Be fearful when others are greedy, and greedy when others are fearful

This article is taken from our spring edition of Equinox. You can view the full version here.

“Be fearful when others are greedy, and greedy when others are fearful”

This quote from the great investor Warren Buffett is one we’ve used in client presentations for many years. We feel it sums up our investment approach pretty well!

Stock markets can be very volatile, as anyone who’s been invested over the past couple of years can vouch for! So, how do you deal with volatility? How do you turn it from something we simply need to suffer into an opportunity?

All our portfolios hold a mixture of different asset classes including equities (shares in companies), fixed interest securities (corporate and government bonds), property, infrastructure and various other so- called ‘alternative’ assets.

The aims of our portfolios are to provide a real return above inflation of (typically) 4% to 5% pa over the long term. We look at long-term historic data for returns, risk and the correlations between each of the asset classes. We use all this data to work out what we think is the optimal mix of assets for each level of target return, giving us the best chance to achieve the goal at the lowest realistic level of risk.

Having designed our long-term framework, we then make shorter term adjustments to it. When stock markets begin to look expensive (when others are greedy) we will hold less in equity than usual (being fearful).

Like everybody else, we unfortunately have no crystal ball and can never tell you whether the market will go up or down over a particular period. However, we can make judgements based on value and risk.

At other times, when markets look cheaper (and investors are fearful) we will hold more equity than usual.

This means, when markets are falling, we tend to be buying on the way down, and, when they’re rising, we tend to be selling on the way up. Over the long term, we believe this enhances returns but, unfortunately, sometimes it can hurt in the short term!

The past few years

The past few years have posed a challenge for investors, as well as presenting us with opportunities.

Here in the UK we have had a great deal of uncertainty caused by Brexit. Globally, the trade war between the US and China has also had a big impact. Economic growth in the UK virtually ground to a halt towards the end of 2019, and all around the world we saw signs of a slowdown.

However, in the weeks before and after Christmas we got more clarity on these issues, with the UK election result and with a trade deal between the US and China. Businesses in the UK geared up to start investing again after two years of holding back, whilst the government promised big infrastructure spending. Global economic data and business surveys all started to pick up, particularly in emerging markets, making us optimistic about 2020.

Then, COVID-19 changed everything.

With a situation like a global pandemic, anything I write about it will be out of date in a few hours and may be totally irrelevant in a month.

Leaving aside the human cost of the pandemic, we know it is going to cause an economic downturn and this will in turn affect investments of all shapes and sizes. What we don’t know at this stage is how steep or how long this downturn will be.

What we do know is that at some point this will all be over and we will see a recovery. There is then a very good chance that in the first few months of that recovery we could see quite a sharp increase in economic activity, as companies and individuals spend the money they had held back.

What is important is that governments and central banks use every weapon in their arsenal to support companies to stay solvent through this temporary downturn. If they can do this successfully and support jobs, as well as helping individuals in other financial ways, then the bounce back could be sharp.

Bear with us…

Recessions happen from time to time and so do bear markets. They are a simple fact of the capitalist system and something long term investors have to navigate their way through. They are never fun!

It is important to remember that downturns create winners as well as losers. For example, one company may gain market share as a competitor goes out of business.

Whatever the cause of an economic downturn, the same investment principles still apply. We can’t predict the future but if we get the opportunity to buy something that we think looks good value taking a five-year view, at a much cheaper price, then we will continue to buy on dips.

However, it is important to note that a recession caused by a pandemic may mean some of the normal “rules” might not apply.

For instance, there are certain stocks which tend to be more ‘defensive’ in a normal downturn. One example is alcoholic drinks manufacturers, as even when people lose their jobs one of the last luxuries they give up is their booze!

Even so, if people are worried about their health or even in quarantine, then perhaps they won’t be buying so much alcohol? Unlike some other spending, people are unlikely to buy twice as much booze when things are back to normal to make up for lost time!

However, we might want to buy a movie on Sky, upgrade our package or play more online video games

if we’re stuck at home, so perhaps these companies might do ok?

Because this is not a normal downturn, we also need to be careful about correlations between asset classes.

One of the reasons the financial crisis was so bad for investors was not just that stock markets dropped sharply, but that virtually everything else lost money too.

Corporate bonds and property funds, which are usually lowly correlated to stocks, fell almost as sharply as equities in some cases.

This means we need to be doubly careful when determining the mix of assets in our portfolios.

Remember that they are designed partly based on historic correlations. We need to make sure that if asset classes become more correlated as we saw in 2008, that portfolios don’t become more vulnerable than usual.

What if this is another 2008?

What if the worst came to the worst and the economic hit was similar to 2008?

As we said earlier, we think this is unlikely as policymakers and central bankers will have learnt lessons from that crisis.

Nevertheless, as always, we need to ask ourselves “what happens if we’re wrong?”

Firstly, it is important to note that whilst our portfolios fell sharply during the credit crunch, they also recovered relatively quickly.

Our long-term average target return of 4% to 5% pa above inflation is based on our expectation for the average five-year period. This works out as in the region of 6% to 7% pa in nominal (not inflation adjusted) terms.

However, we don’t expect to achieve this return in every single five-year period. Some will be better than others, some worse than others. What we hope to do is to not lose clients’ money over even the worst five years.

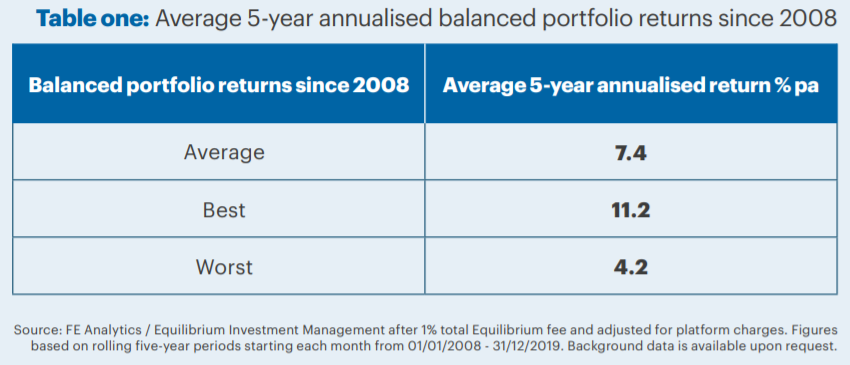

We have long-term performance data on our portfolios going back to 2008 and we have analysed every single five-year period in our data, and that’s over 140 five-year data sets which include the credit crunch, the Eurozone crisis and Brexit. Table one below summarises these results.

The average return has been in line with expectations and we have seen some five-year periods with much better returns.

Some periods have been lower than target, but the worst return we’ve seen so far over a five-year period is an average of 4.2% pa, which is what we saw during the five years beginning in 2008. Even though 2008 was painful, returns were still ahead of inflation when taken as part of a longer-term view.

The other concern people have in a downturn is whether their money is safe? Whilst some of the assets we buy MAY be worth less, at least temporarily, they will still exist.

In our equity portfolios we have exposure to thousands of different companies. It is highly unlikely that they will all go bust.

Our corporate bonds are often secured on a company’s assets and so even if there are large scale defaults, we should recover a large proportion of those loans.

We also hold funds which invest in physical assets like property and infrastructure (toll roads, power generation, railways etc). They will still exist.

Likewise, our investments are held in a secure way. Ultimately, the money that investors put into the IFSL Equilibrium funds is held by its custodian, HSBC Global Investors. It is ring fenced money held completely separately from Equilibrium’s own assets, and those of HSBC bank. Similar procedures apply with the platforms we use, such as Nucleus, Transact or Seven Investment Management.

We have plenty of experience of investing through downturns. Our investment team have collectively experienced the credit crisis, the European debt crisis, the bursting of the tech bubble in the early 2000s, and even Black Monday of 1987 (for one of us anyway!).

Our approach has seen us safely navigate such crises and we will continue to navigate our way through future ones in a similar fashion.

Past performance is never a guide to future performance. Investments will fall as well as rise. Any performance targets shown are, what we believe, realistic long-term returns. They are never guaranteed. The information contained in this publication is based on the opinions of Equilibrium companies and does not constitute advice. Please contact your adviser before taking any actions.