Executive summary

- The expiration of the tariff pause on 8 July creates uncertainty with markets likely to remain in a holding pattern until more clarity is provided. Predictions regarding tariffs remain speculative.

- Surveys indicate rising input prices and decreasing new export orders, suggesting that higher tariffs are affecting consumer and business behaviour, which could lead to higher inflation in the US in the coming months.

- The first quarter of 2025 saw negative economic growth driven by increased imports, potentially due to businesses trying to get ahead of tariffs, but could lead to positive net trade in the next quarter if consumption rebounds.

- The shift in trade dynamics may result in cheaper Chinese goods being redirected to Europe, possibly benefiting consumers with lower prices while the US economy faces challenges. Caution is advised for investment portfolios amid these uncertainties.

Evidence or opinion?

Markets have recovered pretty quickly from the “Liberation Day” sell-off.

For example, the S&P 500 in the US, which fell by almost 11% over two days following the 2 April announcements, is now back to roughly where it was at the end of March although in Sterling terms, the index is still over 10% below its high of 29 January (Source: FE Analytics, 12 May 2025).

The recent gains are largely because the tariffs announced by Donald Trump have now been placed on hold.

This sharp recovery has been dubbed the “T.A.C.O trade”. In this instance, T.A.C.O. stands for Trump Always Chickens Out! Some believe the market reaction to the initial tariffs spooked the Trump administration and forced them to back down.

Regardless, this “pause” for most tariffs expires on 8 July (for China, it’s early August). What will happen then? Nobody really knows! Markets are likely to be in a bit of a holding pattern until we get some clarity. Perhaps we might expect a big move in early July, but in which direction, I’m not sure!

As we’ve said several times recently, trying to predict short-term movements at any time is pretty futile, but perhaps even more so when it depends largely on the whims of one highly unpredictable man.

Just how unpredictable? Well, last week, the President announced the re-opening of Alcatraz prison, the day after the film Escape from Alcatraz was shown on local television in Florida (he was at Mar-a-Lago at the time). Of course, we can’t say for certain whether he watched it, but he does have a reputation for announcing policy moves related to what was on Fox News the night before!

For what it’s worth, our opinion is that it is likely that final tariffs will be lower than the very high levels announced in early April. But they’re also likely to be significantly higher than they were previously. After all, Trump has consistently talked about the trade deficit and his like of tariffs for several decades now, so it seems it’s not just a negotiating tactic.

However, as Goldman Sachs put it in a recent research note about US and China trade, they think that tariffs will be “merely high” as opposed to “prohibitively high”! The recent temporary deal between the two countries seems to confirm this, with 30% “additional” tariffs being levied by the US during the 90-day pause, down from the total 145% announced in April. Capital Economics reckons that it is an effective rate of about 40%, still substantially higher than the pre-Liberation Day rate of around 20%.

Evidence, not opinion

Whilst we can give our opinion, we have to accept that we can’t predict what will happen with tariffs.

However, we can already find plenty of evidence of the effect that all this is having on the economy.

If you recall, tariffs are a tax on goods. There are two main potential effects of higher tariffs: higher prices and fewer sales.

We track various business surveys, including the Purchasing Managers’ Indices (PMIs). These essentially track business confidence and can often give an idea of which way the economy is heading before the official data is released.

Also, within the surveys, businesses are asked what is happening with prices – both “input” prices (for example, the cost of components used to manufacture a good) and “output” prices (the price at which the finished product will be sold).

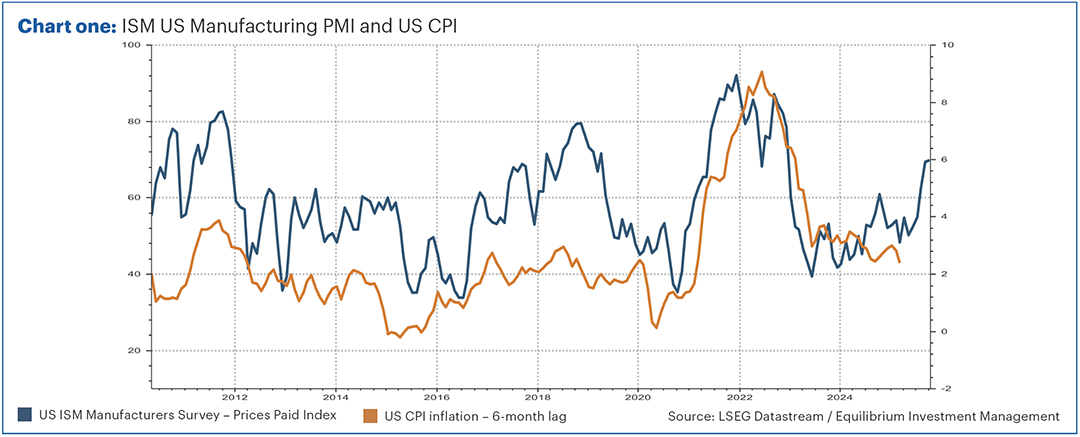

Chart one shows the “input prices” component of the ISM US Manufacturing PMI in blue. This has taken a sharp upturn recently.

Also shown on the chart is US consumer prices inflation (CPI) in orange, but with a 6-month lag. The PMI index has previously given a good indication of where inflation might be about 6 months in advance.

This would indicate that US inflation is likely to move higher in the next few months. This could be important from a portfolio perspective as it might mean the US Federal Reserve needs to keep interest rates higher as a result.

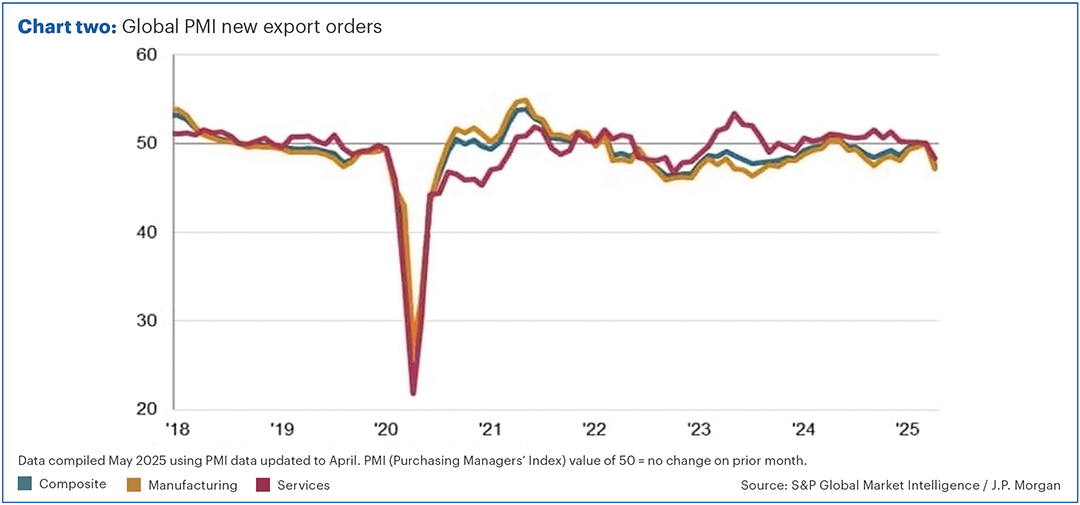

Businesses are also asked about new orders for their products and whether or not orders are increasing or decreasing. Chart two shows the new export orders for companies globally, both manufacturing and services. Both have taken a sharp downturn recently.

Whilst the tariffs remain on pause, the discussions about them have clearly had an impact on the behaviour of consumers and businesses, and this is already affecting the economy in terms of prices and activity.

Surveys like this are ‘soft data’, i.e. can be driven by prevailing sentiment rather than actual outcomes (and are prone to sampling error). If Trump manages to negotiate lower tariffs and trade resumes, then many of these indicators may reverse quickly.

One piece of ‘hard data’ comes in the shape of the US economic growth figures for the first quarter of 2025.

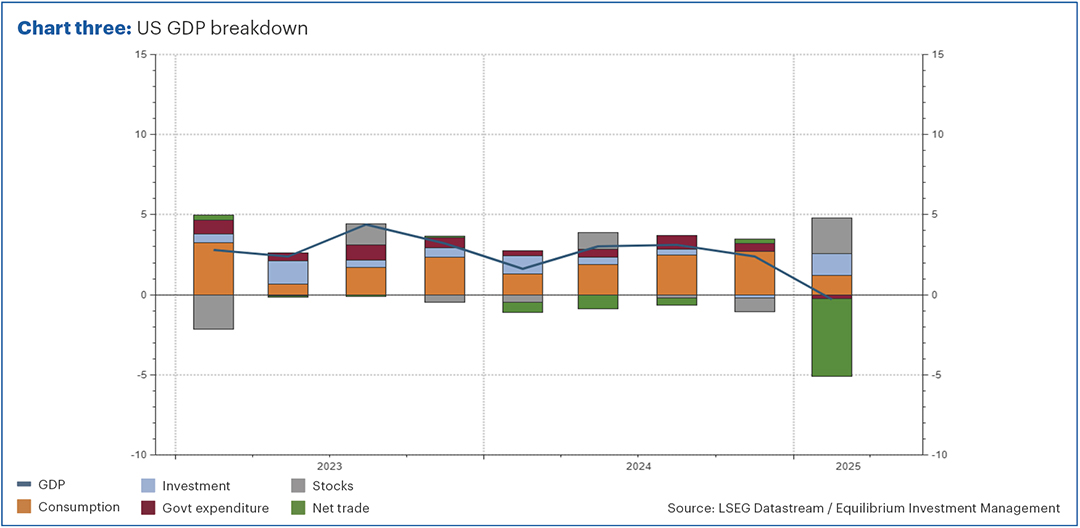

Economic growth was negative – the economy shrank. However, whilst this seems more conclusive evidence than survey data like the PMIs, there has actually been plenty of discussion about what this means.

Chart three shows how the economic growth figures are broken down. The negative growth was entirely driven by “net trade” as shown in the green bars.

Essentially, this shows a surge in the number of imports compared to the number of exports. However, consumption (orange bars) fell relative to previous quarters. This might indicate that businesses have been trying to get ahead of tariffs by importing goods or components before the tariffs kicked in.

If so, we might expect that net trade might be a positive next quarter, with companies likely to be importing fewer goods. It is, however, important that consumption rebounds to absorb some of the previous imports, otherwise there could be lots of goods sitting in warehouses unsold!

Again, the GDP numbers show that tariffs have already affected behaviour. The evidence is pointing to slower economic growth this year and higher prices than we would otherwise have expected, in the US at least.

Things might be different in other parts of the world. For instance, could some of the inexpensive goods from China that were intended for sale in the US now be redirected to Europe instead? Could we benefit from lower prices on things like electrical goods as a result?

Regardless, from a portfolio’s point of view, we think it is best to remain cautious. If US stock markets are going up and the evidence shows the US economy might be going in the other direction, we don’t think that makes a great deal of sense.

If you have any further questions, please don’t hesitate to get in touch with us on 0161 486 2250 or reach out to your usual Equilibrium contact and we can help to maximise your entitlements.

New to Equilibrium? Call 0161 383 3335 for a free, no-obligation chat or contact us here.

Past performance is for illustrative purposes only and cannot be guaranteed to apply in the future.

This newsletter is intended as an information piece and does not constitute investment advice.