In 2010, to much furore, the newly formed coalition delivered its first Budget with the media headlines centred around the various tax rises. Meanwhile, the pension narrative was relegated to a few inside column inches covering the fast-tracking of the State Pension increase to age 66.

Subsequently, over the last 15 years, it is the almost nonchalant announcement of the State Pension triple lock in that Budget that still regularly grabs the headlines.

For those who aren’t aware, the triple lock guarantees those in receipt of the basic State Pension will have it increased annually by the best of three measures: CPI (Consumer Price Index) inflation, average earnings growth, or 2.5%.

Before 2008, state pensions only ever increased in line with the Retail Price Index (RPI). But in 2008, the government added a safety net, promising that pensions would rise by whichever was higher – RPI or 2.5%. That proved to be a lucky move in 2009, when RPI dipped into negative territory at -0.5%. Imagine the uproar if pensioners had suddenly found themselves with less money in their pockets!

This all sounds good for pensioners in the future, but many industry experts view the triple lock as fiscally flawed due to the cost. Jonathan Cribb, associate director at the IFS, stated: “Ultimately, you can’t keep the triple-lock forever, it’s clearly unsustainable.”

With many pension-age voters against its removal, but 80% of voters aged 18-24 who want it removed due to the tax burden on their generation, it remains a political tinderbox.(1)

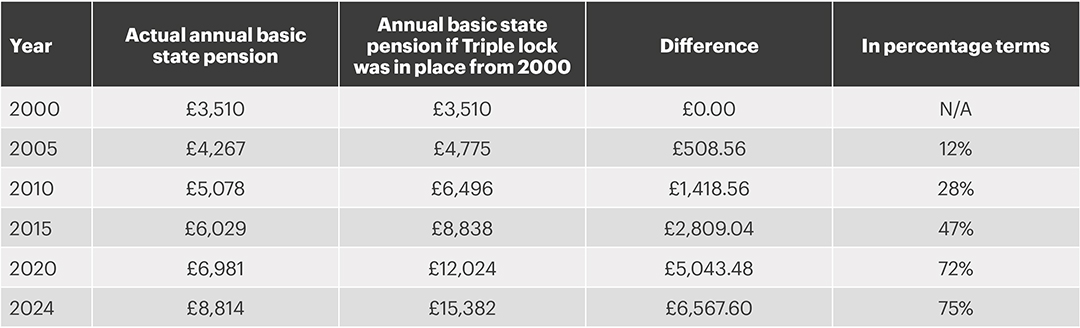

Curious to see whether the triple lock is truly the financial burden the media makes it out to be, we decided to dig into the numbers ourselves. What if the triple lock had been in place since 2000? The results were eye-opening – far beyond what we’d expected. Looking at the figures, we realised just how dramatic the gap would have become over time.

It’s staggering to imagine how the government would have ‘budgeted’ for 75% more income for pensioners had the triple lock been introduced just a decade earlier!

To put things into perspective, the Office for Budget Responsibility (OBR) and HM Treasury reported that in 2023/24, the UK government spent £110 billion on State Pensions. If that figure were 75% higher – reflecting the impact of an earlier triple lock – the bill would soar to £191 billion. That’s £3 billion more than the entire NHS budget for the same year!

For now, it looks like the triple lock is here to stay, with both Labour and Conservative parties promising during their 2024 election campaigns to keep it in place until 2029.

However, with an aging population, raising taxes and reducing public expenditure seem the most likely ways to bridge the gap which does little for popularity. It’ll be fascinating to watch how future governments juggle the books, keep voters happy, and – if the time comes – phase out the triple lock as quietly as it was introduced.

(1) PensionBee