This timeless advice holds true even today, resonating with the legendary investment guru’s career that began in 1962.

Compounding is deemed so powerful that Albert Einstein once described it as the “eighth wonder of the world.” Unsurprisingly, compounding was not in the running when Angkor Wat in Cambodia recently beat Italy’s Pompeii to be bestowed with the title.

Munger’s friend and business partner Warren Buffett agrees with its almost mythical power and has commented: “My life has been a product of compound interest!”

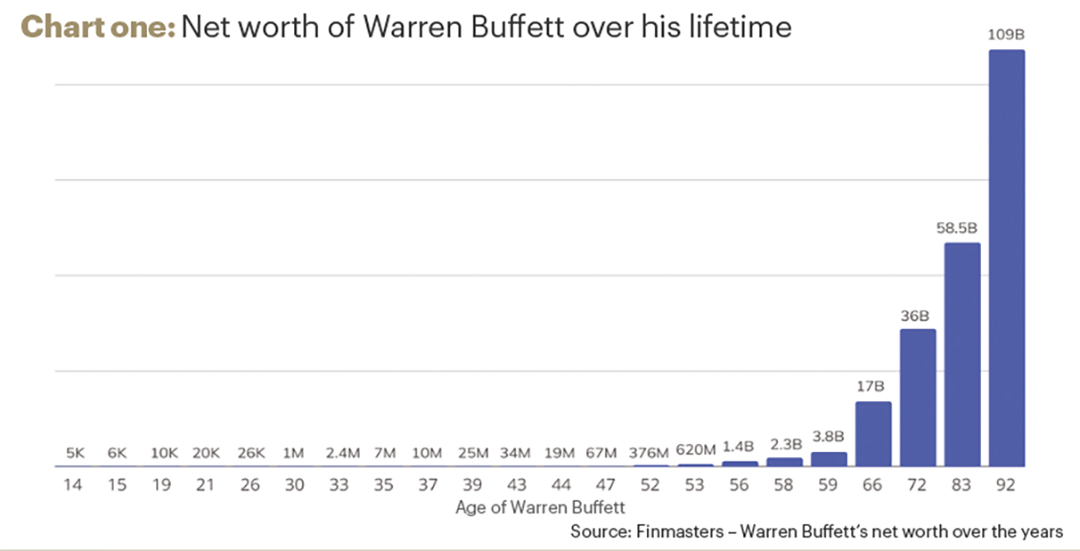

One cannot dispute this statement when witnessing the growth of Buffett’s wealth, from his first investment at the tender age of 11, to his active involvement at the age of 93. Perhaps his daily consumption of five cans of Coke is not as detrimental as one might think; after all he became Coca-Cola’s largest shareholder by turning a $1 billion investment in 1988 into $23 billion by December 2023. (1)

Astoundingly, 90% of Buffett’s fortune was accumulated after he turned 65 (as seen in Chart one), and according to Forbes, his net worth in January 2024 is $121.5 billion, making him currently the sixth richest person in the world. (2) This is even more remarkable considering that his recent investments have closely followed the performance of the S&P 500. This clearly demonstrates the impact of long-term investing and the significance of early success.

Now, let’s imagine if Buffett had not started his investment career until the age of 25. By delaying his investment journey through his teens and early 20s, his fortune in 2019 would have amounted to £9.2 million, a mere 0.013% of its actual worth.

Buffett serves as a prime example of how compound returns from investing can yield great benefits. While not everyone may amass billions, achieving a good return on your money rather than letting inflation erode it is crucial. This means allowing your existing funds to work towards your goals, and the longer they are left to grow, the more you will ultimately benefit.

The Rule of 72

The Rule of 72 is a valuable tool for investors seeking to estimate the growth of their investments in the future. Luca Pacioli, an Italian mathematician, is often credited with the development of this simple rule. It enables even novice investors to predict how long it will take for their investments to double.

For instance, if an investment yields an annual return of 5%, the time required to achieve a 100% return can be calculated using the Rule of 72 as follows:

72 ÷ 5 (% annual return) = 14.4 years

While it is impossible to accurately predict the exact return, historical data can serve as a useful guide.

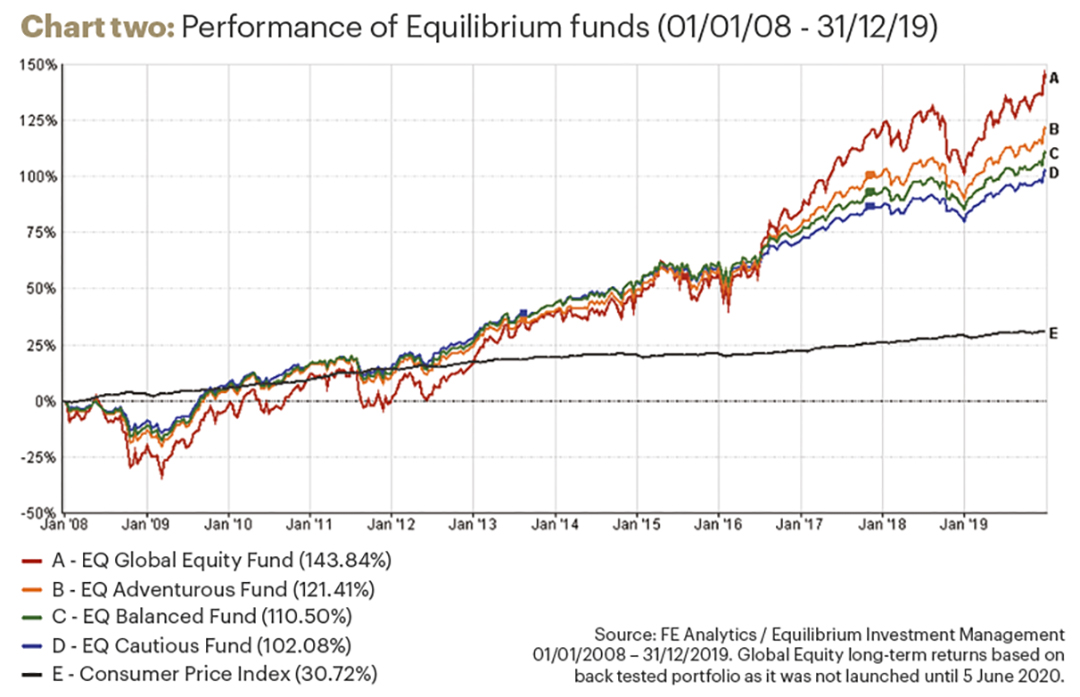

At the start of 2008, Equilibrium became discretionary fund managers, allowing us to make changes to clients’ investment portfolios without seeking prior consent within certain parameters. Unfortunately, the timing could not have been worse as the “credit crunch” wreaked havoc on global stock markets.

By October of the same year, the Equilibrium Balanced portfolio had declined by over 15% (compared to the FTSE 100’s 38% fall), dimming prospects of doubling investments anytime soon; however, as history has shown, markets eventually rebound. By August 2009, investors would have recovered their losses.

By the end of 2019, all Equilibrium portfolios had at least doubled since January 2008 as shown in Chart two. By applying the Rule of 72 in reverse, this provides a useful gauge for estimating future returns.

The results highlight that investors are rewarded over the long term for taking on more risk and the effects that compounding can have in accelerating returns.

So, what does all this mean for you?

Undoubtedly, compounding can have a profound impact, and the earlier you start, the better the outcome. Long-term investing is particularly crucial when it comes to retirement planning, whether for yourself, your children, or your grandchildren. The key is to start saving early and maintain a consistent approach, whilst avoiding the temptation to withdraw savings before retirement.

While it may seem distant for some, retirement offers the best opportunity to earn compound returns on your investments due to its extended time horizon. Compound returns not only provide financial security but also the potential to enjoy retirement earlier for you and your loved ones.

This article is intended as an informative piece and should not be construed as advice.

To speak with one of our experts, if you are a client call us on 0161 383 3335 or by reaching out to your usual Equilibrium contact.

If you are new to Equilibrium and would like to speak with one of our experts, contact us here or call us on 0161 383 3335 for a free, no-obligation initial chat

Sources

(1) Investopedia.com: Why did Warren Buffet invest heavily in Coca-Cola in the late 1980s?

(2) Forbes.com: The real-time billionaires list.