This article is taken from our autumn 2019 edition of Equinox. You can view the full version here.

Our purpose as a business is ‘to make people’s lives better’, and whilst that might seem like a grand goal for a wealth management business, it’s one that we take very seriously.

Essentially, we want to provide our clients with confidence and clarity around their finances, so that they can hopefully make better financial decisions and ultimately improve their own and their family’s lives.

One of the areas where we can make a great impact is in relation to their inheritance tax (IHT) and intergenerational planning. Although they sound similar, these two areas are in fact totally different, but usually clients and their advisers focus on the IHT aspect, paying little or no attention to the intergenerational planning.

So, let’s first consider the difference between the two. IHT planning is simply about doing everything we can to keep your hard-earned wealth out of the tax man’s hands. All it aims to do is keep your wealth intact; by its very nature it’s all about the numbers. It’s a logical process about legislation and technical solutions. It’s certainly the easier of the two to solve.

In many ways it’s dull and soulless and, whilst it makes the beneficiaries wealthier, that in itself does not always lead to making their lives better. I describe it simply as ‘preparing the money for the children’.

Intergenerational planning on the other hand is about making sure that ‘the right people get the right money at the right time’. It is often about emotions, deep- rooted beliefs and unspoken (or even unconscious) conflicts.

The difficulty with both elements is that it usually involves giving your money away, and that is never an easy or comfortable thing to do.

In order to even consider giving money away, you need to have the confidence that you have enough money to meet all your needs going forwards, regardless of how long you might live, of what the economy or markets are doing, or of what unexpected things might crop up.

We aim to achieve clarity on this using an in-depth lifetime cashflow analysis, with a variety of different scenarios.

The goal of this is to identify if you have surplus funds either now or in the future. Once this is identified we can get stuck into the real challenges that all families face.

But knowing you can afford something is very different to actually doing it.

Let me ask you to consider a simple question: would you give a 13-year-old

£250 per week pocket money in cash?

I am guessing that your answer is a definitive no. The reasons for this vary, but usually include:

- They don’t need it

- They won’t spend it wisely

- It would spoil them and wouldn’t enhance their lives

- It could attract false friends

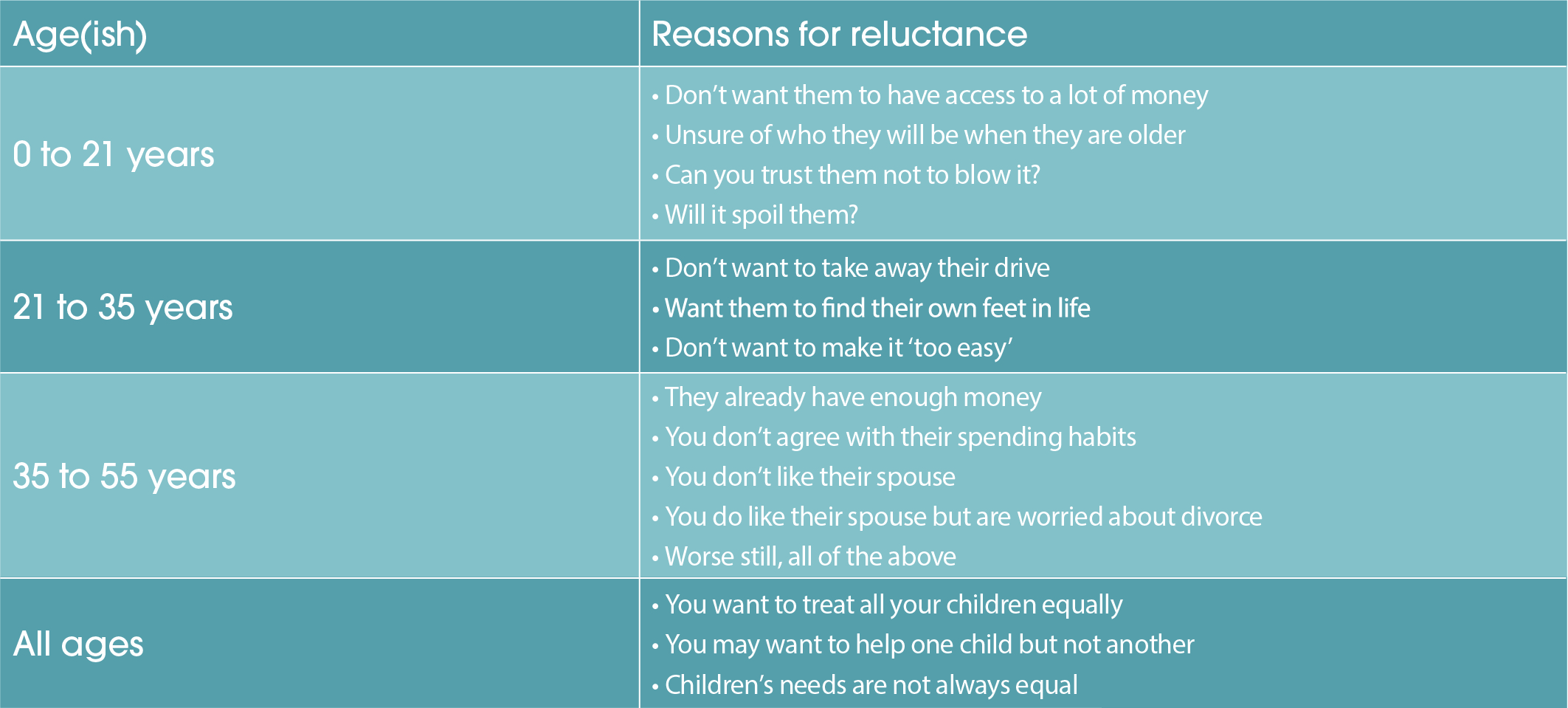

Table one: the gifting conundrum

The interesting thing is that most of us believe that the number of reasons diminish as our children/ grandchildren get older, yet in my experience the opposite is usually true. As they get older, the list of reasons not to give them money actually gets longer and the emotional barriers to gifting get stronger.

It’s what I call the gifting conundrum, and it is outlined in table one below.

“Essentially, we want to provide our clients with confidence and clarity around their finances”

So, we’re worried they will blow it when they’re young, but as they mature we don’t want to take away their drive. Then, if they use that drive to achieve success, we don’t end up giving them any money anyway because they already have enough. It seems like they can’t win!

Unfortunately, as a result, ‘inertia’ kicks in for many people so they do the minimum, only helping out financially when it’s absolutely necessary. They then die with a huge tax bill, leaving the kids with a big lump of money on some random date in time (as demonstrated in graph one below), often when it’s no longer really needed.

This leads to some interesting questions. My favourite is simply this: if you are uncomfortable gifting modest amounts during your lifetime whilst you have influence and can offer guidance and support, why would you give them all of it on death when you have no influence at all?

When we are undertaking financial planning for younger clients who are in their 40s and 50s, their key goal is to repay debt and save enough for a reasonable retirement. We always ask about expected inheritances, and yet every time they refuse to take them into account. This is logical as usually they have no idea how much it will be, plus they definitely don’t want to think about when it will be.

When I ask for an estimate of how much it might be, the usual answer is something along the lines of, ‘not much, they live in a modest house and don’t spend much’. One thing I know for certain is that you cannot guess the wealth of a person based upon the size of their house, the car they drive or whether they fly business class or economy.

The result is that younger clients who are likely to receive a significant inheritance are working on a financial plan that is wildly inaccurate. Often, they will be saving more than they need, sometimes funding this through two jobs when one partner could be at home with the kids if they wished. Or, they may stay in a higher paid job that is causing stress both for the individual and the family as a whole, purely because they mistakenly believe that they need the money.

We had a case recently where we were introduced to a client’s son (their only child) but were asked (initially) to keep the parents’ finances confidential. He was a high school teacher in his late 40s. The parents had helped him to purchase a house years ago and were also helping their grandchildren with university costs. His aim was to retire as soon as possible; after 25 years of teaching he was stressed and no longer motivated to do the job. In his ideal world, he would’ve changed career, but he didn’t believe that was possible without failing to reach his retirement goal. In short, he was trapped in a job he now despised.

His parents (mum at age 72 and dad at age 78) had surplus funds of over £1 million and he would inherit £2 million (if we could solve the inheritance tax issue). If we assume that his mother lives to 90, then he will receive his inheritance in his mid- 60s when he will likely already be retired.

The transformation at this point would be akin to winning the lottery. He would go from having struggled to save for years (the parents believe he spends too much on holidays and cars, plus he spends more on a bottle of wine than they do, a potential source of conflict) suffering in a job which he came to loathe to suddenly having more money than he would know what to do with.

The danger is that he repeats this cycle by retaining the money and continuing his modest lifestyle (his expenditure habits have become fixed by now), only helping his kids with the basics of house purchase etc.

Ultimately, this path would lead him to fall into the exact same trap that his parents did, leaving all of his wealth to his children when he dies, when they too don’t need it anymore.

To me, this is not a great intergenerational strategy. Even if we solved the IHT issue, all we would achieve is a greater sum of money. The money itself is not being put to good use, and unless we can put it to good use so that clients can do something differently, then we are not being true to our core purpose of making people’s lives better.

“A good coach does not have all the right answers, but they do know all the right questions to ask”

So, we went back to the parents and asked them if they would like to take advantage of our new IHT and intergenerational planning module (it’s no extra cost for existing clients) and they willingly agreed. We sent them a questionnaire and asked them to either complete it before the first meeting or to simply consider the issues so that we could talk through them in the meeting.

Over the next three meetings we considered every option and angle. We discussed their values and how they would most like to help their family, and we managed to create a long-term plan that would both help their son and create a legacy that they were proud of.

The end result was a strategy that could be adapted over the years as circumstances changed and that eliminated their inheritance tax liability. They agreed to have a family meeting (which they asked us to facilitate) to openly discuss their finances and how they could help. Their son changed his job, reduced his mortgage and the parents are funding his pension so that he can retire on schedule.

One of my favourite quotes is that ‘every problem exists in the absence of a good conversation’. That, in essence, is what intergenerational planning is all about. A good coach does not have all the right answers, but they do know all the right questions to ask so that you, as a family, can find a solution that works for you.

We are now offering the service as a standalone module so that those who manage their own investments, for example, or have an adviser who is not a specialist in this area can take advantage of the service. There is a one-off fee for this service if you are not an existing client, and it is based on the complexity of the circumstances.

But, the value that can be added by intergenerational planning can be immense and often immeasurable, as it can truly enhance the life of every member of your family.