said, although many will expect little in terms of redress.

These customers have complained about being mis-sold loans they could not afford to repay.

The Treasury Committee of MPs has said their cases have been ‘cast aside’.

Wonga fell into administration in August last year, with thousands of customers awaiting ombudsman rulings on whether they were mis-sold loans.

The company’s demise in the UK followed a surge in compensation claims from claims management companies acting on behalf of people who felt they should never have been given these loans.