Executive Summary

- The demise of a handful of banks recently has been dealt with quickly although the repercussions of these events are likely to be felt wider and longer.

- We highlight three areas we are watching closely for potential after-effects, namely, the financial sector; real estate and the wider economy.

- Against the background of rapidly rising interest rates, the events in the banking sector have the potential to raise risks, but we also show that, in comparison to previous financial shocks, things are a little different this time.

Breaking bad banks

Was that a banking crisis? Has it passed? Is it safe to come out now?

Yes, for now.

But whilst the immediate threat has subsided, we are focused on three main after-effects (or aftershocks) that may follow.

They ripple out from the epicentre, from the two ‘bad banks’ of Silicon Valley Bank (SVB) and Credit Suisse to – a) the wider financial sector, further out to b) the commercial property sector, and then c) to the economy in general.

For each segment, we’ll look at where the bad news may arise and – in the interests of balance – what the good news (or at least mitigating factors) may be.

Break the bank

Let’s first look at banks and financial companies.

As the leading providers of credit in the economy, the health of the banking sector is crucially important. There are different bank models, but on average, a bank only holds around £14.50 for every £100 deposited (1) and so no bank can withstand a ‘run’ whereby all customers demand their money at once. The key is to avoid the spark that compels people to want to do that in the first place.

The recent bank crisis, and indeed the ‘Liability Driven Investment’ scare in the UK last year (after the ‘Mini-Budget’), both have in common the spark of a mismatch of liabilities and assets.

Why? Generally, where a financial company has a financial commitment to pay, whether it be a pension savings, life insurance or something else, they will back some or all of this with government bonds.

Government bonds from developed nations such as the UK and US are pretty secure in terms of credit risk. By all accounts, these countries are not going bust any time soon. That security, however, does not mean that the bonds cannot fall in value – they are not riskless. In fact, last year UK gilts fell by a fifth, returning -20.2%, driven mainly by rising interest rates and political concerns. (2)

This has thrown out a lot of finely tuned calculations for finance companies.

There is a saying in the markets that the central banks will “continue raising interest rates until something breaks.” SVB and Credit Suisse did break but they did not qualify as significant breakage and central banks have continued to raise interest rates since they went bust.

There is good news. Fifteen years after Lehman Brothers crashed, the financial system is safer. Banks, for example, held only around £8 – £8.50 for every £100 of depositors’ capital at the time of the Credit Crisis in 2008 instead of the current £14.50. (1)

In addition, many of the provisions for bad debts that the banks provided for in the Covid pandemic never transpired but have not been written back, giving another buffer to their balance sheets.

In addition, regulation has tightened. In 2008, at the height of the Credit Crisis, markets were shaken as regulators were scrambling around trying to keep up with the unravelling of events. Ben Bernanke, the Chairman of the Federal Reserve in the US at that time explained later, “We were supposed to make things better, yet things kept getting worse…the constraints on our authority had contributed to a sense that we were making it up as we went along”. (3)

In contrast, in 2023, the swift and decisive action by the US and Swiss regulators gave the markets more confidence that financial contagion could be contained, for now.

It was interesting to observe speculators unsuccessfully trying to shift their ire from SVB to Deutsche Bank, only to be firmly rebuffed by the regulator and the Bank.

Commercial Breaks

Next, the second area to watch is commercial real estate.

If you own a large office building, there are three main bugbears keeping you awake at night. The cost of borrowing has gone up by around over 2000% in the last 18 months; working from home has become a permanent feature of modern work, resulting in less demand for office space and, to cap it all, if the economy worsens then the companies renting the property may go bust.

US commercial property prices have been notably weak. Over the last 12 months, the value of industrial units has declined by 12%, and offices have fallen by 25% (Green Street Commercial Property Price Index at the end of March). Indeed, Brookfield, a large asset manager, recently decided to hand back to the banks the keys to two vast office towers in Los Angeles rather than refinancing the $784m of loans associated with the properties. Vacancy rates have risen sharply in many US cities due to technology company lay-offs. (4)

At the end of 2022, the commercial property industry owed $5.6 trillion in debt to investors and financial institutions, half of which was to banks. (5)

This year, around 15% of outstanding commercial property debts are maturing, and the credit-rating agency Moody’s expects that 40% of them will have trouble refinancing, especially if interest rates continue to rise. (5) The danger is that banks end up with lots of offices, which they will have to sell at steep discounts, sending valuations even lower.

Whilst this has overtones of the Credit Crisis, the current situation is different.

Firstly, commercial property is worth just half as much as residential properties which sparked the problems in 2007.

Secondly, The Economist estimates that if landlords hand back half of the loans due this year and the banks recover just half of the value of the loans by fire-selling the properties off, the losses would be $140bn or 10% of the equity of small banks. (5)

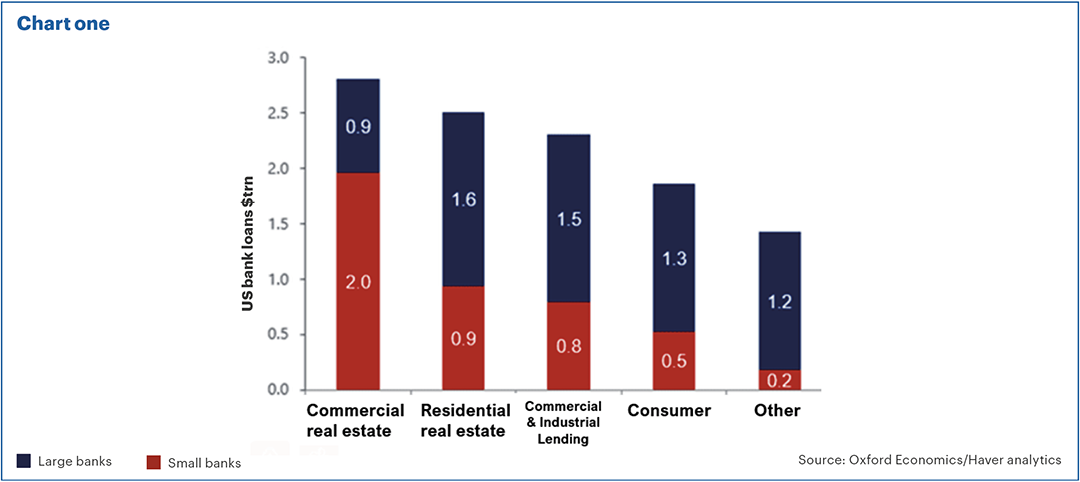

This may inflict wounds but may not be fatal, although small banks would be most at risk, as you can see from Chart one below.

A break from the norm

And what about the wider economy?

The ripples from the 2023 banking “mini-crisis” may impact the country in two key ways; uncertainty and access to credit.

The International Monetary Fund (IMF) published research in 2013 that showed that uncertainty shocks depress UK GDP growth by around 0.3% and global GDP by around 0.5%. For context, the IMF is forecasting global GDP growth of 2.8% this year and 3.0% next year. (6) This would, therefore, likely have a limited impact if that was the end of it, although the research found the peak impact was usually felt 6-12 months after the shock.

Uncertainty generally leads companies to delay investment decisions, preferring to sit on their hands (and cash) until the picture becomes clearer.

The second factor, the tighter access to credit, is more problematic. Economic activity has become more and more dependent on cheap financing. Economies took a long time to recover from the Credit Crisis because of the issues in the credit markets and tighter lending may stymie growth this time too.

A key source of credit for the global economy is the bond market, which did see a freeze on new issuance in March as investors were shaken by the news of SVB and Credit Suisse. This has started to defrost, however, as companies have started to ramp up the issuance of new bonds in late March into April.

In terms of the banks, we can measure their temperature from the share prices; since the end of 2022, global equities (MSCI World Index) have returned 4.7%, the World Banks Index has returned -6.3% but the US small banks index is -16.5%, which reflects that investors are nervous about banks in general but remain particularly worried about the small US banks. (Source: Financial Express Analytics, total returns from 31st December 2022 to 10th April 2023).

Research suggests that falling share prices tend to lead to banks tightening lending. In addition, there have been large-scale depositor outflows which will also limit bank loan growth. (7)

Companies that need capital to grow may struggle and those that need additional capital to remain solvent may go bust. On a broader scale, Goldman Sachs believes this could reduce economic growth by 0.4% in the US and Europe.

Whilst the rapid rise in rates is a big drag for many companies, at a macroeconomic level there is some mitigation, as David Einhorn, Hedge Fund Manager of the $7bn Greenlight Capital fund, recently highlighted. (8)

He pointed out that US households own $17tn of interest rate sensitive deposits but only $5tn of interest rate sensitive liabilities (the biggest set of liabilities are mortgages but in the US 90% of these are fixed, often for 30 years). What that means is the US consumer has $12tn of net positive interest rate holdings, which will therefore see incomes rise by $120bn every time interest rates are increased by 1%.

Of course, that assumes that banks pass rate hikes onto savers as quickly as they pass them on to borrowers!

Even in the UK, only around 35% of homeowners have a mortgage with a total value of £316bn whereas household savings at the end of November last year amounted to £1.47 tn. (9)

Breaking it down

How do the three potential ripple effects inform our investment decisions?

We are not out of the woods yet. Interest rates have risen dramatically, and there is usually a delayed effect of 12-18 months before they have a real-world impact, and something (else) is likely to break.

Many forecasters are expecting economic growth to be slower in the next two years than before the pandemic and we would agree with them. Our base case is now back to being a likely slow down / probable recession this year (in US, Europe and the UK) although this is still likely to be relatively mild in our opinion.

In this environment, some segments of the stock market such as financials and property companies will struggle until interest rates start to be lowered. These are the sectors most likely to see the breakages, but they also could provide interesting investment opportunities if assets come at distressed prices.

Now they offer relatively high yields, bonds offer an attractive alternative. Unlike equity investors, bond investors do not need profits to grow to see a good return and some bond funds have underlying yields in excess of 10%, well above expected levels of inflation.

Indeed, if inflation does drop away over the coming months as we believe it will, this will provide scope for interest rates to fall and many of the financial risks will diminish. In the meantime, we remain vigilant for any repercussions to the sharp rises in interest rates we’ve had in the last year.

Past performance is for illustrative purposes only and cannot be guaranteed to apply in the future.

This blog is intended as an information piece and does not constitute a solicitation of investment advice.

If you have any further questions, please don’t hesitate to contact us. If you’re a client you can reach us on 0161 486 2250 or by getting in touch with your usual Equilibrium contact. For all new enquiries please call 0161 383 3335.

Sources

(1) Basel III Monitoring Report, February 2023 (bis.org)

(2) The worst-performing fund sectors, according to Investment Association (IA) categories and data from FE FundInfo, were: UK Index-Linked Gilts (-30.9%); UK Smaller Companies (24.2%); Technology and Technology Innovations (-22.9%); European Smaller Companies (-21.7%) and UK Gilts (-20.2%).

Worst-performing fund sectors of 2022: time to buy or further pain to come? (ii.co.uk)

(3) Firefighting: The Financial Crisis and its Lessons, Ben Bernanke, Timothy Geithner & Henry Paulson, 2019, Profile Books

(4) The Economist, 29 March 2023 ~ https://www.economist.com/finance-and-economics/2023/03/29/commercial-property-losses-will-add-to-banks-woes

(5) Economist April 1st 2023 ~ https://www.euractiv.com/section/economy-jobs/news/the-unfinished-work-to-avoid-another-lehman-brothers/

(6) The Impact of Uncertainty Shocks on the UK Economy Stephanie Denis; Prakash KannanPublication Date: March 8, 2013

https://www.imf.org/en/Publications/WEO/Issues/2023/04/11/world-economic-outlook-april-2023

(7) What are capital markets telling us about the banking sector? Jaime Caruana General Manager, Bank for International Settlements IESE Business School conference on “Challenges for the future of banking: regulation, governance and stability” London, 17 November 2016

https://www.bis.org/speeches/sp161117.pdf

(8) David Einhorn – The Long and Short of Investing. Invest Like the Best podcast, 28 March 2023

(9) UK mortgage statistics and facts: 2023 | money.co.uk and UK household savings continue to grow, defying expectations of a fall amidst cost-of-living crisis – IFA Magazine