Executive summary

- Recent political changes, particularly under President Donald Trump, may challenge our long-standing investment assumptions.

- Imposing trade tariffs could lead to inflation and a slowdown in the U.S. economy as consumption may decrease.

- The perception of reduced U.S. security support has prompted European nations to increase defence spending, which may stimulate their economies.

- U.S. unemployment might rise given that the Department of Government Efficiency has pledged to cut as much as $1 trillion from the federal budget.

- Interest rates may need to be higher on this side of the Atlantic to prevent the economy from overheating, whilst U.S. interest rates may need to be lower to support the economy.

- Adjustments have been made within our Equilibrium portfolios to manage the current market conditions and position them to benefit from future market opportunities as they arise.

What if this time, it IS different?

We have often quoted the old adage (sometimes attributed to Sir John Templeton) that the most dangerous words in investing are: “This time it’s different”.

From time to time, we get periods where the usual investment rules don’t seem to apply. This often happens when investors are excited about the next big thing when they focus on an interesting narrative rather than fundamentals.

For example, during the dot com bubble in the late 1990s, anything internet-related seemed to do ridiculously well, whether or not that company actually made any revenue (let alone profit!).

Usually, these periods don’t last long. The usual rules eventually re-assert themselves, often with dramatic consequences.

But right now, something DOES feel like it might have changed. Since Donald Trump began his second term as U.S. president, it feels like the entire world order might have been upended, and with it some of our assumptions about how the world (and markets) work!

As you have no doubt read, Trump has begun imposing trade tariffs – essentially taxes on imports – on a raft of goods and services.

However, rather than solely targeting rivals such as China, the new tariffs also affect allies like Europe and Canada.

As we’ve discussed before, excessive tariffs have the potential to be inflationary since they increase the price of goods and slow the economy if consumption reduces as a result.

Meanwhile, Trump’s approach to the Russia-Ukraine conflict has caused huge ructions on this side of the Atlantic, the implications of which are only just becoming apparent. Simply put, many in Europe now feel they can’t rely on the U.S. for security anymore.

As a result, Europe seems about to spend big on defence, with even the famously frugal Germans looking to exempt defence and infrastructure spending from their “debt brake” which limits the amount of government borrowing.

Within the U.S., the Department of Government Efficiency (DOGE) led by Elon Musk, has pledged to cut up to $1 trillion from the federal budget. The potential reduction in federal employees could be the “largest job cut in American history (by a mile),” according to CNBC (How Trump, DOGE job cuts may affect the U.S. economy).

We try to stay out of politics, but all of this COULD have a dramatic impact on the global economy and, therefore, markets. Of course, this might all be mainly rhetoric, and everything might just carry on as before, but it would be remiss of us not to assess the potential impact on your portfolios.

So, what might this all mean?

Here are a few thoughts on how this MIGHT all impact the global economy:

- The U.S. economy could slow as consumption reduces.

- U.S. unemployment might rise as a result of DOGE cuts.

- The European economy could be boosted by large amounts of new government spending.

- Inflation might rise as a result of tariffs (although this should just be a one-off increase) and European stimulus (which could have a longer-term effect).

- European interest rates might need to be higher than expected to stop the economy from overheating and prices rising too steeply.

- U.S. interest rates might need to be lower to support the economy, but the Federal Reserve’s ability to cut might be constrained by inflation, so in the U.S., the direction of rates may well depend on which is deemed more significant.

If any of this is halfway correct, this would be a big turnaround from what we’ve seen over the past decade and more, where the U.S. economy has grown strongly whilst Europe has been sluggish at best.

This could clearly have a big effect on stocks in particular. But more than that, it could mean a change in the behaviour of some of the major asset classes.

For example, in past periods when economic uncertainty has risen and the stock market has fallen, we’ve usually seen investors fly to the safety of government bonds. That’s partly because interest rates are usually cut when the economy takes a downturn, making those bonds more attractive (given the inverse relationship, when bond yields fall, prices increase). However, rate cuts might be less likely in the above scenario.

We’ve also become used to a strong U.S. dollar, which tends to go up when investors are nervous, again because investors seek safe havens. However, this might not be the case if the above turns out to be true, especially if countries become a bit more “isolationist”.

Indeed, we’ve seen the dollar fall by 5.37% against the Euro and 3.37% against the pound since the start of 2025 (Source: FE Analytics to 11 March 2025).

The end of American exceptionalism?

All of this, along with several other factors, have had a big impact on stock markets.

And again, it has not just been the direction of the market but the change in leadership, which has been startling.

Until recently, people have been writing about “American exceptionalism”, with the U.S. economy, companies and stock market seen as superior to elsewhere.

The U.S. market certainly did far better than anywhere else in 2024, with the S&P 500 Index gaining 25.5%, whilst the MSCI World excluding-USA Index, made up of the largest non-American firms, gained just 6.57%.

As we’ve noted previously, this U.S. outperformance has been largely driven by the so-called Magnificent Seven technology stocks, which make up such a big part of the market. An equal-weighted portfolio of those seven stocks went up 63.4% in 2024 (Source: FE Analytics / Equilibrium Investment Management, total return in Sterling terms).

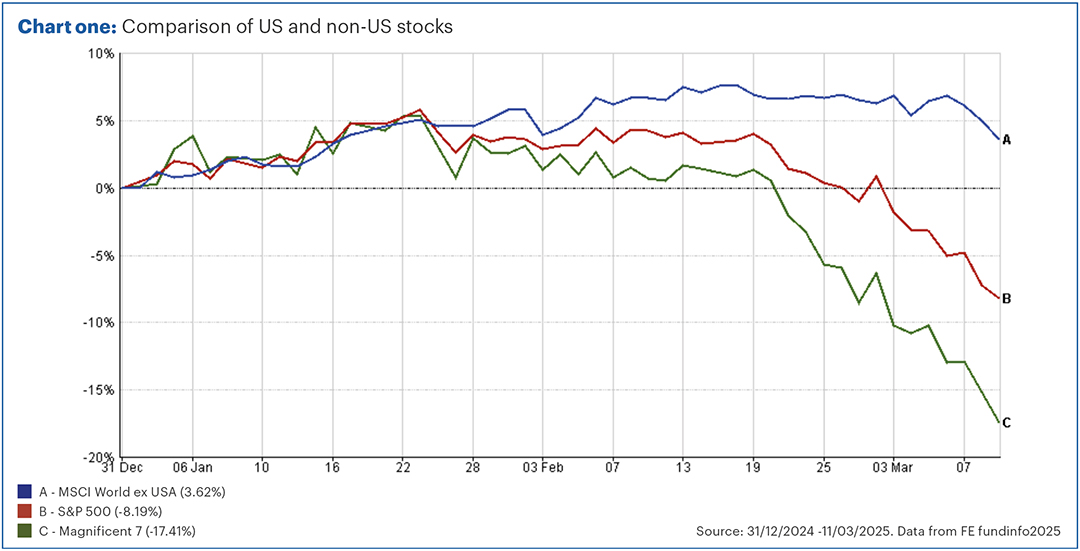

So far this year, this trend has been reversed, as shown in Chart one. Non-U.S. stocks are up 3.6%, whilst U.S. stocks are DOWN 8.2%. The Magnificent Seven doesn’t look quite so magnificent over this time frame, losing 17.4%.

As we discussed last month in The Pulse – February 2025, this isn’t all down to Trump. We’ve recently seen a few (slightly) disappointing results from some of the big technology firms, as well as the release of a new Chinese artificial intelligence (AI) program, which has led a lot of people to re-assess their assumptions about AI. In particular, investors are wondering whether tech firms need to invest quite as much money in Nvidia chips as they had previously thought!

Since then, with all the tariff and geo-political news, the U.S. market has fallen further. In total, the S&P 500 Index has fallen 9.31% from its peak to 11 March 2025.

Portfolio positioning

As you may know, we have been reducing exposure to the S&P 500 recently due to concerns it could be at risk of a pull-back. Some of that has remained invested in U.S. stocks, but just in different ways.

For example, we invested in an S&P 500 equal-weight tracker fund. This invests an equal amount into each of the 500 companies, rather than investing the largest proportion in the biggest (technology) stocks. The fund has fallen less (5.1%) so far this year as it doesn’t have so much exposure to the Magnificent Seven.

We’ve also made changes to some of our S&P 500 exposure to be indirectly invested via defined returns products rather than directly in the equities.

For example, we’ve recently had a product with UBS kick-out (mature). This was set up in September and promised to pay an annual rate of return of 11.65% should both the S&P 500 and the FTSE 100 indices be the same or higher than the starting value, at any of the specified kick-out dates.

The good thing about these products is that we don’t need markets to go up strongly to get a good return. There is also an element of capital protection should the markets fall over the five years of the product.

The kick-out dates were set for every six months over the five years, the first one being 10 March 2025. Because both indices had gone up over that time frame, the product kicked out and gave us a 5.83% return (half of 11.65%). This return was more than both the FTSE (5.55%) and S&P 500 (4.5%) over the same period (Source: FE Analytics).

We’ve now reinvested this into a similar product with Citigroup, which will pay a potential 12.85% p.a. on similar terms. The rates have improved recently as volatility has increased, and of course, we’re also buying in at a lower level of the market.

We’re also fairly relaxed about the falls in U.S. stocks for a couple of other reasons. Firstly, in the core portfolios, we hold less in equities and more in some of the lower-risk, short-dated bonds, which we think look very attractive at present (again, as discussed last month).

In addition, we have also purchased “portfolio insurance” against potential U.S. market falls. This is called a “put option”.

In essence, this goes up in value when the U.S. market falls, which can offset some of the losses from falling equities.

However, like all insurance policies, we have been paying our premiums in the hope the insurance never needs to pay out! Should the market recover, then the put option will eventually expire worthless. However, holding it also allows us to keep equity exposure relatively high so we can benefit from any market gains without worrying so much about the downside.

It gives us comfort that should current trends accelerate, portfolios should hold up relatively well and we will be in a good place to take advantage by buying in at relative lows.

Past performance is for illustrative purposes only and cannot be guaranteed to apply in the future.

This newsletter is intended as an information piece and does not constitute a solicitation of investment advice.